Pre-opening Comments for Wednesday December 21st

U.S. equity index futures were higher this morning. S&P 500 futures were up 29 points in pre-opening trade.

The Canadian Dollar was virtually unchanged at US73.44 cents following release of Canada’s November Consumer Price Index at 8:30 AM EST. On a year-over-year basis November CPI was expected to increase 6.7% versus a gain of 6.9% in October. Actual was an increase of 6.8%. Excluding food and energy, consensus was a gain of 4.9%. Actual was an increase of 5.0%

FedEx advanced $5.75 to $170.10 after reporting higher than consensus fiscal second quarter earnings.

BlackBerry slipped $0.07 to US$4.08 after reporting a fiscal third quarter loss.

Nike jumped $13.20 to $116.41 after reporting higher than consensus fiscal second quarter revenues and earnings.

Starbucks dropped $1.02 to $96.98 after Jefferies downgraded the stock from Buy to Hold.

EquityClock’s Daily Comment

Headline reads “The Consumer Discretionary sector ETF has broken below the lower limit of a descending triangle pattern, but the more opportune time to short exposure may be following the traditional Santa Claus rally period”.

http://www.equityclock.com/2022/12/20/stock-market-outlook-for-december-21-2022/

Technical Notes

Zoom $ZM a NASDAQ 100 stock moved below $69.54 extending an intermediate downtrend.

IDEXX Laboratories $IDXX a NASDAQ 100 stock moved below $396.75 completing a double top pattern.

Restaurant Brands International $QSR.TO a TSX 60 stock moved below Cdn$87.77 completing a double top pattern.

CCL Industries $CCL.B.TO a TSX 60 stock moved below $57.49 extending an intermediate downtrend.

Trader’s Corner

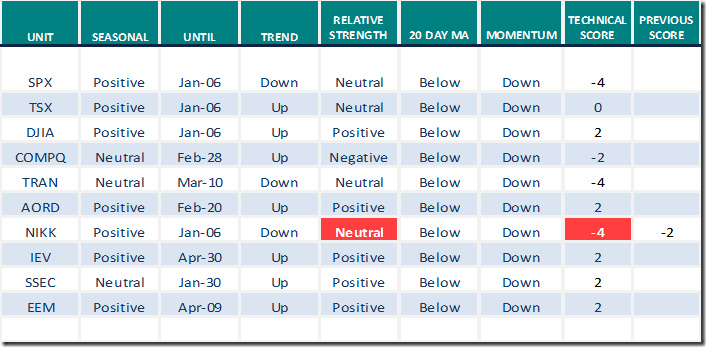

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for December 20th 2022

Green: Increase from previous day

Red: Decrease from previous day

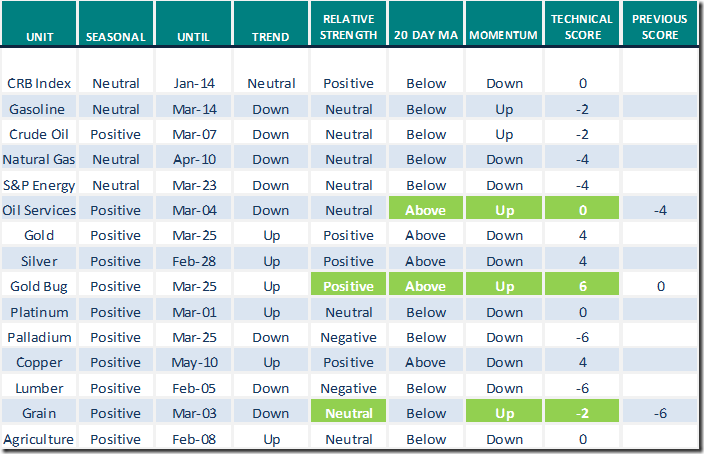

Commodities

Daily Seasonal/Technical Commodities Trends for December 20th 2022

Green: Increase from previous day

Red: Decrease from previous day

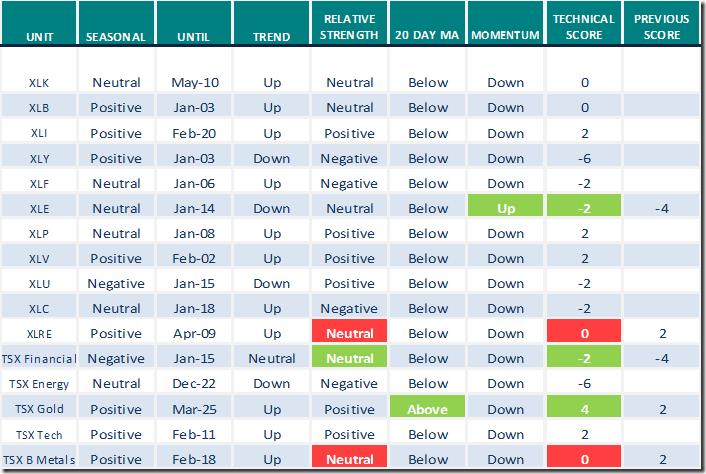

Sectors

Daily Seasonal/Technical Sector Trends for December 20th 2021

Green: Increase from previous day

Red: Decrease from previous day

Link offered by a valued provider

Tom Bowley asks “How low will the S&P 500 go”?

https://www.youtube.com/watch?v=0rlgR_Eb_4s

S&P 500 Momentum Barometers

The intermediate term Barometer added 0.60 to 53.20. It remains Neutral.

The long term Barometer slipped 0.20 to 47.80. It remains Neutral .Trend remains down.

TSX Momentum Barometers

The intermediate term Barometer added 4.22 to 46.26. It remains Neutral.

The long term Barometer added 2.95 to 40.93. It changed from Oversold to Neutral on a recovery above 40.00.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed