by Stephen H. Dover, CFA, Chief Market Strategist and Head of Franklin Templeton Institute, Franklin Templeton

Is globalization truly dead? Stephen Dover, head of Franklin Templeton Institute, explores what drives globalization, whether we are currently in a “de-globalization” wave—and what it means for investors.

Originally published in Stephen Dover’s LinkedIn Newsletter Global Market Perspectives. Follow Stephen Dover on LinkedIn where he posts his thoughts and comments as well as his Global Market Perspectives newsletter.

No one can deny the significance of the today’s globalized economy. From our homes and offices, we can order an unimaginable array of goods and services from nearly every country in the world, delivered to our doorstep and enjoyed at our leisure.

However, this was not always the case. In the millennia prior to the US Civil War, incessant human strife—as well physical limits on transportation and communication—kept nations, civilizations and economies apart. However, the half century between the end of the US Civil War and the start of the first World War saw the rise of a globalized economy. Moving forward, the period from 1914 to 1945 experienced two world wars separated by the Great Depression, which shattered humanity’s first try at globalization. It was only in 1945 under American hegemony that the second great era of globalization rebooted. This wave of globalization accelerated for almost four decades and gained powerful momentum with China’s emergence into the world economy in the early 1980s. The fall of the Berlin Wall in Germany reinforced this trend with the opening of communist countries after 1989.

Today, the buzzword is de-globalization. It is defined as the movement toward a less- interconnected world—one with groups of nation states replete with fresh barriers to the free movement of goods, services, capital and labor dominating once again. There are a variety of reasons that this narrative has taken hold, but to best explore whether this is truly the path we are on, an understanding of how we got here is needed.

What drives globalization?

We see three forces that drive globalization. The first is the ability to shorten distances in both transport and communication. The second is the commitment of nation states to establish and adhere to rules, standards and safeguards that ensure that goods, services, capital and labor can move relatively freely across borders. The third is the incentive of firms and consumers to push the boundaries of what is possible in the ever-present quest for profits and pleasure.

First, consider the role of technology in connecting the world. Globalization could not emerge until modern sailing vessels, roads, railroads and air travel made worldwide transportation both feasible and affordable. In similar fashion, the telegraph, undersea cables, phones, radio—and more recently the internet and satellites—made instantaneous communication over great distances possible. Globalization required the emergent technologies of the 19th century and their refinements thereafter to shorten transportation and communication distance.

Second, globalization requires the participation of nation states, willingly or otherwise. The first waves of globalization began with European colonization and empires, culminating in Britain’s dominance as the global naval power in the 19th and early 20th centuries. World wars shattered that dominance, with global hegemonic leadership shifting to the United States in 1945.

Yet, in contrast to 19th century experience, the globalized economy of the past 75 years was codified in law, treaties and international standards that eventually spawned willing cross-border trade, finance, transportation, travel and, to a lesser degree, immigration. The second great era of globalization was an agreed framework, not one imposed by empire.

The superstructure of modern globalization was the Bretton Woods institutions, including the General Agreement on Trades and Tariffs (GATT, which then morphed into the World Trade Organization), the International Monetary Fund (IMF), the World Bank, and a host of other international and governmental organizations. Together, these organizations established the legal, security, business and everyday norms of global economic and financial engagement.

