The Bottom Line

Technical action by U.S. equity markets on Friday was encouraging. Indices responded favourably to the December Employment Report: Unemployment unexpectedly dropped to 3.5% from 3.7%. Of greater importance, Average Hourly Earnings on a year-over-year basis dropped to 4.6% from 5.1% in November. However, the good news is likely to raise concerns by the Fed.

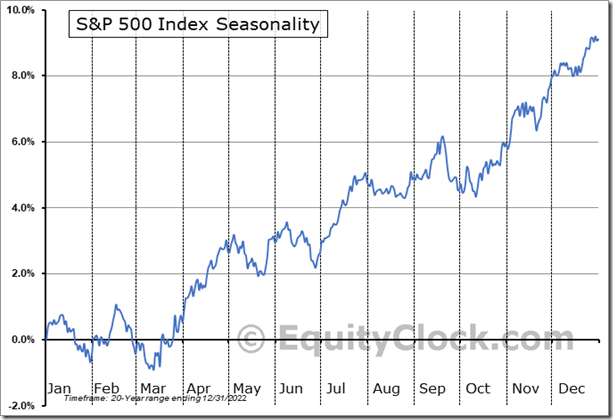

U.S. equity indices have a history of moving sideways between the first week in January and the second week in March. Thereafter, they move higher to the end of the year. They are notably stronger after mid-March during the third week in the U.S. Presidential cycle

Several current events suggest that history will repeat:

- Fourth quarter earnings by S&P 500 companies on average are expected to move lower on a year-over-year basis for the first time since 2008 followed by break-even earnings in the first and second quarters of 2023.Analyst continue to lower estimates.

- The intermediate term momentum Barometer moved to Overbought on Friday and the long term momentum Barometer is Neutral. Both are trending higher.

- The Federal Reserve has maintained a tightening monetary policy in order to dampen inflation pressures. More information about Fed intentions on interest rates is expected to be released by Federal Reserve chairman Powell on Tuesday morning. The Federal Reserve also is likely to update its intentions after release of the December CPI report on Thursday.

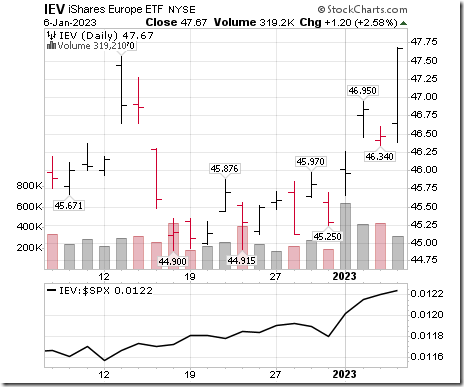

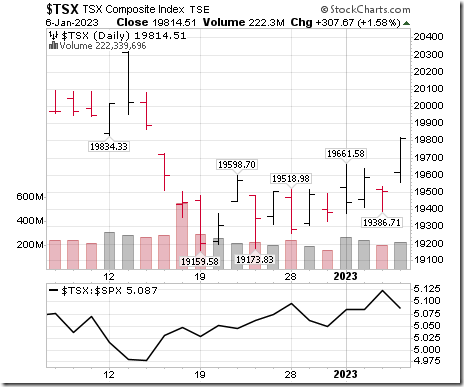

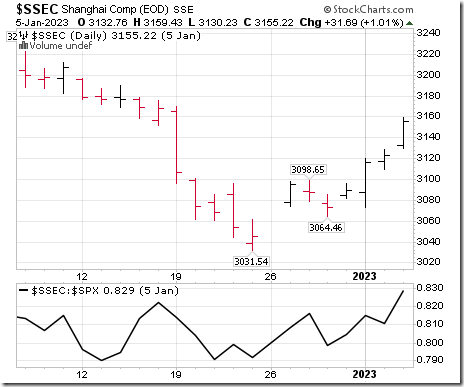

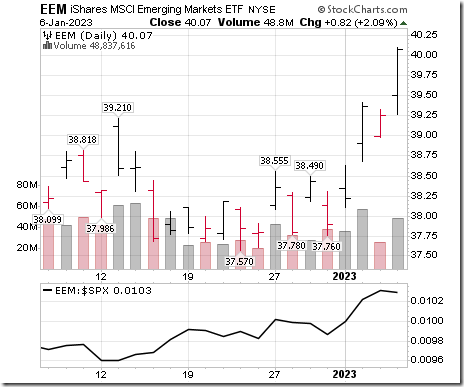

Prospects for equity markets outside of the U.S. look more interesting between now and mid-March. Recently they have started to outperform the S&P 500 Index

Consensus for Earnings and Revenues for S&P 500 Companies

Analysts once again lowered fourth quarter earnings and revenue estimates since our last report on December 19th. According to www.factset.com fourth quarter earnings are expected to decrease 4.1% (versus previous decrease of 2.8%) and revenues are expected to increase 3.8% (versus previous increase of 4.0%). For all of 2022 earnings are expected to increase 4.7% (versus previous increase of 5.1%) and revenues are expected to increase 10.4%.

Preliminary earnings estimates for 2023 also moved lower. According to www.factset.com first quarter 2023 earnings are expected to decrease 0.1% (versus previous increase at 0.7%) but revenues are expected to increase 3.8% (versus previous increase of 3.6%). Second quarter 2023 earnings are expected to decrease 0.5% (versus previous increase at 0.3%) and revenues are expected to increase 0.9% (versus previous increase at 1.10%). For all of 2023, earnings are expected to increase 4.8% (versus previous increase of 5.5%) and revenues are expected to increase 3.2% (versus previous increase of 3.3%).

Economic News This Week

Federal Reserve Chairman is scheduled to release a comment at 8:00 AM EST on Tuesday

U.S. December Consumer Price Index released at 8:30 AM EST on Thursday is expected to increase 0.1% versus a gain of 0.1% in November. On a year-over-year basis, December CPI is expected to increase 6.6% versus a gain of 7.1% in November. Excluding food and energy, December Consumer Price Index is expected to increase 0.3% versus a gain of 0.2% in November. On a year-over-year basis, core December CPI is expected to increase 5.7% versus a gain of 6.0% in November.

January Consumer Sentiment released at 10:00 AM EST on Friday is expected to increase to 60.0 from 59.7 in December.

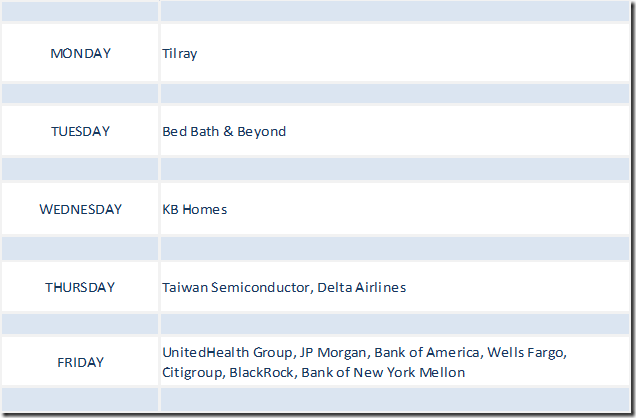

Selected Earnings News This Week

Focus this week is on reports released by money-center banks on Friday.

Trader’s Corner

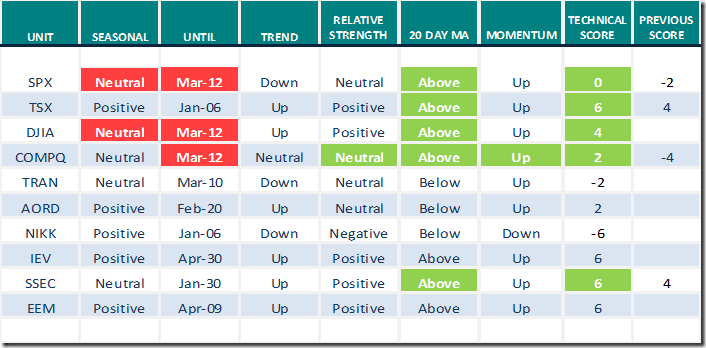

Equity Indices and Related ETFs

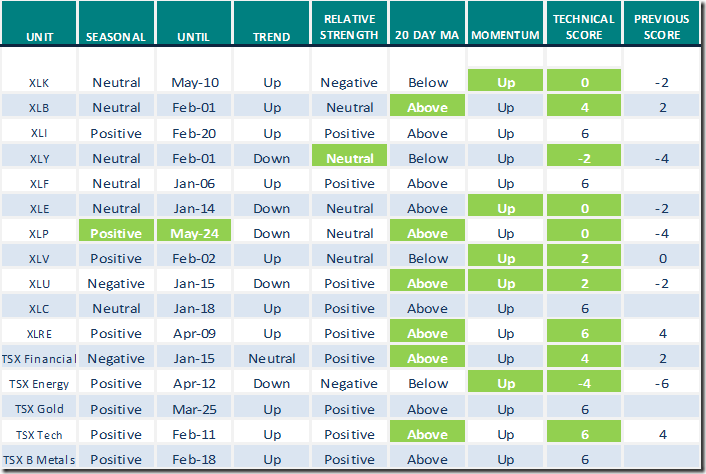

Daily Seasonal/Technical Equity Trends for January 6th 2023

Green: Increase from previous day

Red: Decrease from previous day

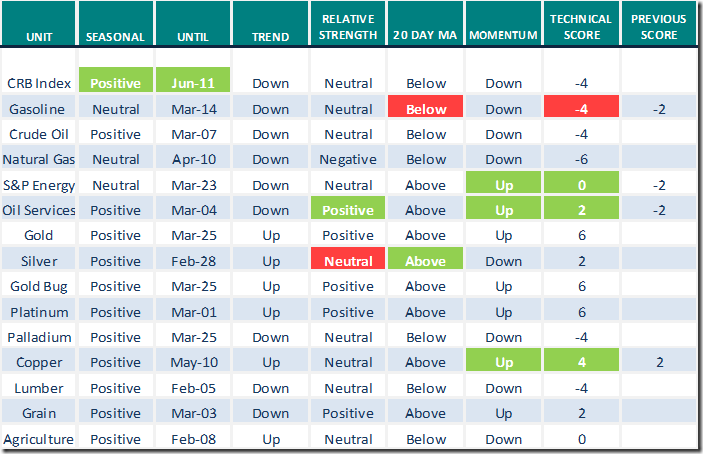

Commodities

Daily Seasonal/Technical Commodities Trends for January 6th 2023

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for January 6th 2023

Green: Increase from previous day

Red: Decrease from previous day

Technical Scores

Calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

(Higher highs and higher lows)

Intermediate Neutral trend: Score 0

(Not up or down)

Intermediate Downtrend: Score -2

(Lower highs and lower lows)

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower

Changes Last Week

Technical Notes from Friday

Eurozone iShares $EZU moved above $41.67 extending an intermediate uptrend.

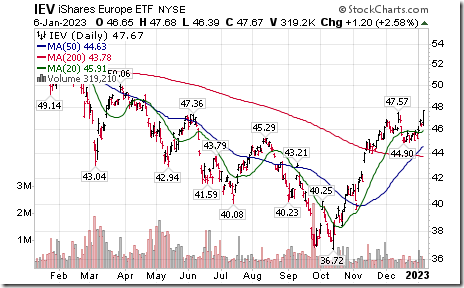

Europe iShares $IEV (includes United Kingdom positions moved above $44.57 extending an intermediate uptrend.

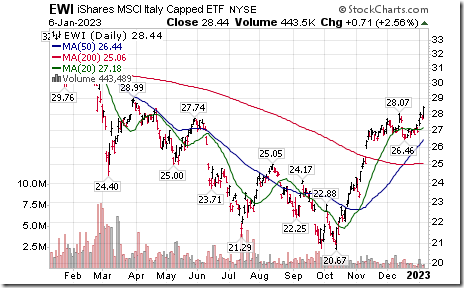

Italy iShares $EWI moved above $28.07 extending an intermediate uptrend.

Germany iShares $EWG moved above $26.16 extending an intermediate uptrend.

Steel ETF $SLX moved above $60.58 extending an intermediate uptrend.

Aerospace & Defense ETf $PPA moved above $80.35 to an all-time high.

Base Metals iShares $PICK moved above $43.25 extending an intermediate uptrend.

Copper Miners ETF moved above $37.47 extending an intermediate uptrend.

Rio Tinto $RIO one of the largest base metals producer in the world moved above $73.35 extending an intermediate uptrend.

Freeport McMoran $FCX one of the world’s largest copper producer moved above $41.15 extending an intermediate uptrend.

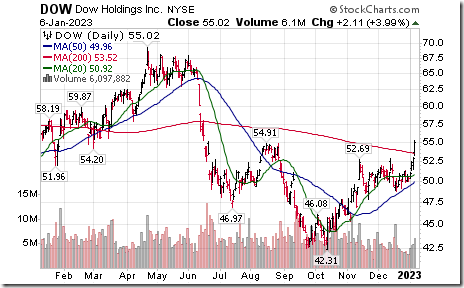

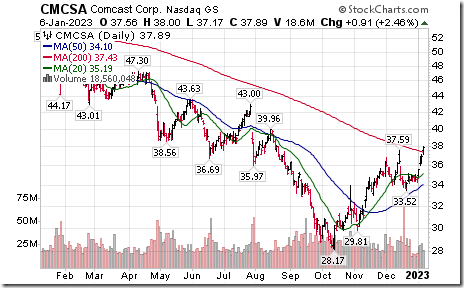

S&P 100 stock breakouts: Comcast $CMCSA moved above $37.59 extending an intermediate uptrend. FedEx $FDX moved above $184.39 extending an intermediate uptrend. Oracle $ORCL moved above $85.58 extending an intermediate uptrend. AT&T $T moved above $19.52 extending an intermediate uptrend. Dow Holdings $DOW moved above $52.83 and $54.91 completing a reverse Head & Shoulders pattern. Dupont $DD moved above $71.90 extending an intermediate uptrend. Berkshire Hathaway $BRK.B moved above $319.56 extending an intermediate uptrend. Duke Energy $DUK moved above $105.52 extending an intermediate uptrend. American International Group $AIG moved above $105.52 extending an intermediate uptrend.

NASDAQ 100 stock breakouts: Booking $BKNG a NASDAQ 100 stock moved above $2,152.37 and $2,161.05 extending an intermediate uptrend. Ross Stores $ROST a NASDAQ 100 stock moved above $120.39 extending an intermediate uptrend.

Starbucks $SBUX a Dow Jones Industrial Average stock moved above $105.54 extending an intermediate uptrend

Links offered by valued providers

Greg Schnell asks “Is this the look for 2023”?

Is This The Look For 2023? | The Canadian Technician | StockCharts.com

Mark Leibovit’s comment

The Implications of a Dropping US Dollar – HoweStreet

Links from Mark Bunting and www.uncommonsenseinvestor.com

Best Stock Ideas for 2023 From Our All-Star Roster – Uncommon Sense Investor

Eight Top Global Stock Ideas for 2023 – Uncommon Sense Investor

12 Best Stocks to Buy for 2023 | Kiplinger

7 Best Small-Cap Stocks to Buy for 2023 | Kiplinger

3 Cheap Stocks to Start 2023 | Morningstar

Michael Campbell’s Money Talks for January 7th

https://mikesmoneytalks.ca/category/mikes-content/complete-show/?mc_cid=69d621644e&mc_eid=592546b4b5

Tom Bowley says “This sentiment indicator SCREAMS go long NOW”.

This Sentiment Indicator SCREAMS Go Long NOW! | Tom Bowley | Your Daily Five (01.06.23) – YouTube

Has A New Bear Market Begun? | Mary Ellen McGonagle | The MEM Edge (01.06.23)

Has A New Bear Market Begun? | Mary Ellen McGonagle | The MEM Edge (01.06.23) – YouTube

Bob Hoye notes that “Financial pressures again increasing”

Financial Pressures Again Increasing – HoweStreet

David Chapman and www.EnrichedInvesting.com weekly comment

S&P 500 Momentum Barometers

The intermediate term Barometer advanced 21.80 on Friday and 18.40 last week to 67.80. It changed from Neutral to Overbought on a move above 60.00. Trend has turned up.

The long term Barometer added 8.60 on Friday and 7.60 last week to 57.60. It remains Neutral. Trend has turned up.

TSX Momentum Barometers

The intermediate term Barometer added 13.55 on Friday and 11.87 last week to 64.41. It changed from Neutral to Overbought on move above 60.00. Short term trend is up.

The long term Barometer added 5.93 on Friday and 8.47 last week to 54.66, It remains Neutral. Short term trend is up.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed