There is a time to be long, a time to be short and a time to go fishing.

- Jesse Lauritson Livermore

Alfonso Peccatiello, Founder and Strategist at Macro Compass, channels Jesse Livermore, suggesting that "there is a time to be long, a time to be short, and a time to go fishing." For most of 2022, inflation skyrocketed and the Federal Reserve turned hawkish, causing bonds to be kryptonite for investors, leading to the need to be short. However, between October 2022 and today, inflationary pressures have moderated, with the economy hanging in there and 10-year Treasuries stuck between 3.50% and 4.00%. As a result, it is now time to go fishing.

The question is, with long-dated Treasury yields approaching 4% again, is this the time to go long? In his recent substack post, Peccatiello explores when the ideal conditions are to buy bonds, focusing on both historical and current conditions, and answers the question of whether it is the right time to buy bonds.

According to Peccatiello, the best periods to buy bonds were:

- when nobody wanted or thought they needed bonds at all,

- a few quarters before companies started losing money, and people started losing their jobs.

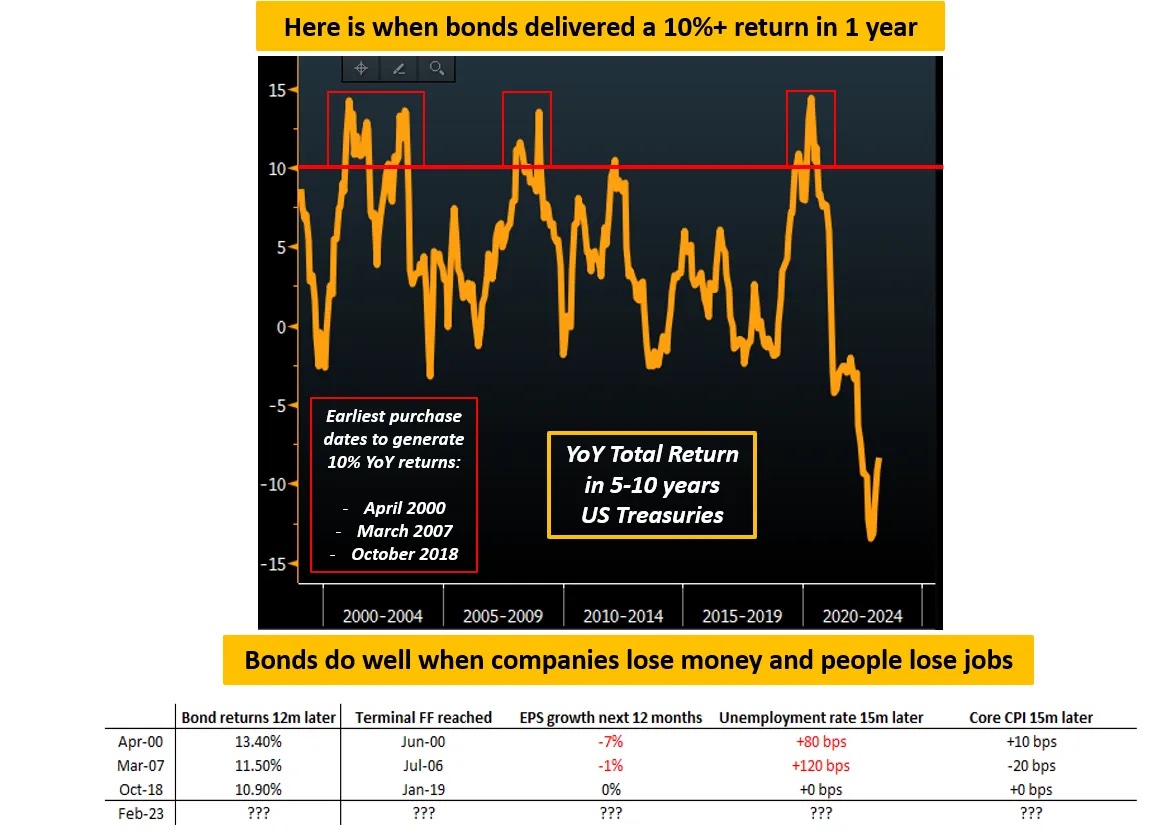

He points out that buying 5-10 years US Treasuries in April 2000, March 2007, and October 2018 delivered a subsequent 12-month return north of 10% (a 'banger' return), despite no announcement of QE or being in a recession. This shows that in these periods, everybody hated bonds, but the odds of negative EPS growth and higher unemployment rates were rising rapidly, indicating that nobody wanted bonds, but everybody would soon need them.

Source: Alfonso Peccatiello, The Macro Compass

The common feature in these periods is that they were right before negative EPS growth and higher unemployment rates started rising rapidly. During these periods, earnings growth didn't look good, the labor market cooled off, and core inflation stalled, leading to a nominal growth slowdown, which in two out of three cases morphed into an outright recession (2001, 2008).

Therefore, history shows that the best moment to buy bonds is right at the intersection when nobody wants them, but macro data will soon remind investors that they need bonds. Currently, it may not yet be the time to buy bonds since current macro data doesn't point to similar conditions. However, investors need to keep monitoring macroeconomic indicators and be prepared to take advantage of the right opportunity as it arises.

In conclusion, the best time to buy bonds is when nobody wants them, and macro data will soon remind investors they need them. With long-dated Treasury yields approaching 4%, it may not be the right time to buy bonds, but investors should keep an eye on macroeconomic indicators to identify the right opportunity when it arises.

For the full scope, go to The Macro Compass:

The Macro Compass: When to buy bonds?

Footnote:

1 (Alf), Alfonso Peccatiello. "When To Buy Bonds?" The Macro Compass, 22 Feb. 2023, themacrocompass.substack.com/p/when-to-buy-bonds.