by Bill DeRoche, MBA, CFA®, Head of Quantitative Investing, AGF Investments LLC

An equity hedge can provide insulation to shocks by lowering a portfolio’s volatility, and over time lower volatility may translate to greater wealth.

Not surprisingly, anti-beta equity strategies did very well for investors who followed them in 2022 – after all, performing well when the stock market as a whole is doing poorly is exactly what such strategies are supposed to do, and 2022 was a very bad year for equities. Now, investors are hoping 2023 will bring respite from central banks’ punishing interest rate hikes and a resurgent stock market, and many might be thinking equity hedging will no longer be a winning strategy. They might be wrong.

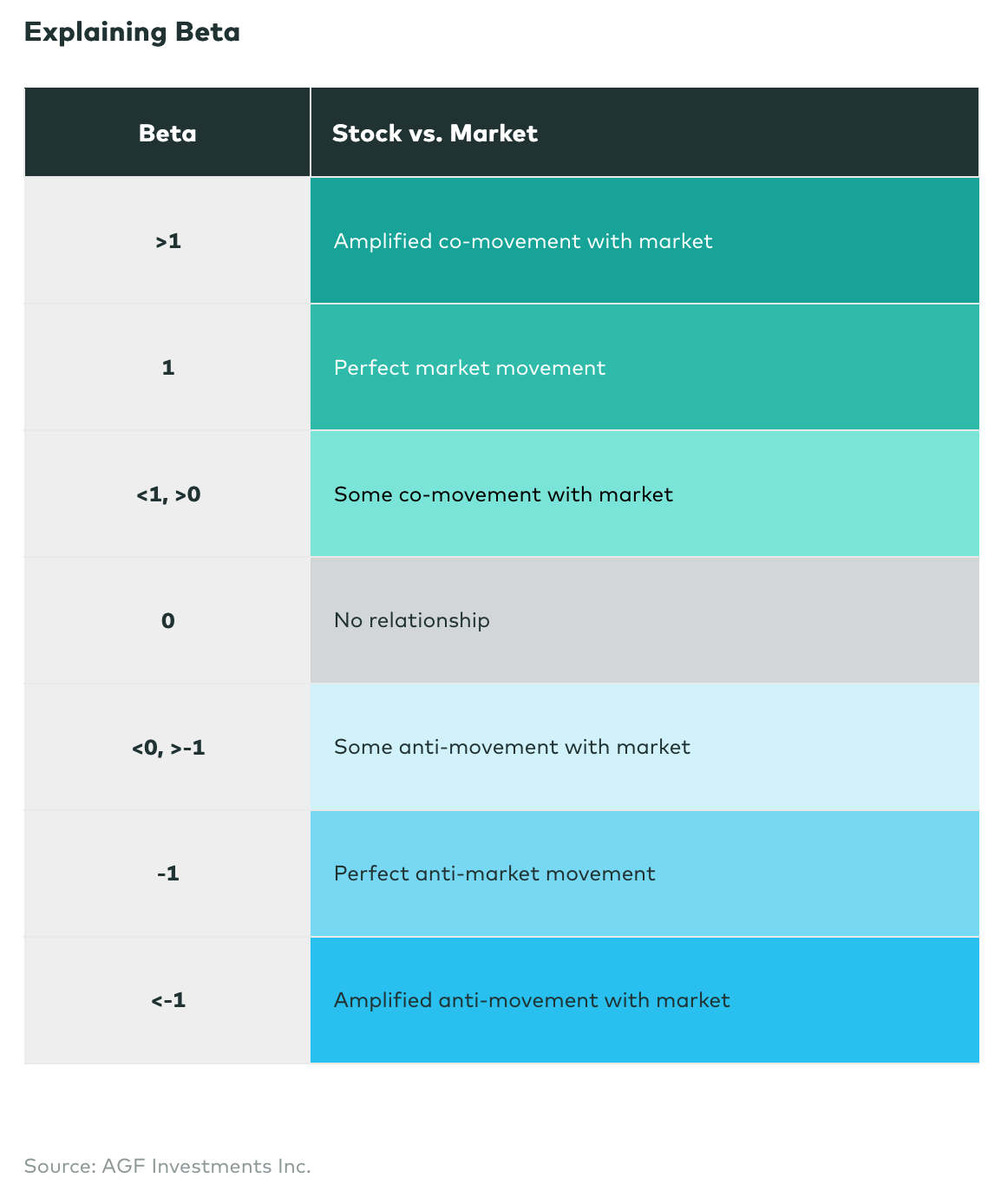

In fact, there are several reasons to believe that anti-beta hedging strategies – which, generally speaking, seek to short equities that have higher betas and go long on equities that have lower betas – will remain important tools to counter market volatility and risk in 2023.

One is that so many uncertainties still need to be resolved before the risk level in the stock market can begin to move downward. Chief among them is the terminal level of interest rates; U.S. Federal Reserve officials have been clear that they see rates capping out at 4.75% to 5%, but those estimates have been revised upward repeatedly over the past few months. As well, given robust consumer balance sheets and low unemployment, the demand reduction the Fed wants to create could take longer than markets anticipate – and it’s quite possible there are no rate cuts at all in 2023.

More significant, perhaps, is uncertainty over how severe and lengthy a recession, which looks very likely, might be. Compared to the recent shock-induced downturns of COVID-19 in 2020 and the housing crisis of 2008, the next recession might be longer, though perhaps less dramatic. Granted, equity markets tend to “see through” a recession to a recovery, so we would expect them to bottom out well before the end of the coming downturn. Until that end is in sight, however, we would also expect elevated volatility – which, based on our calculations using Bloomberg data, has been about 50% higher this year than pre-pandemic – to continue.

There are two conditions in which an anti-beta equity hedge does very well: when equities sell off and when interest rates are rising, in large part because the short high-beta portion of the portfolio tends to have a much longer duration than the long low-beta portfolio. Both conditions may still apply at least through the early part of 2023. If so, they may continue to highlight the vulnerabilities of traditional bonds – which were clobbered in 2022 right along with stocks, defying their traditional role as a hedge to equities – and alternative assets like gold or real estate, whose negative correlation to the stock market can fluctuate dramatically.

