Investor confidence has continued to decline for the second consecutive quarter, according to a new report by J.D. Power. The report surveyed over 1,900 investors aged 18 and older with at least $100,000 in investable assets, and found that while the inflation rate had decreased at the end of 2022, investor confidence was still impacted by inflation concerns.

Investors were asked to rate their confidence in managing their overall financial life, including their ability to keep pace with inflation, prepare for future healthcare expenses, and plan for retirement. Inflation was the biggest factor contributing to the quarterly decline in investor confidence, with only 24% of respondents stating they were highly confident in their ability to keep up with inflation.

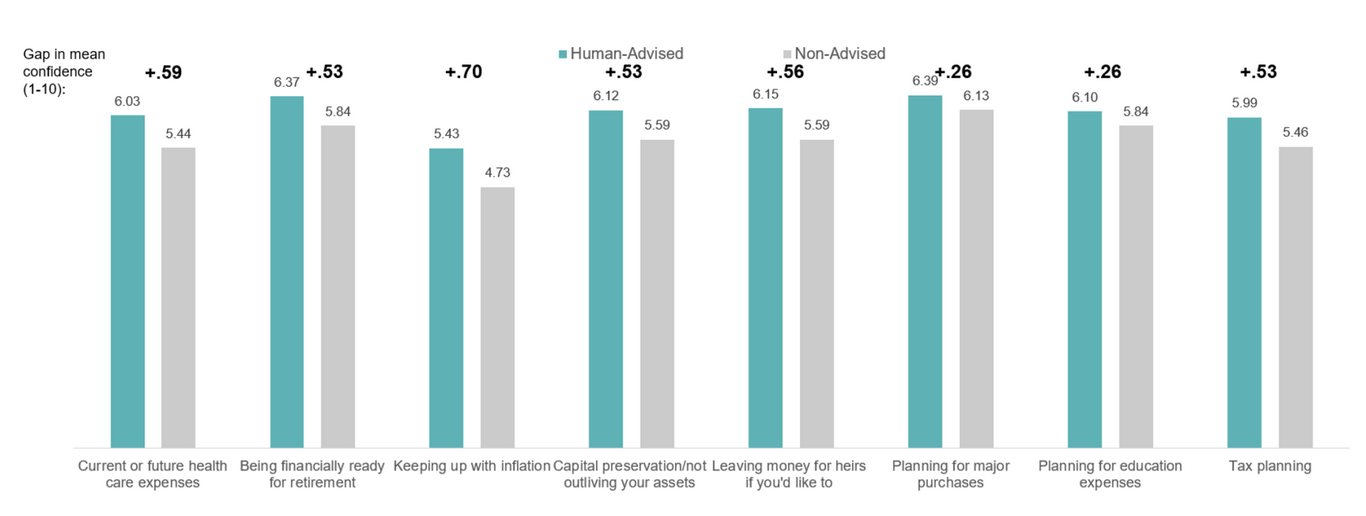

The report revealed that women had significantly lower investor confidence scores than men, with Gen Z and Millennial investors having higher levels of confidence than Gen X and Boomer investors. Investors who worked with an advisor had a higher confidence level across all categories, particularly in areas with more uncertainty, such as inflation.

Even with an advisor, investor confidence in their ability to keep pace with inflation remains low, with the average score for non-advised investors at 4.73 on a 10-point scale, and 5.43 for advised investors. This suggests that it is not a good time to stop having conversations about inflation with clients, according to Mike Foy, senior director of the wealth management practice at J.D. Power and author of the report.

Despite the decline in investor confidence, only 6% of respondents said they planned to decrease their investments, with 91% stating that they planned to maintain or increase their investments. The report suggests that investors may lack confidence in their ability to manage their financial life, but this does not mean they are abandoning the markets.

Investors who worked with advisors were found to have a higher overall confidence level than those who did not, particularly in areas with more uncertainty such as inflation. However, the report also highlights the historical struggles advisors have faced in connecting with women investors and Gen Z and Millennial investors, who continue to be underserved in the advisory space.

In conclusion, while investor confidence has continued to decline for the second consecutive quarter, investors are still planning to maintain or increase their investments. The report by J.D. Power suggests that investors lack confidence in their ability to manage their financial life, particularly when it comes to keeping pace with inflation. Advisors may need to have more conversations with their clients about inflation and other areas of uncertainty to help build their confidence and address their concerns.

Footnotes:

1 Adapted from source: Deaton, Holly. "Advisors Should Remain Vigilant as Investor Confidence Falls for the Second Straight Quarter." RIA Intel, 7 Feb. 2023, www.riaintel.com/article/2b91d1gi7m8ybjv0fw4xs/advisors-should-remain-vigilant-as-investor-confidence-falls-for-the-second-straight-quarter.

2 "Investor Confidence Sinks for Second Consecutive Quarter, but 91% Plan to Maintain or Increase Investment." J.D. Power, 21 Feb. 2023, www.jdpower.com/business/resources/investor-confidence-sinks-second-consecutive-quarter-91-plan-maintain-or.