Technical Notes

Key Chinese equities trading on U.S. exchanges responded to news that China has relaxed its Zero COVID policy and relaxed regulation on raising capital. JD.com $JD a NASDAQ 100 stock moved above $61.40 extending an intermediate uptrend. Baidu $BIDU a NASDAQ 100 stock moved above $124.11 extending an intermediate uptrend.

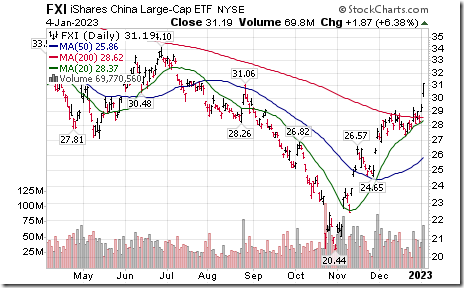

China Large Cap iShares $FXI moved above $29.13 and $31.06 extending an intermediate uptrend. China Technology ETF $CQQQ moved above $45.43 extending an intermediate uptrend.

Hong Kong listed equities and related ETFs also responded to China’s policy changes. Hong Kong iShares $EWH moved above $21.81 extending an intermediate uptrend.

Emerging Markets iShares $EEM moved above $39.21 extending an intermediate uptrend. Units are heavily weighted in Chinese equities.

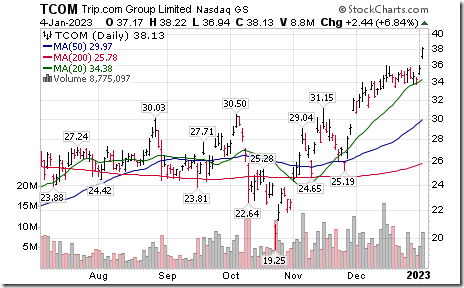

Trip.com $TCOM a NASDAQ 100 stock moved above $35.99 extending an intermediate uptrend.

Align Technologies $ALGN a NASDAQ 100 stock moved above $221.62 completing a double bottom pattern.

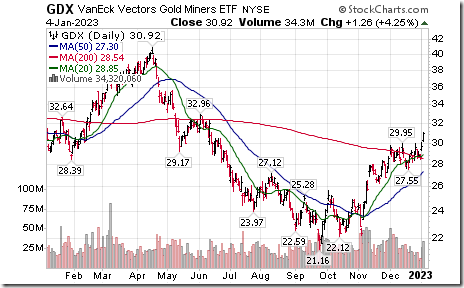

Gold and gold equity ETFs on both sides of the border responded to higher bullion prices. U.S. Gold Equity ETF $GDX moved above $29.95 extending an intermediate uptrend. TSX Gold iShares $XGD.TO moved above $18.66 extending an intermediate uptrend.

Kinross Gold $KGC a TSX 60 stock moved above US$4.49 and Cdn$6.07 extending an intermediate uptrend.

Southern Copper $SCCO, one of the largest copper miner in the world moved above $63.15 extending an intermediate uptrend.

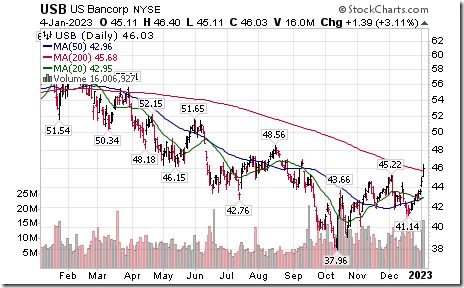

US Bancorp $USB an S&P 100 stock moved above $45.22 extending an intermediate uptrend.

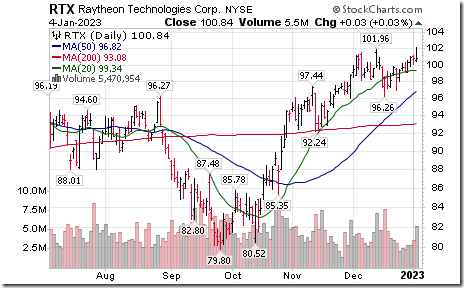

Raytheon Technologies $RTX an S&P 100 stocks moved above $101.96 extending an intermediate uptrend.

Open Text $OTEX a TSX 60 stock moved above US$30.41 extending an intermediate uptrend.

New Flyer Industries $NFI.TO moved above $10.71 completing a double bottom pattern. The company received a contact with Winnipeg Transit to provide up to 166 zero emission buses.

Mosaic $MOS one of the world’s largest fertilizer producer moved below $46.26 in early trading extending an intermediate downtrend.

Trader’s Corner

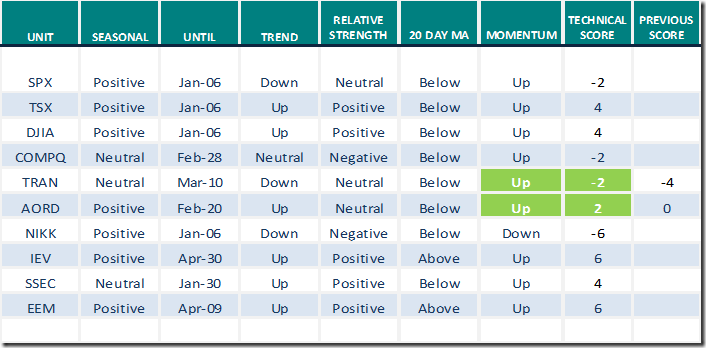

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for January 4th 2023

Green: Increase from previous day

Red: Decrease from previous day

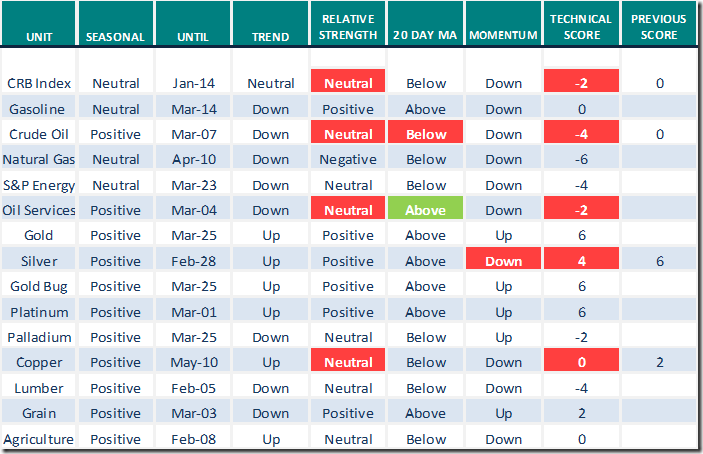

Commodities

Daily Seasonal/Technical Commodities Trends for January 4th 2023

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for January 4th 2023

Green: Increase from previous day

Red: Decrease from previous day

S&P 500 Momentum Barometers

The intermediate term Barometer advanced 8.80 to 57.40. It remains Neutral.

The long term Barometer added 3.40 to 53.20. It remains Neutral.

TSX Momentum Barometers

The intermediate term Barometer added 2.97 to 55.93. It remains Neutral.

The long term Barometer added 3.39 to 49.58. It remains Neutral.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed