by Vaibhav Tandon, Senior Economist, Northern Trust

U.S. consumers did not slow their spending over the holidays.

The holiday shopping season in 2021 was a big hit, with Americans spending freely as they emerged from the shadows of COVID-19. Heading into the 2022 holidays, the question on most observers’ minds was: will shoppers flock to the stores, or is a there a recession in store?

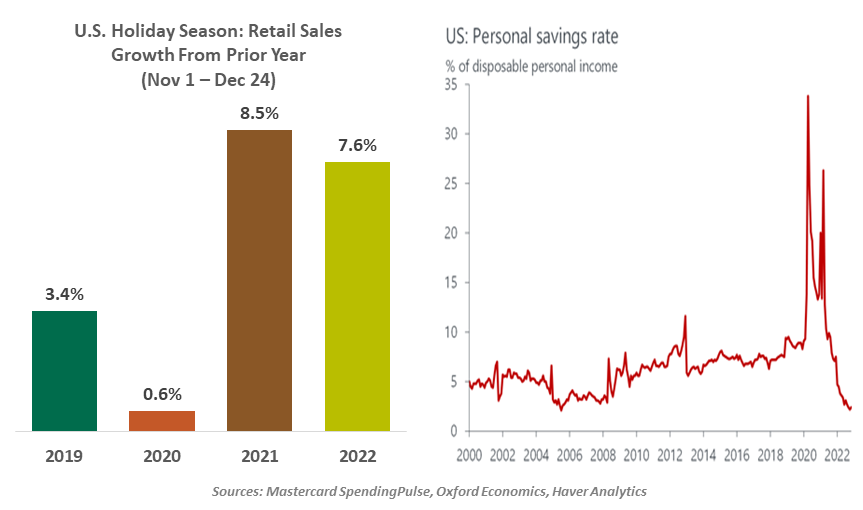

The holiday season is important for retailers (accounting for 25% or more of annual sales) and in turn for the economy. Despite higher prices for almost everything from food to gas and ongoing speculation of a recession, Americans remained upbeat and active. The Conference Board’s Consumer Confidence Index jumped to its highest reading in eight months in December. According to data from MasterCard SpendingPulse, sales from November 1 to December 24 rose 7.6% in nominal terms. The National Retail Federation expects U.S. holiday retail sales to have grown by 6-8% year over year in 2022.

While e-commerce spending remained strong, Americans also shifted back slightly to spending at brick and mortar stores for a more traditional holiday shopping experience. In-store sales grew 12% year over year on Black Friday. Traffic in stores rose 7% over the same time period. All these are signs that the U.S. economy closed the year positively.

Current spending patterns are not consistent with an imminent downturn. Average sales for October and November still point to a robust contribution to gross domestic product growth in the fourth quarter from consumer spending. Americans are still splurging on services, underpinned by still-robust labor market conditions. Higher airline spending implies a shift from holiday gifts to trips and leisure. Consumption will continue to underpin the economy if the labor market stays tight.

American consumers had a happy holiday season.

Beneath the bustle reflected in the headline numbers, there are signs that Americans are becoming more cautious. The November retail sales report showed consumers dialed back spending on big-ticket discretionary items such as furniture, electronics, clothing and sporting goods.

While retail sales are a useful indicator to assess the health of the economy, it is not the perfect gauge of holiday spending. Retail sales measures are sums of dollars spent and are distorted by major changes in prices. Price discounting by retailers, with replenished inventory during the all-important holiday shopping season, pushed sales lower. The measure also includes a broader set of items that wouldn’t typically find their way into holiday shopping basket. Last year’s worries of shortages also likely pushed consumers to front-load their spending, leading to a weaker reading in November after a strong rise in the month of October.

Going forward, discretionary spending faces many headwinds: elevated food and energy prices, higher borrowing costs, lower excess savings and negative wealth effects from lower stock and house prices. Credit card balances have ticked up while personal saving rates have fallen.

Complete findings on holiday shopping won’t be known until after the major retailers release their fourth quarter earnings, which will reveal how discounts and inflation impacted their profits. However, the available data clearly shows that Americans rang in the new year in decent overall financial shape, and they celebrated accordingly. As long as labor markets hold up, the days ahead still may be merry and bright.

*****

Vaibhav Tandon

Vaibhav Tandon

Vice President, Economist

Vaibhav Tandon is an Economist within the Global Risk Management division of Northern Trust. In this role, Vaibhav briefs clients and colleagues on the economy and business conditions, supports internal stress testing and capital allocation processes, and publishes the bank's formal economic viewpoint. He publishes weekly economic commentaries and monthly global outlooks.