Pre-opening Comments for Thursday January 26th

U.S. equity index futures were higher this morning. S&P 500 futures were up 9 points at 7:30 AM EST.

December Durable Goods Orders released at 8:30 AM EST are expected to increase 2.5% versus a drop of 2.5% in November. Excluding Transportation Orders, December Durable Goods Orders are expected to slip 0.1% versus a gain of 0.1% in November.

Next estimate of U.S. fourth quarter GDP released at 8:30 AM EST is expected to show growth at an annualized rate of 2.6% versus a previous estimated growth rate of 3.2%.

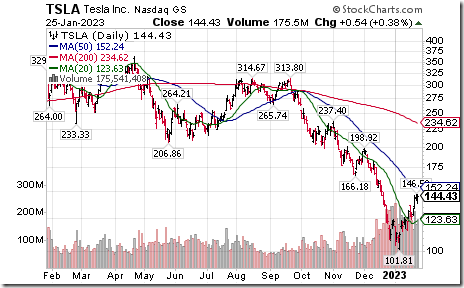

Tesla added $0.30 to $144.73 after reporting slightly higher than consensus fourth quarter earnings, but slightly lower than consensus fourth quarter revenues.

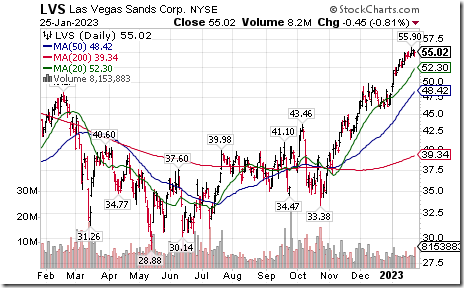

Las Vegas Sands gained $1.98 to 57.00 after offering positive guidance.

IBM added $0.24 to $141.00 after reporting fourth quarter earnings in line with consensus and after reporting fourth quarter revenues slightly higher than consensus.

Chevron advanced $3.62 to $182.70 after announcing a $75 billion share buyback program

EquityClock’s Daily Comment

Headline reads “Bank of Canada is pausing and the Fed is expected to suggest the same: Study shows that the best performing investment 3 to 6 months after the last rate hike is bonds. The worst: Gold”.

http://www.equityclock.com/2023/01/25/stock-market-outlook-for-january-26-2023/

Technical Notes

Fox $FOX an S&P 100 stock moved above $30.87 completing a double bottom pattern. FOX.A moved above $32.76 completing a double bottom pattern.

CVS Health $CVS an S&P 100 stock moved below $44.06 extending an intermediate downtrend.

CSX $CSX a NASDAQ 100 stock moved below $30.52 setting an intermediate downtrend.

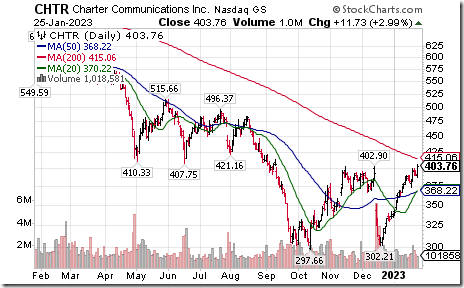

Charter Communications $CHTR an S&P 100 stock moved above $403.49 completing a double bottom pattern.

Incyte $INCY a NASDAQ 100 stock moved above $84.86 extending an intermediate uptrend.

Rio Tinto $RIO one of the world’s largest base metals producers moved above $79.61 (after adjusting for cancelled trades on Tuesday) extending an intermediate uptrend.

Canadian National Railway $CNR.TO a TSX 60 stock moved below Cdn$160.15 setting an intermediate downtrend. The company offered a cautious outlook.

Shopify $SHOP.TO a TSX 60 stock moved above Cdn$60.63 completing a reverse Head & Shoulders pattern

Franco-Nevada $FNV.TO a TSX 60 stock moved above Cdn$200.68 and US$149.66 extending an intermediate uptrend.

Trader’s Corner

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for January 25th 2023

Green: Increase from previous day

Red: Decrease from previous day

Commodities

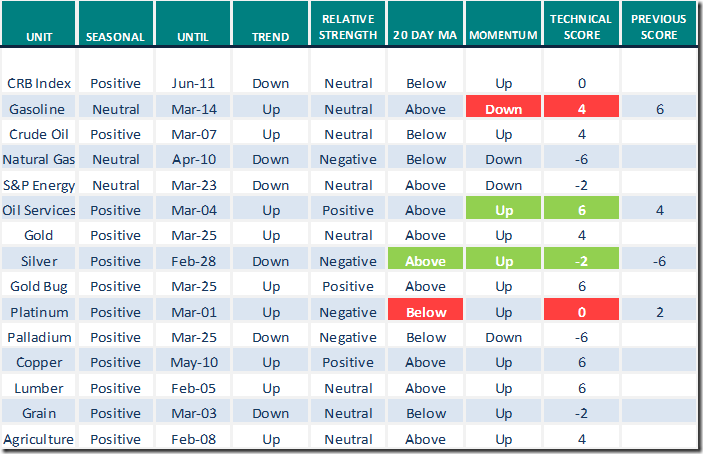

Daily Seasonal/Technical Commodities Trends for January 25th 2023

Green: Increase from previous day

Red: Decrease from previous day

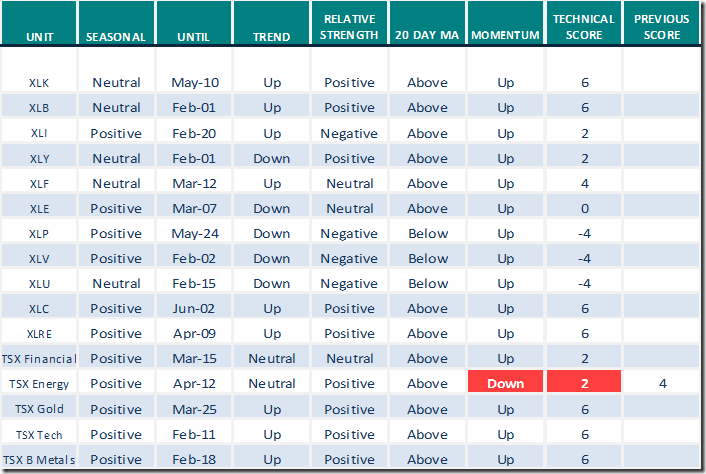

Sectors

Daily Seasonal/Technical Sector Trends for January 25th 2023

Green: Increase from previous day

Red: Decrease from previous day

Links offered by valued providers

Positive Rotation From Bear to Bull | Greg Schnell, CMT | Market Buzz (01.25.23)

Positive Rotation From Bear to Bull | Greg Schnell, CMT | Market Buzz (01.25.23) – YouTube

JPMorgan’s Marko Kolanovic explains why he’s "outright negative" on stocks

JPMorgan’s Marko Kolanovic explains why he’s "outright negative" on stocks – YouTube

Morgan Stanley’s Wilson on Stocks, China Reopening

Morgan Stanley’s Wilson on Stocks, China Reopening – YouTube

S&P 500 Momentum Barometers

The intermediate term Barometer slipped 0.80 to 69.00. It remains Overbought.

The long term Barometer slipped 0.45 to 65.20. It remains Overbought.

TSX Momentum Barometers

The intermediate term Barometer slipped 0.85 to 76.27. It remains Overbought.

The long term Barometer added 0.42 to 70.34. It remains Overbought. Short term trend remains up.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed