by Dev Chakrabarti, CIO, Concentrated Global Wealth, AllianceBernstein

Inflation, interest rates and growth challenges are evolving differently around the world. But country-specific macroeconomic conditions shouldn’t determine global equity allocations. Investors should look beyond a company’s domicile to find the most promising sources of long-term growth.

In this year’s global economic crisis, no two regions are having identical experiences. While inflation rages across much of the world, price rises have been more moderate in some countries than others. Similarly, the scale of rate hikes and the degree of recession fears aren’t uniform.

The US is enduring rate-cycle pain earlier and faster than elsewhere because of the Federal Reserve’s aggressive monetary tightening. In Europe, where inflation is even higher than the US, the energy crisis is complicating central bank action and amplifying recession risks. Japan, in contrast, has low inflation, loose monetary policy and a weak yen. China, meanwhile, is trying to stimulate growth, while managing a zero-COVID policy and coping with housing-sector risks.

Top-Down Regional Allocations Are Flawed

In this environment, investors in global equity portfolios might be tempted to seek regional exposures that reflect regional macro conditions. We think this type of top-down approach is flawed for three reasons. First, it is notoriously difficult to predict macro trends. Second, macro trends don’t always translate into equity market returns. And third, even as deglobalization accelerates, many companies don’t rely on domestic markets for revenue.

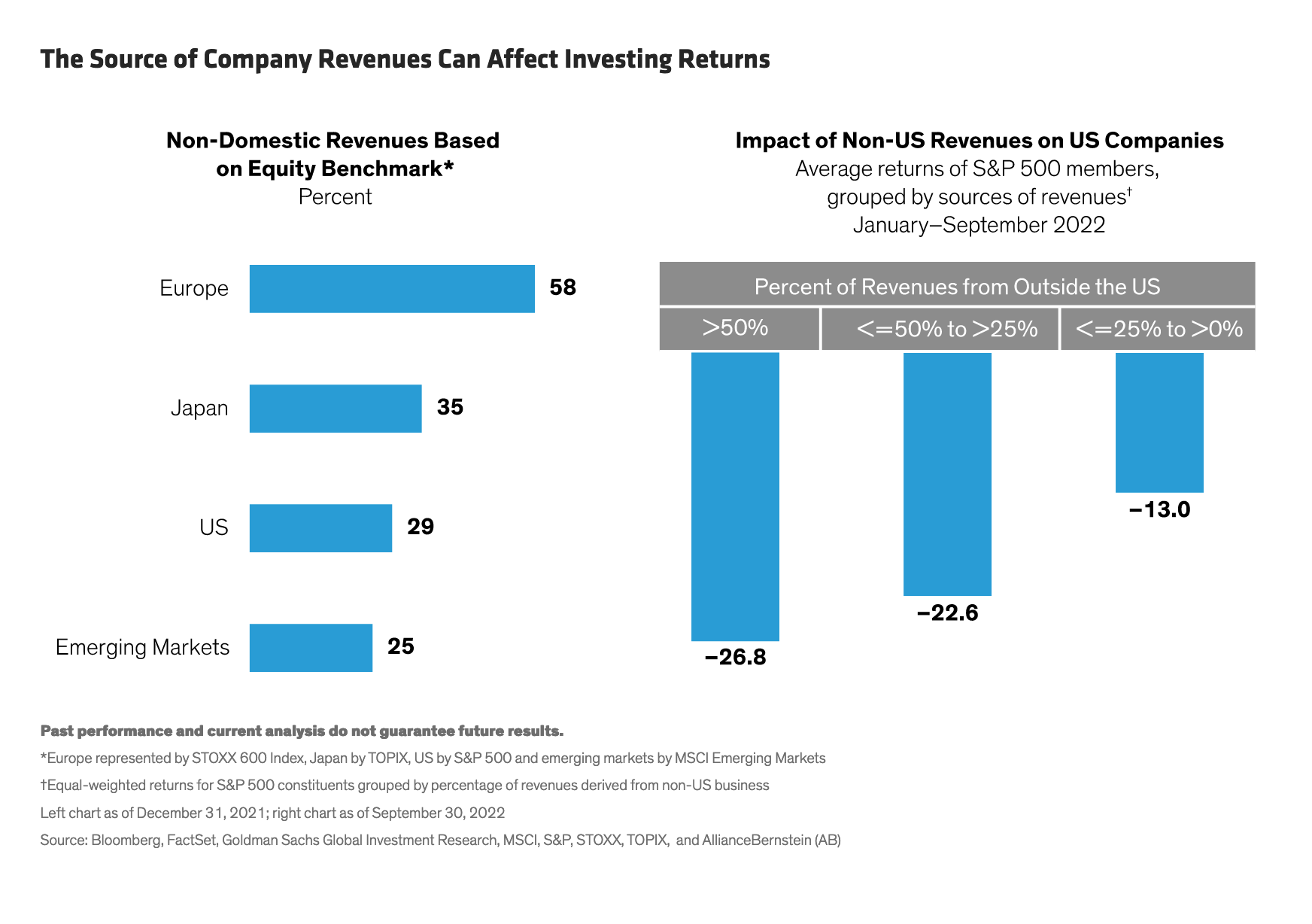

European companies generate 58% of their revenue from outside the region (Display, left). Japanese and US companies also sell significant volumes to customers abroad. As a result, in many cases, revenue and earnings growth potential will be determined more by global industry dynamics than inflation and GDP at home. What’s more, in a year when the US dollar has appreciated sharply, business performance has been acutely affected by currency exposures.

Recent equity market performance has reflected these trends. For example, shares of S&P 500 companies with more than 50% of revenues from outside the US fell by 26.8% through September (Display above, right). That’s more than double the declines of US companies with less than 25% of revenues abroad. The stronger US dollar erodes the value of non-US revenues booked in dollars.

Earnings revisions also appear to be driven by fault lines in regional businesses. US firms that derive more of their business at home have enjoyed stronger earnings revisions, while those with more international revenues fared worse, according to Goldman Sachs data (Display, left). In Europe, that pattern is reversed; the outlook for domestic-focused companies deteriorated, while those with US exposure are seen as more favorably positioned (Display, right).

Identifying Sources of Growth Potential

Currencies can change direction quickly and their effects can be fickle. Indeed, in late November, the US dollar began to weaken amid signs that US inflation was easing, fostering hopes that the Fed might slow its rate hikes. So, when evaluating long-term growth potential of companies in the current environment, currency exposure should be one factor in a broader fundamental analysis of growth positioning. Even amid today’s diverse macro challenges, we believe solid sources of growth potential can be found in areas including:

Non-US companies with significant US growth businesses: Europe-based companies with significant business in the US are clear beneficiaries from the stronger US dollar. But favorable currency exposure on its own doesn’t make an investment thesis. The underlying business growth potential must be robust. Contract catering is a good example. Compass Group, a UK-domiciled group, has a significant position in the US, where demand for food services in business, education and healthcare institutions is enjoying a post-COVID resurgence. The company also benefits from translating stronger US dollar revenue back into pounds sterling.

Enablers of efficiency: Technology trends such as robotics are an important part of corporate efforts to cut costs—a structural shift that doesn’t depend on economic growth. Fanuc of Japan is a global leader in factory automation, which currently enjoys currency advantages from a weak yen. In the US, pharmaceutical companies are seeking ways to become more efficient, especially amid new price caps on drugs. Iqvia, based in Durham, North Carolina, supplies and runs clinical trials to help drugmakers save on R&D spending.

Post-COVID recovery trends: The ongoing recovery from the pandemic is creating diverse opportunities. Thailand is a popular destination for medical tourism, which is rebounding as international travel recovers. Bangkok Dusit Medical Services is a Thai hospital group that serves both domestic and foreign patients, and benefits from both growing domestic and international demand for its services. Samsonite, the US-based luggage manufacturer with distribution in 100 countries, is another beneficiary of a return to travel. Strong sales growth across regions has helped the company offset negative currency effects of a strong US dollar.

These are just some of the areas where investors can discover resilient sources of growth that aren’t tied to domestic macro circumstances. In today’s murky economic environment, it takes a clear, disciplined strategy to build a portfolio of companies that are capable of increasing earnings consistently over time, while also incorporating risks and opportunities created by currency moves. Regional allocations of portfolios like these will have little to do with country macro trends but will be truly global by virtue of capturing business growth dynamics that transcend national borders.

About the Authors Dev Chakrabarti

Dev Chakrabarti

Joining AB from the global equity research and portfolio management team at WPS Advisors, Dev Chakrabarti's background is focused on deep research insights. AB has proven to be a good home for him as Chief Investment Officer for Concentrated Global Growth.

Chakrabarti's Concentrated Global Growth investment team is composed of a small, dedicated group of analysts distributed between London, Hong Kong, Singapore and New York. With an investment philosophy that exemplifies active management, each analyst conducts deep research for a select group of companies. This rigorous approach allows for the consistent returns that the fund is known for.

"Our type of growth—high-quality companies with consistent revenue and stable earnings growth potential—is what we believe drives investment returns over time," Chakrabarti says. "We don't look for blue-sky growth. We want consistency."

Copyright © AllianceBernstein