by Brian Levitt, Global Market Strategist, Invesco

Key takeaways

Conflicting signals

Traditional market indicators are sending inconsistent messages — the usual markers point to a recession in the U.S., but the economy is strong.

A hard or soft landing?

The evidence may still point to a reasonably soft landing for the U.S. economy, but we still await the lagged effects of monetary policy tightening.

A lost decade?

Is the U.S. headed for a lost decade for equity returns, like the 1970s or 2000s? Despite some similarities between then and now, I vote no.

In last month’s column, I concluded by pointing to the January Barometer, which says that positive U.S. stock market returns in January may be a predictor of positive returns over the rest of the year. Supposedly it has an 86% hit rate1 (which may not be as impressive as it sounds, given that U.S. stocks have been positive in roughly 75% of the years since 1901 anyway).2 Regardless, after January’s positive returns, I was about to declare victory and take the rest of the year off ...

… then in February, the Kansas City Chiefs from the American Football Conference won the Super Bowl, and apparently that’s a bad omen. On average, U.S. markets have historically performed better when a team from the National Football Conference wins.3 (As if Philadelphia fans weren’t upset enough about that late-game flag!)

So, the superstition-fueled market predictors are sending conflicting signals. That’s ok. The traditional indicators are sending inconsistent signals too — the usual markers point to a recession in the U.S., but the economy is strong. Disinflation appears to be here, only maybe it’s not.

Since I’m no longer taking the year off, let’s delve into it.

A ‘keep it simple’ strategy

1. Where is the U.S. in the cycle?

Will the U.S. economy’s landing be hard or soft? There hasn’t been this much debate over those labels since the last time I selected a taco shell. The evidence may still point to a reasonably soft landing inflation has been moderating, growth has been resilient), but we still await the lagged effects of monetary policy tightening. Remember, it roughly takes 12-18 months for tighter policy to be felt in the economy — and one year ago the Fed Funds Rate was 0.00%.4 I’d still characterize the risks to the cycle as high, but I believe that a mild recession was priced by the market last year.

2. What’s the market telling us about the direction of the U.S. economy?

Financial markets have been in recovery mode. How can that be? The market leads the economy, not vice versa. Last year the market was looking ahead to a growth contraction by mid-2023 (seems reasonable), while now the market appears to be anticipating an economic recovery in the latter part of this year and into next year. But the path between now and then won’t be a straight line for markets. Financial conditions could tighten in the coming months (stronger dollar, lower equity valuations) if it becomes clear that more policy tightening is in the offing.

3. What will be the U.S. Federal Reserve’s (Fed) policy response?

All eyes are on the Fed. Inflation expectations are climbing again5 albeit from low levels, and expectations for the Fed Funds Rate have been ratcheted higher6. We’re confident that inflation has peaked and will continue to come down, but perhaps not as fast as the Fed had hoped. The Fed pause may not be coming now until the middle of the year, at the earliest.

Ok, wait. It’s a recovery until it isn’t, but then it will be again? Well, yes. The current market recovery may not be the recovery. Markets may retrace some of the recent gains if inflation slows by less than expected and if the economy becomes less resilient. Tactical investors may want to lock in recent gains and become more defensive. Nonetheless, history tells us that markets have tended to do well over the subsequent 1-, 2-, and 3-year periods after inflation peaks.7 I’m a FOMO guy. I have a Fear Of Missing Out on most things, particularly a post-inflationary environment intermediate-term market advance.