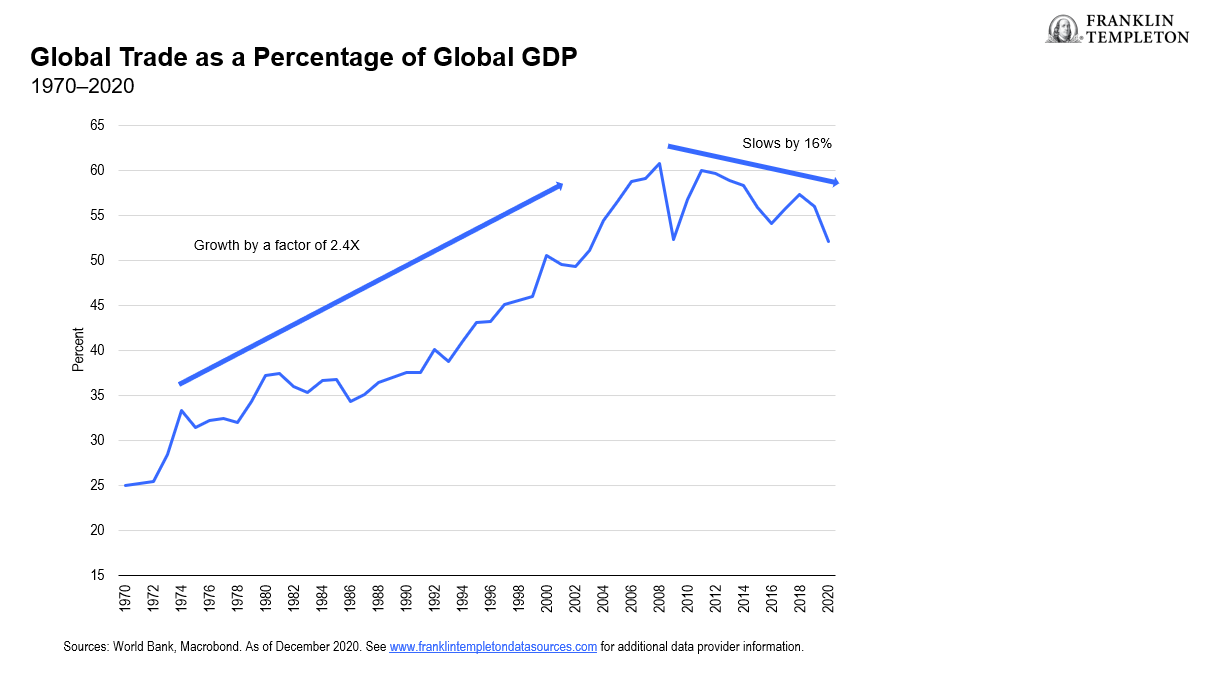

Third, given the technological means to globalize as well as the legal, political and security assurances to do so, it was all-but inevitable that profit and consumption motives would complete the task. In the six decades from the late 1940s until the global financial crisis (GFC) of 2008, growth in world trade and cross-border financial transactions easily outpaced the growth rate of the global economy (see chart below). Profit-driven firms and consumer desires to acquire more goods at lower cost caused globalization to explode in less than a generation. In the process, more people worldwide were lifted out of famine, poverty and destitute living conditions than in any previous era of human history.

What is the future of globalization?

As the chart also clearly demonstrates, the positive era of more rapid world trade than gross domestic product (GDP) growth ended around the time of the GFC in 2008. Since then, trade growth has lagged world income growth.

The adoption of multi-lateral trade agreements was one of the driving forces of postwar globalization. But the last of the big trade openings was in 2001, when China was admitted into the World Trade Organization. Despite considerable efforts, little progress has since been made, notwithstanding significant opportunities for trade gains in agriculture or services. That is one key reason why, over the past two decades, global trade growth has slowed below the pace of world GDP growth. And as surveys suggest,1 popular support for globalization has fallen sharply in the past decade in various countries, including the United States and the United Kingdom.

In academia and policymaking, fresh challenges have also arisen to the free trade principles of comparative advantage and mutual gain David Ricardo first articulated some 200 years ago. Strategic trade theory, which considers how firms with increasing returns to scale, can gain vast market power and create large domestic economic benefits. Search, social media and telecommunications offer examples. Look no further than California’s Silicon Valley. Strategic trade theory has underpinned a shift in policy attitudes away from free trade and in the direction of promoting, subsidizing and even protecting the industries of the future, such as artificial intelligence or alternative forms of energy. It is safe to say that the case against free trade, if not for outright protectionism, has found support in the corridors of academia that has spilled over into the policymaking arena.

Lastly, immigration has been a major casualty of the rise of populism. Physical walls at borders have been erected along the borders of the United States and parts of Europe, while virtual barriers limit the allocation of visas and work permits nearly everywhere.

Are non-economic factors reimagining globalization?

Challenges to globalization also reflect national security concerns. US postwar leadership has been replaced with strategic rivalry, visible on the battlefields of Ukraine and at the political pulpits in Beijing and Washington. US restrictions on high-end computer chip manufacturing technology are the latest example of how national security is impeding globalization. Strategic competition even extends to accounting rules, which are helping to reverse US listings of Chinese public companies. Overall, the tendency to replace economics with national security is further undermining cross border investment, trade and capital flows.

Meanwhile, the COVID-19 pandemic, Russia’s invasion of Ukraine, and rise of geopolitical tensions have all called into question reliance on long and vulnerable supply chains with “just in time inventories,” which had been one of the great efficiency pillars of modern globalization. Perhaps before long, the widespread adoption of labor-saving technologies such as robotics, artificial intelligence or 3D printing may further erode reliance on low-wage manufacturing as the driver for rising international trade and finance.

The end of the China boom is another factor slowing globalization. China’s evolution from low-cost producer to middle-income country has reduced its comparative advantage in supplying the world with cheap manufactured goods. So far, however, no other country (e.g., India, Brazil, Mexico, Russia, or Turkey) has been able to follow in China’s footsteps. Only Vietnam and Bangladesh have partly filled the void China’s exit from low-end manufacturing created. In other words, the new low-cost producer to replace China as the next global manufacturing hub has yet to emerge on a significant scale, an outcome which shares blame for the slowing pace of global trade growth this century.

Finally, the re-regulation of the financial services industry after the GFC had both global and distinctly national elements, both of which created fresh obstacles to cross-border financial flows; for example, via high bank capital requirements on riskier credit exposures.

Globalization is down but not out

Three conclusions emerge.

First, globalization is down but not out. The data are clear—an era of super-charged cross-border growth in trade and capital flows has ended. However, there has been no generalized decline in international economic activity. Rather, its growth rate has slowed. In that sense, genuine de-globalization is not yet broadly underway.

Second, of the factors responsible for globalization, the one now failing is political commitment. Populism, nationalism, financial re-regulation and national security concerns have usurped economics as the priorities of international relations. At fault is not technological progress nor diminished desires to profit and consume. Rather, political opposition to further liberalize and to actively promote some back-sliding have been responsible for the slowing pace of globalization over the past 15 years.

Third, for all the concern about too much dependence on China or discussion of reshoring manufacturing back to the United States or Europe, the reality is different. The world is not yet shifting the nexus of production back within national borders. As the demand for goods surged when economies were reopened in 2021 and in early 2022, China’s exports boomed,2 revealing that global supply chains remain intact and integral to the functioning of the world economy.

In the same sense, it is premature to believe that regionalization is replacing globalization yet. The United States has applied tariffs to its USMCA (the US, Mexico, Canada Agreement that replaced the North American Free Trade Agreement) neighbors and the European Union (EU) since 2016. The United Kingdom famously opted to leave the EU that same year. Whether the USMCA, the EU, or Mercosur (the South American trade bloc), past success stories in expanding regional trading links have recently run smack into the populist brick wall that opposes virtually all forms of trade liberalization. Even the Transpacific Partnership (TPP), set up to deepen links among Pacific rim countries, remains essentially frozen following the US withdrawal in 2017 under the Trump Administration and great reluctance among many of the remaining TPP countries to onboard China. Simply put, regionalization appears no easy substitute for flagging globalization.

That said, declarations of the death of globalization are premature. As noted above, a slowdown in global trade growth has been underway for more than a decade, but not an accelerating rate. The system of international production and trade seems to be trending toward one that is more resistant to supply interruptions—“just in case” replacing “just in time”—but that is much more efficient than “every country on its own.” But it is true that globalization needs popular support to thrive, and that support has unambiguously evaporated. Understanding the global political winds will be critical in deciphering what path globalization will ultimately take.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions.Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in an investment portfolio adjust to a rise in interest rates, the value of the portfolio may decline. Investments in foreign securities involve special risks, including currency fluctuations, economic instability and political developments. Investments in emerging market countries involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. Such investments could experience significant price volatility in any given year.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. All investments involve risks, including possible loss of principal.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

__________________________________

1. Source: Pew Research Center. In U.S. and UK, Globalization Leaves Some Feeling ‘Left Behind’ or ‘Swept Up’, October 5, 2020.

2. Source: CNBC. “China’s export growth gains steam despite weakening global demand.” August 7, 2022.