by Walt Czaicki, CFA, Senior Investment Strategist—Equities, David Wong, Senior Investment Strategist and Head—Asia Business, Development, Equities, & Robert Milano, Senior Investment Strategist and Head—EMEA Equity Business Development, AllianceBernstein

After a tough year for equities, is a recovery imminent? While nobody can predict when the market will bottom, we do know what happened after sharp downturns in the past. Patient investors can find comfort knowing that strong recoveries are common after sharp drawdowns.

Stock market volatility continues to rage, even after recent glimmers of hope. Despite recent gains, the S&P 500 was down by 15.1% this year through November 15. Outside the energy sector, there have been few places to hide in equity markets, with sharp declines across Europe, Asia and emerging markets.

Setting the Stage for a Healthier Recovery

Severe stock market drawdowns are always unsettling. But they often set the stage for a healthier recovery. That’s why market downturns are commonly known as “corrections.” Share values are reset to better reflect a company’s long-term earnings expectations. This process can be volatile, especially when share prices in parts of the market are unreasonably high and when the earnings outlook is extremely uncertain. Both conditions have been present this year.

But what happens after a drawdown is encouraging. Following sharp US market declines since 1950, equities typically roared back with gusto. From the low point in eight US market downturns of more than 20%, equities delivered a 51.1% forward return after one year on average, and a three-year return of 82% (Display). Five and 10 years later, investors also enjoyed handsome gains.

Skeptics might argue that conditions today are extraordinarily bad. While we agree that there is plenty of uncertainty, bad conditions are what drive sell-offs, and their underlying circumstances are often different when they occur. Today, inflation and its knock-on effects are challenging economic growth. Higher energy prices, rising global yields and roughly two years’ worth of global central bank tightening are filtering down to economic activity with a lag. It would be foolish to declare that the coast is clear.

This Isn’t the First Massive Market Shock

But take a closer look at the episodes listed above. For example, the bursting of the dot-com bubble in 2000–2002 and the global financial crisis in 2007–2009 dealt massive shocks to markets and economies—and were terrifying moments in financial history. Yet investors who maintained an appropriate exposure to equities in their portfolios were ultimately rewarded. There are still many good reasons to stay invested in stocks.

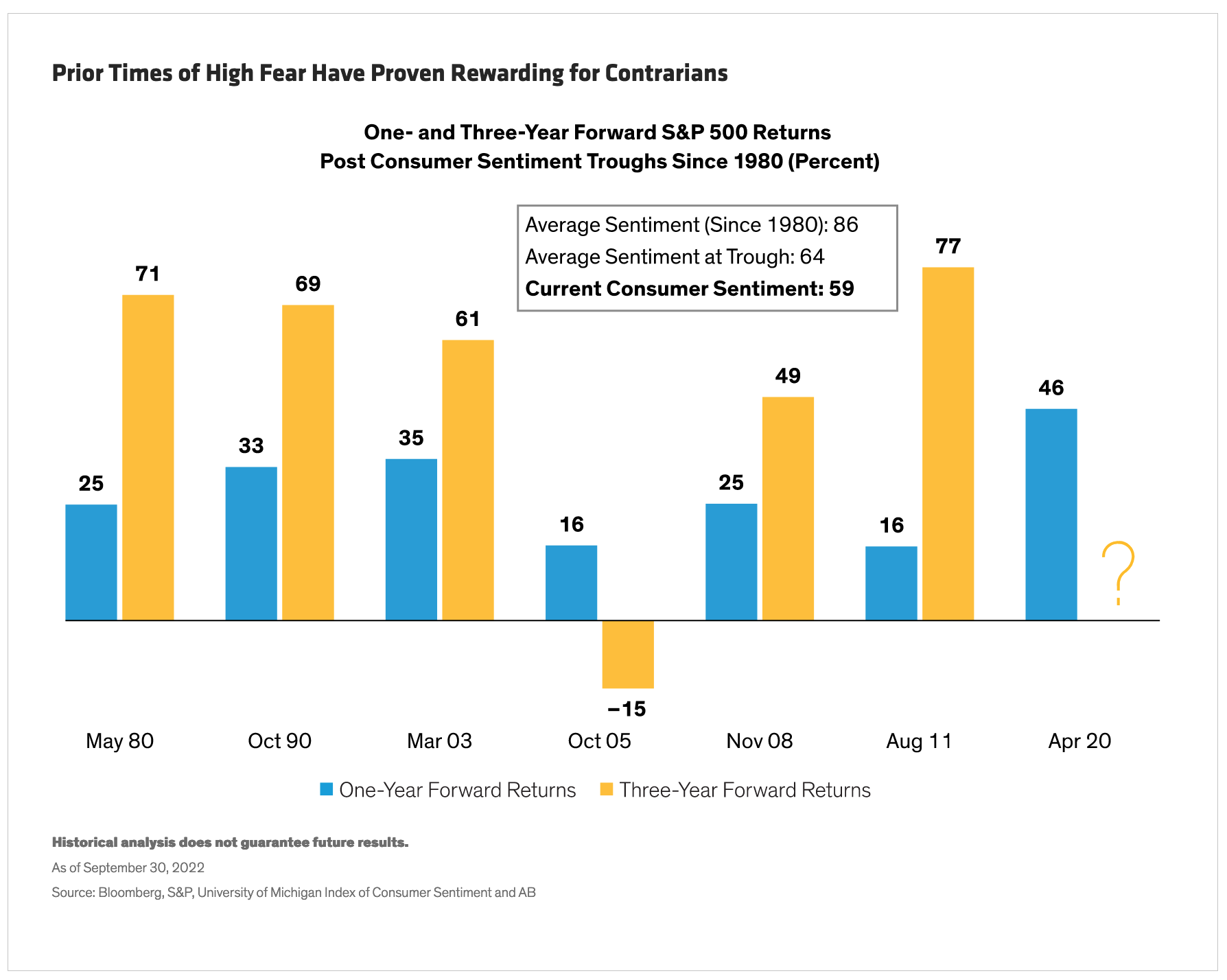

To be sure, the fear factor is a deterrent. So, we looked at how stocks performed after moments of extreme pessimism, as measured by the University of Michigan Index of Consumer Sentiment. Here, too, when consumer sentiment dropped to a low point, stocks did well in the aftermath. In November 2008, consumers were stunned by the collapse of equity markets, the US subprime mortgage crisis and the demise of major financial institutions. Yet pulling out of equities would have been a poor decision. The S&P 500 advanced by 25% over the next year and 49% over the next three years (Display). Today, the Index of Consumer Sentiment is at 59—below the average low point in prior crises.

In fact, moments of extreme pessimism often turned out to be a favorable entry point for investors with longer time horizons. Today, valuations may be nearing a low point, based on our analysis of the relationship between US stock multiples and interest rates. And as we gain more clarity on how earnings are holding up amid escalating economic stresses, portfolio managers can identify companies with stronger recovery potential. In our view, pockets of relative value can now be found in equity markets, regardless of market capitalization, style or geography, particularly in companies with quality businesses.

Conquering the Fear Factor

Investors who abandon a well-thought-out investment strategy at the wrong time may end up worse off. Reducing equity allocations now means locking in losses and forfeiting recovery potential. And since it’s almost impossible to time inflection points in the market, we believe maintaining a strategic allocation to equities is essential. Missing just a few of the best days of a recovery can be very costly to long-term returns, our research shows.

In times like these, it’s not easy to shift an investing mindset from fear to hope. But we believe active investing approaches that aim to steer away from vulnerable companies and to find those with durable businesses can help investors feel more comfortable with an equity allocation today. With a clear strategy that emphasizes quality stocks, investors can gain confidence that an equity allocation is appropriate for individual risk appetites—and be positioned to unlock return potential in better times.

About the Authors Walt Czaicki, CFA

Walt Czaicki, CFA

Walt Czaicki serves as a Senior Vice President and Senior Investment Strategist for Equities at AB. He rejoined the firm in 2015 and has been in the investment-management industry since 1986. Czaicki's roles have ranged from a fundamental equity research analyst and portfolio manager to chief investment officer. Prior to rejoining AB, he worked on the buy side for a Regions Financial predecessor organization, as well as at Commerce Trust Company and Bank of America. Czaicki holds a BSBA in finance and an MBA, both from Saint Louis University. He is a CFA charterholder. Location: Dallas

David Wong is a Senior Investment Strategist and Head of Asia Business Development for Equities. He joined AB in March 2015, bringing two decades of experience in global equity markets to the firm. Prior to joining AB, Wong was a partner at Janchor Partners, a Hong Kong-based long/short equity hedge fund with US$2 billion in assets under management (AUM). Before that, he had set up the Hong Kong office for GMT Capital, an Atlanta-based long/short equity hedge fund with $5 billion in AUM, where he served as portfolio manager and head of Asian investments. Over Wong's eight years at the two hedge funds, he was responsible for global investments in technology stocks, and also served as a generalist portfolio manager for the Asia-Pacific region, including Japan. He was also the founder and managing director of Mobile Adventures, a pan-Asian wireless content company. Wong started his career as an equity research analyst at Bankers Trust and Deutsche Bank; at Deutsche, he managed a team of five associates as the firm's regional semiconductor analyst. He holds a BA in political science from Yale University. Location: Hong Kong

Robert Milano is a Senior Investment Strategist and Head of EMEA Equity Business Development. He is responsible for partnering with regional sales leadership to set strategic priorities and goals for the EMEA Equities business, develop new products, and engage with clients to represent the market views and investment strategies of the firm. Previously, Milano was a senior investment strategist supporting AB's Select US Equity and US Growth Portfolios. He joined the firm in 2013 as a product analyst on our Fixed Income Business Development team, where he supported the firm's taxable and municipal funds for the US Retail market. Milano holds a BS in finance from Manhattan College. Location: London