by Jeffrey Rosenberg, Sr. Portfolio Manager, Systematic Fixed Income, Blackrock

Key takeaways

- Throughout 2022, the Fed’s policy response to inflation and the resulting recession risks created a challenging environment for the traditional 60/40 portfolio1 of stocks and bonds.

- Now, higher yields have boosted the appeal of bonds, but inflation and policy uncertainty may continue to undermine the diversifying properties of traditional fixed income.

- Alternative strategies like the BlackRock Systematic Multi-Strategy Fund can take advantage of higher yields and differentiated return streams while providing an added layer of diversification in portfolios.

2022 marked the shift to a new regime characterized by greater macroeconomic uncertainty and volatility. The US Federal Reserve’s (“Fed’s”) aggressive response to persistent inflation and the resulting recession risks created a challenging environment for both equity and bond investors. The effectiveness of the traditional 60/40 portfolio, and the ability of bonds to act as a buffer during equity sell-offs was virtually erased.

Now, the magnitude of rate increases is slowing and yields have reached more compelling levels—potentially creating a better backdrop for bonds in 2023. This begs the question: are bonds back? Yields are back, but bonds may struggle to deliver the level of diversification that they once provided as inflation and policy uncertainty persist. This brings into focus the role of alternative strategies as an additional source of diversification and returns in portfolios. Alternatives can capture the same yield opportunities found in traditional fixed income, while unlocking new return streams and providing the ballast that’s needed in portfolios today.

