xTechnical Notes

Taiwan iShares $EWT moved above $45.03 completing a reverse Head & Shoulders pattern.

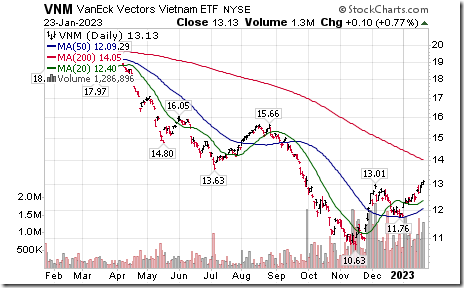

Vietnam ETF $VNM moved above $13.01 completing a double bottom pattern.

Auto ETF $CARZ moved above $46.51 completing a double bottom pattern.

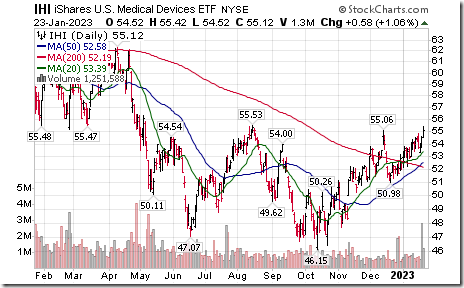

Medical Devices iShares $IHI moved above $55.06 extending an intermediate uptrend.

Semiconductor iShares $SOXX moved above $398.94 extending an intermediate uptrend.

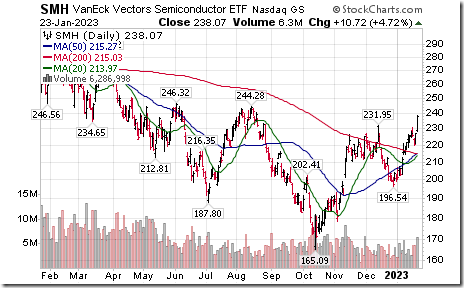

Semiconductor ETF SMH moved above $231.95 extending an intermediate uptrend.

Nvidia $NVDA, a NASDAQ 100 stock moved above $187.90 extending an intermediate uptrend.

Take Two $TTWO a NASDAQ 100 stock moved above $109.80 completing a double bottom pattern.

Qualcomm $QCOM an S&P 100 stock moved above $128.20 completing reverse Head & Shoulders pattern. The stock was upgraded by Barclays to Outperform.

Marriott International $MAR an S&P 100 stock moved above $169.05 extending an intermediate uptrend.

TSX Information Technology iShares $XIT.TO moved above $36.28 and $36.78 completing a reverse Head & Shoulders pattern.

Bausch Health $BHC.TO a TSX 60 stock moved above Cdn$10.99 extending an intermediate uptrend.

Silver ETN SLV moved below $22.40 completing a double top pattern.

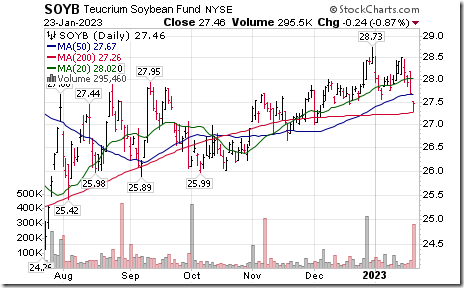

Soybean ETN $SOYB moved below $27.56 completing a double top pattern.

Trader’s Corner

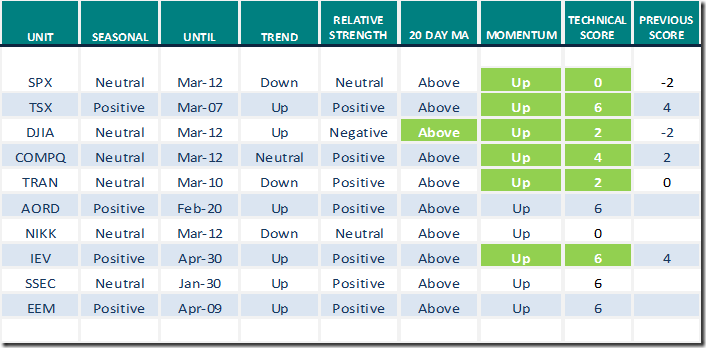

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for January 23rd 2023

Green: Increase from previous day

Red: Decrease from previous day

Commodities

Daily Seasonal/Technical Commodities Trends for January 23rd 2023

Green: Increase from previous day

Red: Decrease from previous day

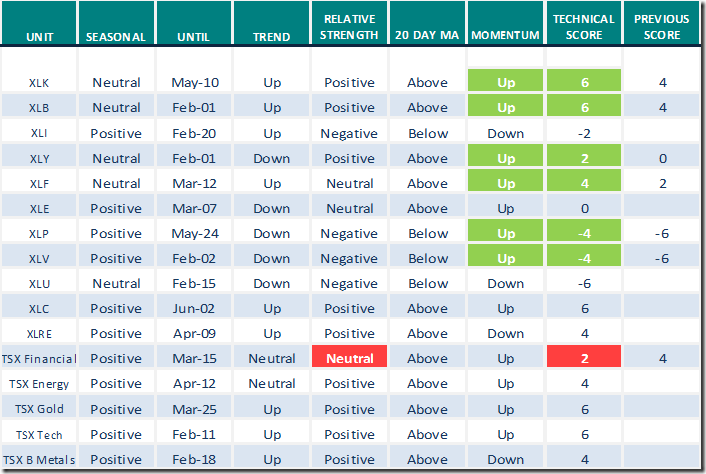

Sectors

Daily Seasonal/Technical Sector Trends for January 23rd 2023

Green: Increase from previous day

Red: Decrease from previous day

S&P 500 Momentum Barometers

The intermediate term Barometer advanced 6.40 to 69.20. It remains Overbought.

The long term Barometer added 4.20 to 66.40. It remains Overbought.

TSX Momentum Barometers

The intermediate term Barometer added 1.69 to 79.66. It remains Overbought.

The long term Barometer added 1.69 to 70.34. It remains Overbought and trending up.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed