by Ryan James Boyle, Senior Economist, Northern Trust

Now is not the time to consider changing inflation targets.

The Federal Reserve Act mandates that the Federal Reserve conduct monetary policy “so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates." Of late, just two words—stable prices—are receiving outsized attention. The broad language in the Act leaves a lot of room for interpretation: What range of price changes are considered stable?

This question vexes central banks around the world. Most have adopted inflation targets, and in developed markets, almost all of them center around 2%. But the post-pandemic period has initiated scrutiny of this figure. Should it ever change, and what circumstances would justify an adjustment? These questions hover like a large shadow over today’s monetary policy.

Before any central bank ever set a numerical target, they operated under the impression that moderate inflation is healthy, but extreme inflation is not. When prices rise too rapidly, consumers fall behind and struggle to keep pace: the result can be a wage-price spiral or a collapse in demand, both regrettable.

Deflation (broadly declining prices) is also economically damaging. In this latter case, businesses’ margins shrivel, and they respond with rapid job cuts, ensuring a recession.

The right answer is a Goldilocks state of inflation, neither too hot nor too cold. Steady economic activity and growth of the supply of money will lead to moderate inflation and predictable interest rates.

Inflation targeting policies have value beyond monetary policy decision-making. The International Monetary Fund (IMF) looked back at central banks’ performance against their targets, concluding that targets help to anchor inflation expectations. This is an important goal of monetary policy. The clear objective also informs other decisions, such as structuring fiscal policy with an eye toward managing inflation.

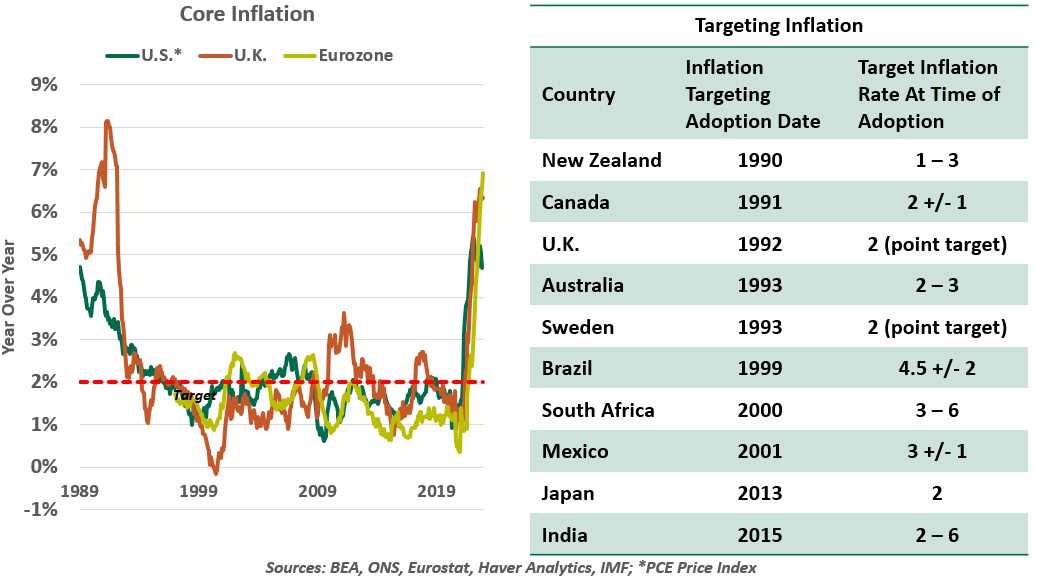

Pinpointing a specific target of 2% is a relatively recent phenomenon. The Reserve Bank of New Zealand was the first central bank to discuss an explicit target in 1990. Their initial conjecture was 0-1% following a spate of high inflation, but 2% was ultimately selected in a process described as “not ruthlessly scientific.” Setting a formal target caught on around the world; the Federal Reserve’s adoption of the 2% goal came relatively late, in 2012. Targets can vary, and many emerging markets with pervasively higher inflation set the bar higher.

In the wake of the Global Financial Crisis, some economists urged the adoption of a higher inflation target. The IMF’s leadership at the time advocated a target of 4%: in their view, such a rate would be consistent with an environment of higher interest rates, but would not necessarily be detrimental to growth. For instance, in the high-growth interval of 1983-89, U.S. core inflation averaged 4.1%. A higher policy rate gives central banks greater conventional room to intervene in the event of a crisis, when low interest rates can be quite limiting.

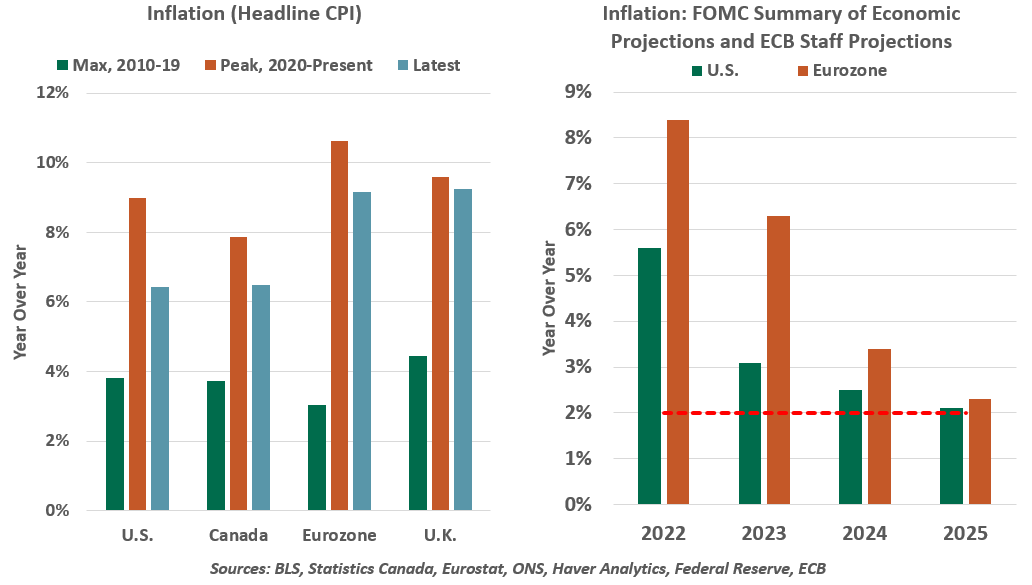

As we write today, inflation is elevated, but on its way down. The U.S. passed peak price increases over the summer. High energy costs have kept inflation in Europe higher for longer, but recent readings show the beginnings of a decline. As the world moves on from the complications of COVID and the Ukraine invasion, inflation will settle, but a return to 2% may be a long way off. Given the potential economic cost of pressing too hard to reach 2%, is it time to gain comfort with a higher inflation target? We believe such speculation is premature, for a number of reasons.

Targeting an inflation rate has value even if it proves elusive.

First, it is much too soon to conclude that inflation cannot return to current targets. While the duration of the “transitory” cycle proved longer than most forecasters anticipated, it appears to be over. The inflation challenge was driven primarily by exogenous supply shocks that were beyond anything central banks could prevent or solve. Best to wait to see the extent of further improvement in inflation before considering any change to policy.

Second, the difference between 2% and 3% inflation may seem small, too small to trifle over given the immense measurement error that attends the establishment of the price level. But over time, the difference in compounding and discounting between the two levels is immense. Making an alteration could therefore have a substantial impact on wage expectations and asset prices.

Above all, we believe central banks should hold to their targets in the name of stability. The target serves as a lodestar: even if it is not reached, it sets an anchor. Modifying a goal to suit actual outcomes is disingenuous, akin to shirking a weight loss challenge by purchasing larger clothes. Volatility in the target reflects volatility in policy-making, a reputation that central banks will go to great lengths to avoid.

Now is not the time to consider changing inflation targets.

The target could be revisited at some point in the future, if we see stable growth, employment and interest rates with inflation holding steadily above 2%. But as of this writing, such an outcome is far from assured. Speculation should not be the basis to change the goal today.

Instead of wholesale target revisions, central banks may instead alter the way in which they are implemented. The Federal Reserve modeled this with their 2020 shift to a long-term average inflation target of 2%. This came partially in response to a decade of anemic inflation; the shift allowed the Fed to indulge price increases that were higher than target, if they had fallen short of target for a time.

The policy was strategically ambiguous as to how long the term should be. As of today, including the current run-up, the average core PCE inflation rate stands at 2.1% over the past ten years. The altered approach granted policymakers more discretion to manage through this inflationary interval.

The challenges facing central banks today are many and varied. They are taking the fight against inflation seriously, using all policy tools available to them. The year ahead will bring a shift toward monitoring the effects of a year of rapid tightening. Inflation targets will be the gauge of success; if we don’t have a firm fix on the destination, we can’t be certain if we have arrived.

Copyright © Northern Trust