Yields are back for alternatives, too

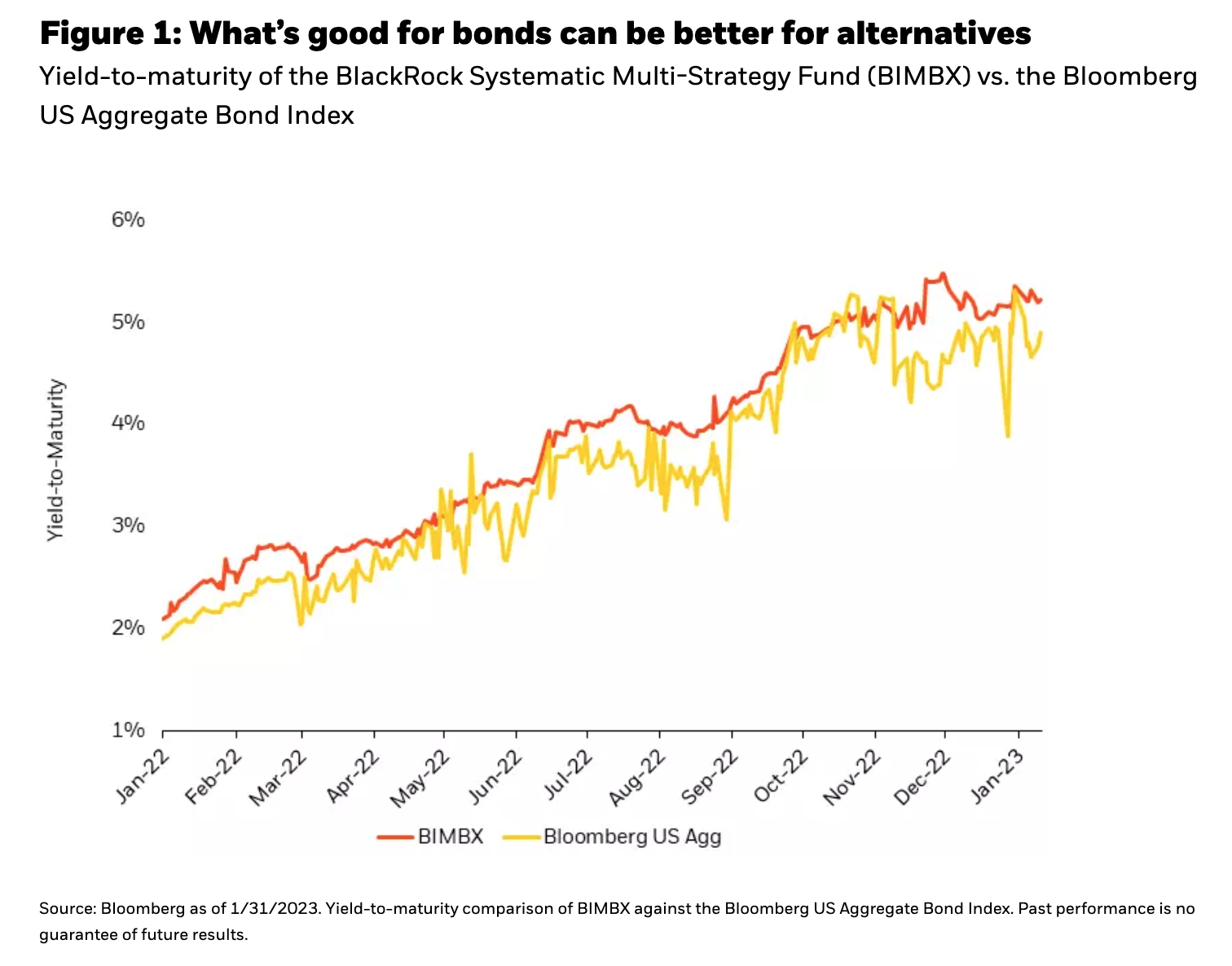

Rising interest rates have boosted the appeal of bonds which now offer an attractive source of income for the first time in years. One aspect that may be overlooked by investors is that similar to bonds, alternatives can also benefit from higher yields. Many alternatives have “cash plus”2 return targets, meaning that they may have the potential to capitalize on higher yields to generate higher returns. BlackRock Systematic Multi-Strategy (“SMS”), for example, seeks market upside participation by investing in a diversified portfolio of fixed income securities. The strategy has continued to out-yield US bonds as yields have increased over the course of the Fed’s hiking cycle (Figure 1).

Alternatives can unlock new return sources

Beyond fixed income, alternatives can tap into other opportunities arising from higher rates that aren’t found in the traditional 60/40 construct. Higher rates can influence security dispersion, or the divergence between the best and worst performing assets. For example, higher rates can increase the gap in performance between highly levered companies and those with less debt on the balance sheet. Alternatives can capture these cross-sectional opportunities using a long/short framework3 that goes long companies who are expected to outperform and short companies who are expected to underperform.

Security dispersion is a return dynamic that is disconnected from the direction of markets and tends to be more pronounced in highly volatile or downward trending markets. As a result, long/short strategies can provide a defensive return stream that has the potential to work best when equity markets sell-off—offering downside protection without relying on duration4 as a ballast. Figure 2 shows the quarterly performance of the equity long/short sleeve within SMS, which has delivered durable returns with a -0.41 correlation to the S&P 500 during down months.

Diversify your diversifiers

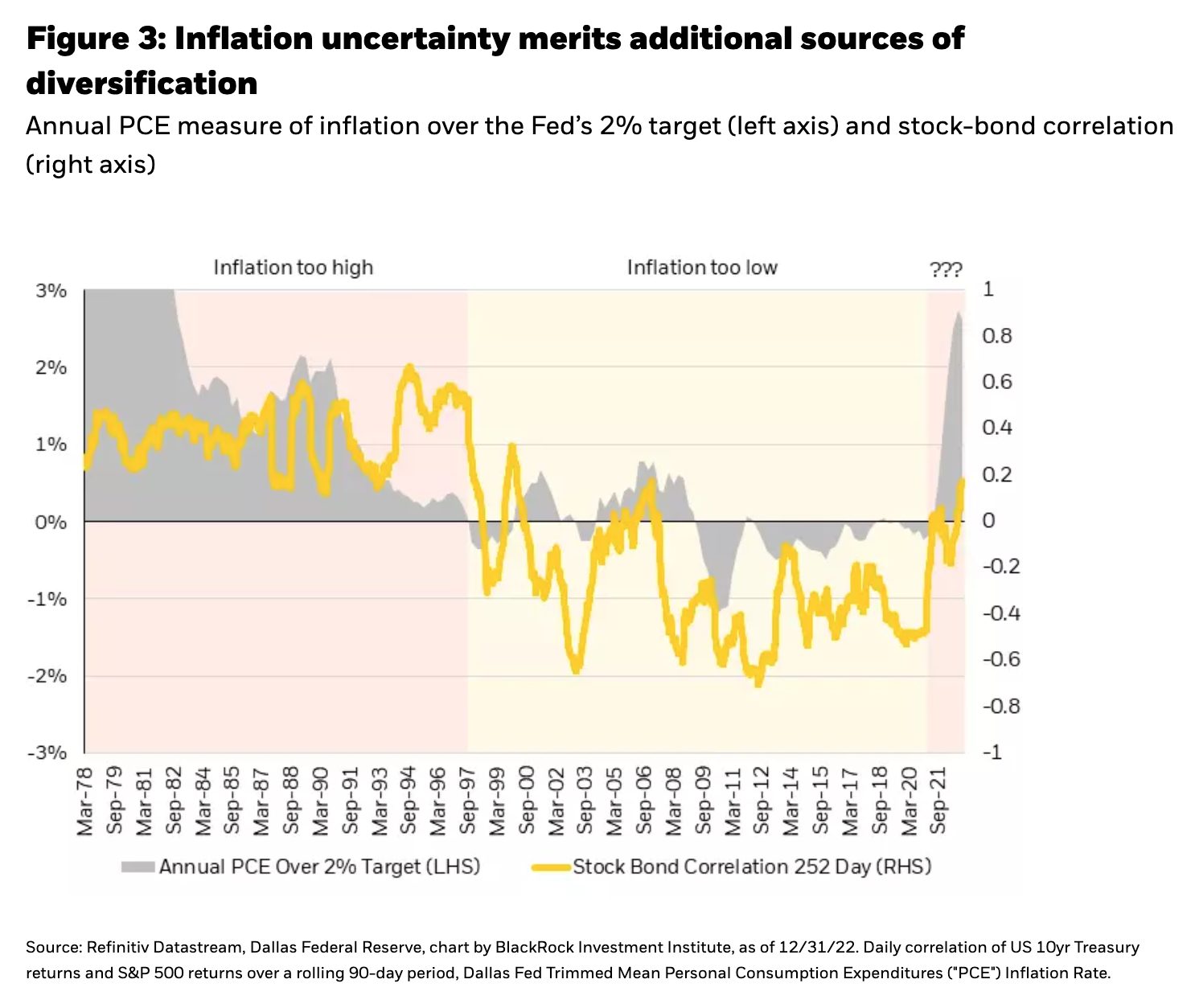

By combining multiple differentiated return sources, alternative strategies can target a balanced return profile with a low correlation to other asset classes and even other alternatives. This is especially important as the path of inflation and economic growth remains uncertain. If inflation stays elevated longer than the market expects, the expectation for a negative stock-bond correlation could become less reliable, meaning that stocks and bonds may once again fall in lockstep.

Why? Bond prices tend to appreciate during growth slowdowns as central banks cut interest rates to support the economy—which provides a ballast during equity sell-offs. The exception to this rule is when a recession coincides with persistent inflationary pressures. Central banks are unlikely to prop up a slowing economy with rapid rate cuts in response to a recession that they engineered to conquer inflation.

Inflation uncertainty has the potential to continue to impact monetary policy and the economy in 2023. While inflation showed some signs of easing near the end of 2022, recent inflationary data and revisions to November and December 2022 CPI prints show that inflation may not have been falling as fast as the market initially expected. The difficulty of forecasting inflation’s path and its effect on the stock-bond correlation mean that now may be a good time to diversify your diversifiers.

Figure 3 shows the relationship between inflation and stock-bond correlation throughout history. Stock-bond correlations were strongly positive during the 1970s and 1980s as the Fed was fighting runaway inflation. Negative stock-bond correlations didn’t return until the late-1990s when inflation finally fell below central bank targets. This suggests that unless inflation swiftly returns to the Fed’s 2% target, the 60/40 portfolio may require new sources of diversification for the foreseeable future.

Yields are back, but the need for additional diversification remains

Yields are back, but the hedging efficacy of bonds may still be missing. Alternative solutions like BlackRock Systematic Multi-Strategy can take advantage of higher yields while targeting a defensive return stream with a low correlation to broad asset classes. As recession risks grow, a rapid shift back to a deeply negative stock-bond correlation is unlikely which could create ongoing challenges for the 60/40 portfolio. A true alternative diversifier can seek to provide strong risk-adjusted returns along with the added source of diversification that’s needed to weather a more volatile macro and market regime.

Copyright © Blackrock