It may be confirmation bias, but …

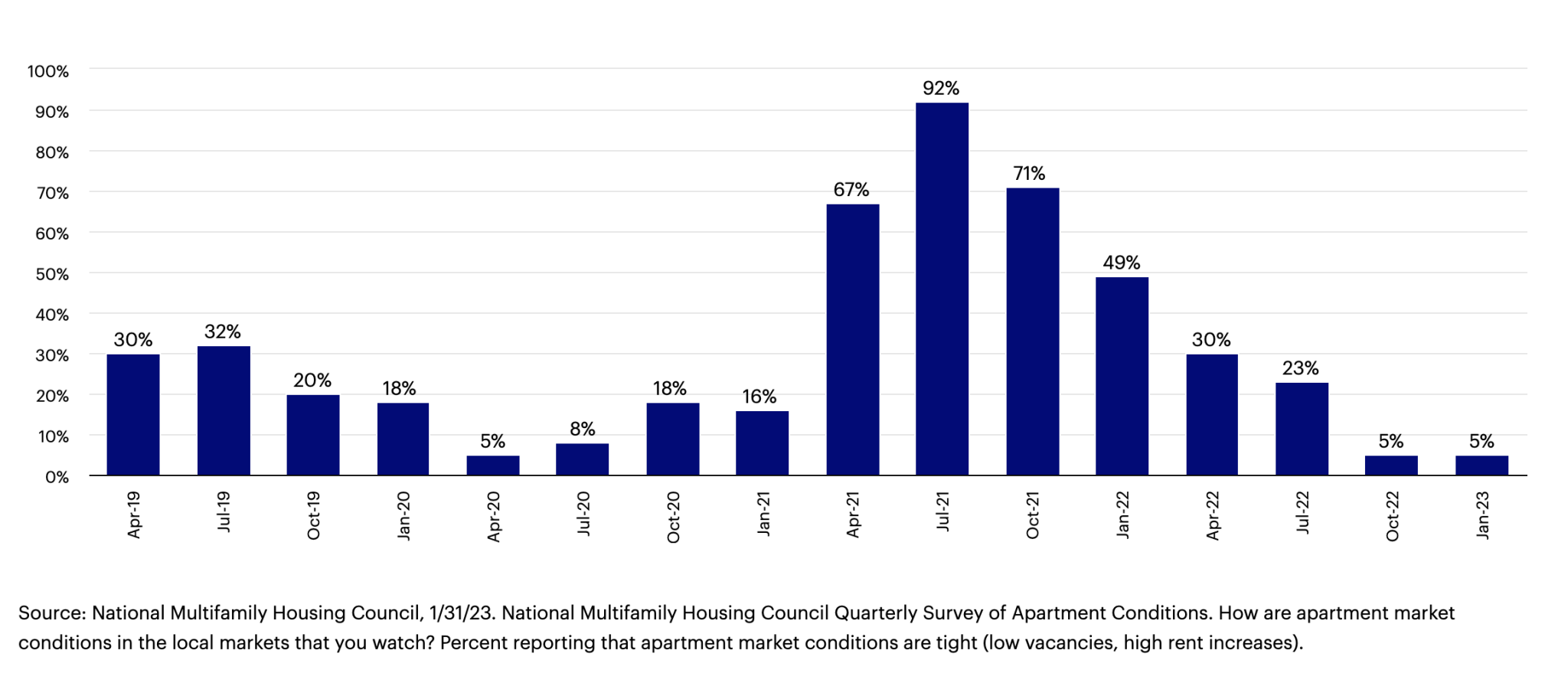

…shelter costs, which have significant relevance to services inflation in the Consumer Price Index8, appear poised to decline in the U.S. For example, a survey from the National Multifamily Housing Council highlights that conditions in the apartment industry are now near lows last seen during the early days of the pandemic.9 In the past, a sharp decline in the apartment conditions survey has presaged a moderation in rental prices.10

National Multifamily Housing Council Quarterly Survey of Apartment Conditions

Percent reporting that apartment market conditions are tight (low vacancies, high rent increases)

Automate my job?

Automate my job?

I’m introducing a new category. Each month I’ll pose a question to ChatGPT — the artificial intelligence (AI)-driven chatbot — and assess the response.

Q: Is the U.S. economy heading towards a recession?

(Note: the first few times I asked the question, the response was, “ChatGPT is at capacity right now.” Can I use that response at work?)

A: As an AI language model, I do not have access to real-time economic data beyond my knowledge cut-off date of September 2021…It is important to note that the U.S. economy is influenced by many complex factors…Therefore, predicting the direction of the U.S. economy can be challenging and subject to many variables.

Tell me about it! The most predicted recession in memory has still failed to materialize. Nonetheless, I would have been impressed if ChatGPT had said something more like this: “Recessions tend to occur when the Fed raises rates to cool inflation, growth slows as a result, and the banks tighten lending standards amid rising creditor concerns. Each of these things appears to be happening.”

I suppose my job is secure for another month at a minimum.

It was said

“It looks more possible that we’ll have a soft landing than it did a few months ago,”

– Lawrence Summers, Former U.S. Treasury Secretary

A far cry from when Summers was warning that without a high rise in the unemployment rate, inflation would become entrenched. Lest we get too optimistic, Summers continues to warn that the “greatest tragedy” would be if central banks don’t finish the job.

“We got to get 218. We’re trying to get the framework. We want all buy in.”

– Ralph Norman, U.S. Representative (R-SC 5th District)

The U.S. debt ceiling game of chicken is on. The White House and Senate Democrats don’t believe that House Speaker Kevin McCarthy has the votes to raise the debt ceiling. To them, ironically, that’s a good thing. They reason that the Republicans will ultimately have to vote to raise the debt ceiling with no strings attached, to avoid default. The Republicans are looking to strengthen their bargaining position by finding a proposal for future spending cuts that the party can get behind. Here’s hoping that everyone realizes we’re all in the same car.

“I don’t think the American people need to worry about aliens with respect to these crafts, period.”

- John Kirby, White House Spokesperson, addressing the multiple unidentified flying objects recently shot out of the sky by the U.S. military.

I’m not sure if I’m disappointed or not.

Phone a friend

Are U.S. equity valuations too elevated for a new market cycle to commence? Let’s put the questions to Talley Leger, Invesco’s Equity Strategist:

“Stock valuations have already experienced a downward adjustment. Remember the S&P 500 Index’s price/earnings ratio at the beginning of 2022 was 30x.11 Equity multiples fell to 17x by October 2022 as higher interest rates compressed what investors were willing to pay for earnings, while at the same time earnings continued to expand.12

This raises the question of where equity valuations were at the start of the past few major market bottoms. The answer: 18.5x in 2002, 16.3x in 2009, and 18.6x in March 2020, suggesting that there is nothing about valuations at the Oct. 13, 2022, trough that would inhibit a new market advance13.”

Since you asked

Will this be a lost decade for U.S. equity returns like it was in the 1970s or 2000s?

Admittedly, there are some parallels between then and now. Inflation is elevated as it was in the 1970s. And, like in the early 2000s, investors have reassessed what they are willing to pay for equities in a new interest rate environment. But I’d argue that’s where the similarities largely end.

In the 1970s, the Fed had lost credibility as long-term inflation expectations were in the double digits14, fostering a prolonged period of policy uncertainty that weighed on markets. Currently, long-term inflation expectations are within the Fed’s perceived “comfort zone.”15

In the 2000s, interest rates, in hindsight, were left low for too long and ushered in an era of substantial leverage and bank balance sheet impairment, culminating in a global financial crisis. Now, a substantial amount of monetary policy tightening has already occurred.16 In addition, leverage remains relatively benign17 while the nation’s banks appear to be well-capitalized18.

I’ll see you in March. These markets may go into the month like a lion. A pullback from recent gains could last for a bit. Beyond that, we would expect markets to progress through the year and go into 2024 more like a lamb.

Footnotes

1 Source: Standard & Poor’s, 12/31/22. Based on returns of the S&P 500 Index from 1957 to 2022.

2 Source: Bloomberg, 12/31/22. Based on the rolling monthly 1-year returns of the Dow Jones Industrial Average from 1901 to 2022.

3 Source: Bloomberg, 12/31/22. Based on returns of the S&P 500 Index from 1967 to 2022. The average return of the S&P 500 in years that an NFC won the championship is 10% versus 6.9% in years that an AFC team won.

4 Source: U.S. Federal Reserve, 1/31/23.

5 Source: Bloomberg, 2/16/23. Based on the 1-year U.S. Inflation Breakeven. The breakeven inflation rate is calculated by subtracting the yield of an inflation-protected bond from the yield of a nominal bond during the same period.

6 Source: Bloomberg, 2/16/23. Based on Fed Funds Implied Rates.

7 Source: Bloomberg, 1/31/23. Based on S&P 500 Index returns following the inflation peaks in February 1970, December 1974, March 1980, December 1990 and July 2008. On average, the S&P 500 had a cumulative return of 17% one-year after the peak, 28% two years after, and 46% three years after.

8 Source: U.S. Bureau of Labor Statistics, 1/31/23.

9 Source: National Multifamily Housing Council, 1/31/23. National Multifamily Housing Council Quarterly Survey of Apartment Conditions. How are apartment market conditions in the local markets that you watch? Percent reporting that apartment market conditions are tight (low vacancies, high rent increases).

10 Source: National Multifamily Housing Council, 1/31/23.

11 Source: Bloomberg, 1/1/21.

12 Source: Bloomberg, 1/31/23. As represented by the S&P 500 Index.

13 Source: Bloomberg, 1/31/23. As represented by the S&P 500 Index.

14 Source: University of Michigan Consumer Survey.

15 Source: University of Michigan Consumer Survey.

16 Source: Bloomberg, 1/31/23. Based on Fed Funds Implied Futures.

17 Source: U.S. Federal Reserve. Based on Nonfinancial Corporate Debt to Profits ratio.

18 Source: U.S. Federal Reserve, 1/31/23. Based on Tier 1 Risk-Based Capital Ratios.