When considering hedging, investors need to ask how much risk they are willing to take on. Volatility creates significant sequence risk – that is, the risk that market shocks create significant draw-down events at particular points in time. Even though equities over the long term are great wealth drivers, such drawdowns can decimate a portfolio. Hedging provides insulation to shocks by lowering a portfolio’s volatility, and over time lower volatility can translate to greater wealth.

In short, even as we look forward to a Fed “pivot” and a rebound in the market, equity hedging as a complement to core stock and fixed income allocations should still be an important portfolio construction tool for investors in 2023.

Bill DeRoche, MBA, CFA®Head of Quantitative InvestingAGF Investments LLC

Bill DeRoche, MBA, CFA®Head of Quantitative InvestingAGF Investments LLC

The views expressed in this document are those of the author and do not necessarily represent the opinions of AGF, its subsidiaries or any of its affiliated companies, funds, or investment strategies.

The commentaries contained herein are provided as a general source of information based on information available as of December 6, 2022 and are not intended to be comprehensive investment advice applicable to the circumstances of the individual. Every effort has been made to ensure accuracy in these commentaries at the time of publication, however, accuracy cannot be guaranteed. Market conditions may change and AGF Investments accepts no responsibility for individual investment decisions arising from the use or reliance on the information contained here.

This document may contain forward-looking information that reflects our current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties, and assumptions that could cause actual results to differ materially from those expressed herein.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA), AGF Investments LLC (AGFUS) and AGF International Advisors Company Limited (AGFIA). AGFA and AGFUS are registered advisors in the U.S. AGFI is registered as a portfolio manager across Canadian securities commissions. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. The subsidiaries that form AGF Investments manage a variety of mandates comprised of equity, fixed income, and balanced assets.

This document is for use by Canadian accredited investors, European professional investors, U.S. institutional investors or for advisors to support the assessment of investment suitability for investors.

® The “AGF” logo is a registered trademark of AGF Management Limited and used under licence.

RO: 20221128-2610811