by William and Cole Smead, Smead Capital Management

In 1817, David Ricardo developed his theory of comparative advantage to explain why countries engage in trade together, even when one country has an absolute advantage. The law of comparative advantage holds true today, but comparative advantages for particular goods change. A country’s advantage ebbs and flows with currency value, labor availability, labor prices, tariffs and other factors when it comes to goods. The law of comparative advantage is always shifting on the map of the globe.

The last 10 years have been led by the dominance or advantage of products made in Asia, but profited from in the USA. The USA’s advantage has been primarily its lead in its entrepreneurial culture, company building, technology and the ability to raise money for businesses that benefit from these factors. The product that makes us think of this process of building in Asia, but profiting in the USA, is the iPhone produced by Apple. The product wasn’t in existence 20 years ago, so it gives us a particular view of the flow of money for goods globally from a 20-year perspective. It was the most purchased product by revenue during that era.

Below is a breakout of the portion of the iPhone’s revenues that go to suppliers versus Apple itself:

This chart shows where the money has gone. The orange portion is the production costs, which have primarily flowed to Asia. The blue portion is what is going to Apple in the USA. This requires billions of people to purchase these products, ultimately in US dollars, and causes a huge demand-pull for the US dollar as a currency. The pandemic caused many people to go out and buy new iPhones. We had never been more completely dependent on technology in our lives at that point. Consumers aren’t buying iPhones now that they are free from their homes. They are off traveling and visiting the world. The flow of dollars from consumers has slowed to this product. This is our view of the current account of the USA in a classic economic sense.

Our view of the capital account in economics is what has taken place in the stock and bond returns. Below are the returns of US stocks and bonds over the last 10 years:

The USA went from producing gorgeous returns for foreign investors to producing losses in treasuries, corporate bonds and stocks. The old saying is that dogs chase cars and humans chase stocks. As investors, we know they chase anything that goes up and run from anything that goes down. The problem for the US dollar is that if they run from the asset they were just chasing, it could take a while for the capital account situation to get back to the strength it has had.

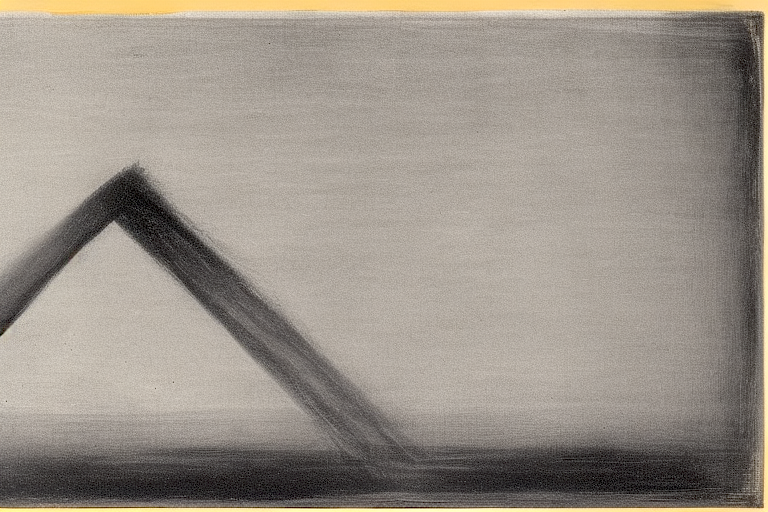

The last decade has been an unprecedented move to American technology products and US assets going one way together. This has been the USA’s comparative advantage and has helped the US dollar largely. Below is a chart of the trade-weighted dollar index over the last 10 years:

Source: Bloomberg.

It peaked at a gain of close to 42%, coming off the fears of Ukraine and higher rates in the US. It has since fallen to a 30% gain over the prior decade. We expect the comparative advantage of US technology products and the US investment assets to be the problem of the US dollar.

Does this spell a nightmare for the US? No, what is in the rear-view mirror won’t tell us the future. We are going to watch the west shift their supply chains to their allies and closer to home. Thus, away from Asia, a departure from the recent past. If you read Shannon O’Neil’s recently published book The Globalization Myth, you could see a world where we are much friendlier to our neighboring countries, Canada and Mexico, again a departure of the last ten years. What else could be a complete departure from the last 10 years? Poor US stock returns, poor US bond returns and a weak US dollar. For the investors in the Smead International Value strategy, we should relish these problems. The frustration of other investors and the strength of non-US dollar assets we believe will be our comparative advantage.

Fear stock market failure,

_______________________________________________

The recent growth in the stock market has helped to produce short-term returns for some asset classes that are not typical and may not continue in the future. Margin of safety is the difference between the intrinsic value of a stock and its market price. The price-earnings ratio (P/E Ratio or P/E Multiple) measures a company’s current share price relative to its per-share earnings. Alpha is a measure of performance on a risk-adjusted basis. Beta is a measure of the volatility of a security or a portfolio in comparison to the market. FAANG is an acronym for the market’s five most popular and best-performing tech stocks, namely Facebook, Apple, Amazon, Netflix and Alphabet’s Google. Growth investing is focused on the growth of an investor’s capital. Leverage is using borrowed money to increase the potential return of an investment. Momentum is the rate of acceleration of a security’s price or volume. The earnings yield refers to the earnings per share for the most recent 12-month period divided by the current market price per share. Profit margin is calculated by dividing net profits by net sales. Quality is assessed based on soft (e.g. management credibility) and hard criteria (e.g. balance sheet stability). Value is an investment tactic where stocks are selected which appear to trade for less than their intrinsic values. The dividend yield is the ratio of a company’s annual dividend compared to its share price.

The information contained herein represents the opinion of Smead Capital Management and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

Smead Capital Management, Inc.(“SCM”) is an SEC registered investment adviser with its principal place of business in the State of Arizona. SCM and its representatives are in compliance with the current registration and notice filing requirements imposed upon registered investment advisers by those states in which SCM maintains clients. SCM may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. Registered investment adviser does not imply a certain level of skill or training.

This newsletter contains general information that is not suitable for everyone. Any information contained in this newsletter represents SCM’s opinions, and should not be construed as personalized or individualized investment advice. Past performance is no guarantee of future results. There is no guarantee that the views and opinions expressed in this newsletter will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. SCM cannot assess, verify or guarantee the suitability of any particular investment to any particular situation and the reader of this newsletter bears complete responsibility for its own investment research and should seek the advice of a qualified investment professional that provides individualized advice prior to making any investment decisions. All opinions expressed and information and data provided therein are subject to change without notice. SCM, its officers, directors, employees and/or affiliates, may have positions in, and may, from time-to-time make purchases or sales of the securities discussed or mentioned in the publications.

This Newsletter and others are available at smeadcap.com