Technical Notes

Nike $NKE a Dow Jones Industrial Average stock moved above $117.77 extending an intermediate uptrend. The company reported higher than consensus fiscal second quarter revenues and earnings.

Caterpillar $CAT a Dow Jones Industrial Average stock moved above $239.85 to an all-time high extending an intermediate uptrend.

Trader’s Corner

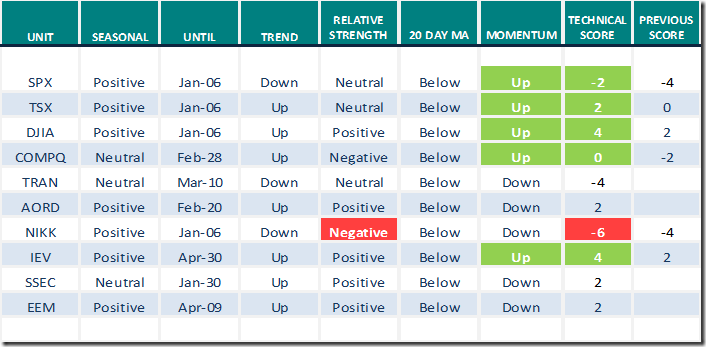

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for December 21st 2022

Green: Increase from previous day

Red: Decrease from previous day

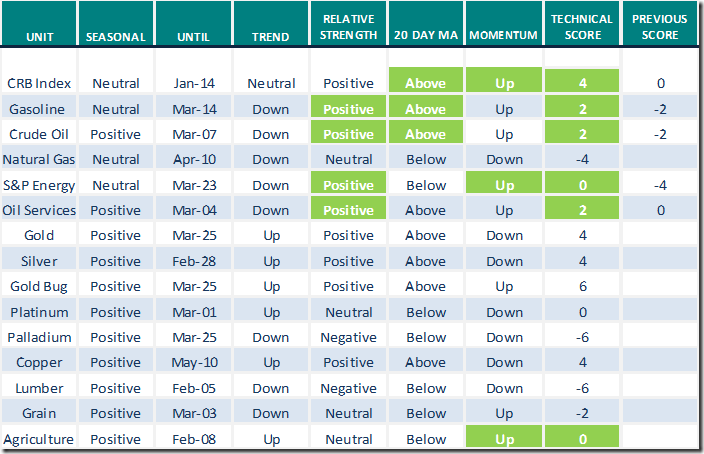

Commodities

Daily Seasonal/Technical Commodities Trends for December 21st 2022

Green: Increase from previous day

Red: Decrease from previous day

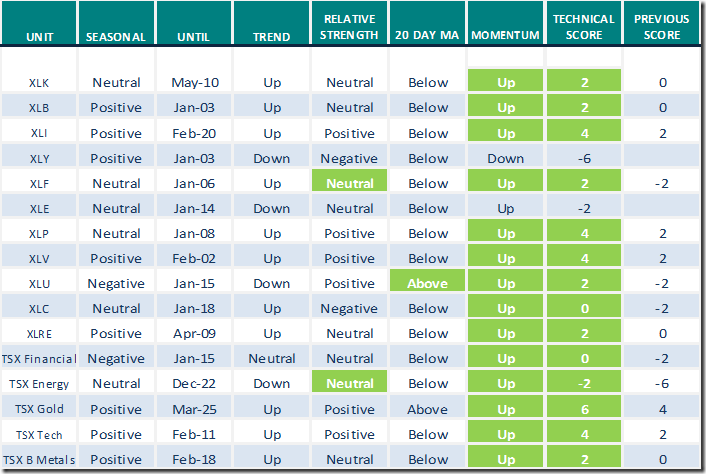

Sectors

Daily Seasonal/Technical Sector Trends for December 20th 2021

Green: Increase from previous day

Red: Decrease from previous day

Canadian Association for Technical Analysis Meeting

Next meeting is offered tonight at 8:00 PM EST. Speaker is Keith Richards. Everyone is welcome. Not a member of CATA? More information is at https://canadianata.ca/

Links offered by a valued providers

Market Buzz from Greg Schnell

2022 Year End Review, Part 1 | Greg Schnell, CMT | Market Buzz (12.21.22) – YouTube

Final Bar with Dave Keller

(12.21.22) Next Steps for the US Dollar | David Keller, CMT | The Final Bar – YouTube

Rick Rule says “If you’re dumb and trusting, you will be separated from your money: Advice for 2023.”

JP Morgan says “U.S. earnings are going to have to come down”

U.S. earnings are going to have to come down, says JPMorgan’s Joyce Chang – YouTube

S&P 500 Momentum Barometers

The intermediate term Barometer added 9.40 to 62.60. It changed from Neutral to Overbought on a move above 60.00.

The long term Barometer added 4.20 to 52.00. It remains Neutral.

TSX Momentum Barometer

The intermediate term Barometer added 10.13 to 57.38. It remains Neutral.

The long term Barometer advanced 5.49 to 46.41. It remains Neutral.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed