by Larry Adam, Chief Investment Strategist, Raymond James

Market volatility and the Federal Reserve's efforts to reduce inflation will continue to garner attention.

To read the full article, see the Investment Strategy Quarterly publication linked below.

Key takeaways:

- We believe that inflation will be moderate over the next year which will allow the Federal Reserve (Fed) to back off, but investor focus is likely to shift toward the damage done to the economy.

- Volatility is likely to continue for now, and the bottoming process and recovery may be elongated.

- Don’t lose sight of the bull market opportunity that will occur on the other side of the current weak trend. We expect a mild recession in 2023, but equities will bottom well ahead of the economy and corporate earnings.

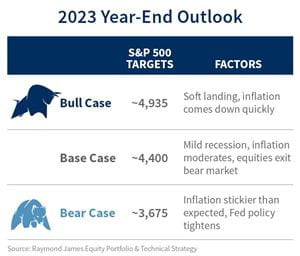

- We use ~4,400 as our base case S&P 500 target.

2023 will be heavily influenced by three questions: to what degree will inflation moderate, how will central bank policy progress, and how much demand-driven pressure will the Fed need to inflict on the economy in order to bring inflation down?

The main issue continues to be that inflation is far too high. Because it has stayed at such a high level, it is putting increased pressure on consumer disposable income levels, saving rates, and when accompanied by weak asset prices, is resulting in weak purchasing power for the backbone of the U.S. economy: the U.S. consumer.

The Fed does not have the ability to dampen inflation by improving supply, but it can negatively impact demand through rate hikes. Swift rate hikes throughout 2022 will act with a lag on the economy and are already starting to show up in the economic data; i.e., mortgage applications are at 25-year lows, leading economic indicators are negative, the yield curve is inverted, and layoffs/hiring freezes are being announced. We expect a recession to occur in 2023; but while the R-word can be scary, we believe it will be mild. We believe that inflation will indeed moderate over the next year – which will allow the Fed to back off, financial strains to ease, and equity markets to bottom and begin climbing into the next bull market.

Focused on the Fed

The path forward for inflation remains highly uncertain and will be a large determinant of Fed expectations, bond yields, and equity valuations. Because of this, investors will be highly data-dependent on the incoming inflationary readings. Two consecutive months of lower than expected consumer price index (CPI) data provided a potential light at the end of the tunnel. However, the Fed will need a series of improvements over time in order to raise conviction that inflation is indeed on track to a more reasonable level. We also believe it will take time for this moderation to be convincing and clear enough for the Fed to become comfortable. Still-strong demand from the services side of the economy and high wage growth suggest the path to inflation improvement will likely not be quick or easy. And during that time, volatile economic data could result in volatile equity markets.

Bull, bear and base

Despite the potential for further volatility over the coming months, we do believe that we are in the late stages of this bear market. Recessionary bear markets decline 33% on average over 13 months, but we have seen a 25% contraction over 11 months already. We expect the economy and corporate earnings to weaken over the next year, as Fed tightening (which remains ongoing) works with a lag on the economy.

On average historically, the S&P 500 has bottomed two to six months prior to recession end while earnings bottom eight to nine months after recession end. While equities may have further downside or time left before durable upside can occur, we do believe that the majority of this bear market is behind us at this point. Don’t lose sight of the bull market opportunity that will occur on the other side of the current weak trend. Bear markets can go down 25-33% on average over a year or so, but bull markets can appreciate 152% over four to five years.

Taking all of this into account, our base case S&P 500 target for 2023 is ~4,400. This target incorporates a mild recession, moderation in inflation, and equities climbing out of the current bear market by year end.

Valuation views

Given our 2023 expectation that inflation moderates and the Fed backs off, bond yields are likely to peak and valuations bottom. This will provide opportunity throughout the market, particularly in high-quality names where high inflation and bond yields have resulted in outsized pressure, i.e., high beta, Consumer Discretionary, and Technology-oriented areas. Small-cap equities are another area that we believe are set up for outperformance, but timing is important with these trades. Additionally, many of the areas that may outperform in a recovery scenario are also likely to underperform should equities fall. Therefore, it is important to maintain balance in portfolios between managing risk while also keeping an eye on the longer-term opportunity. With this in mind, we recommend investors refrain from chasing the rally periods and build exposure to favored areas in the weak periods as long-term risk/reward improves.

Read the full

Investment Strategy Quarterly

*****

All expressions of opinion reflect the judgment of the Chief Investment Office, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance may not be indicative of future results. Asset allocation and diversification do not guarantee a profit nor protect against loss. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary. Investing in small cap stocks generally involves greater risks, and therefore, may not be appropriate for every investor. International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility. Investing in emerging markets can be riskier than investing in well-established foreign markets. Investing in the energy sector involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices rise. If bonds are sold prior to maturity, the proceeds may be more or less than original cost. A credit rating of a security is not a recommendation to buy, sell or hold securities and may be subject to review, revisions, suspension, reduction or withdrawal at any time by the assigning rating agency. Investing in REITs can be subject to declines in the value of real estate. Economic conditions, property taxes, tax laws and interest rates all present potential risks to real estate investments. The companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Copyright © Raymond James