Technical Notes for yesterday

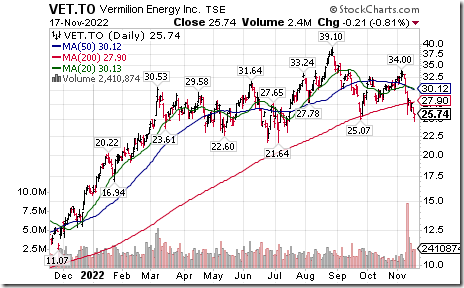

Canadian energy stocks came under pressure with weakness in crude oil prices. Vermillion Energy $VET.TO moved below $25.07 completing a double top pattern.

Cisco Systems $CSCO an S&P 100 stock moved above $46.21 resuming an intermediate uptrend. The company reported higher than consensus quarterly results.

Trader’s Corner

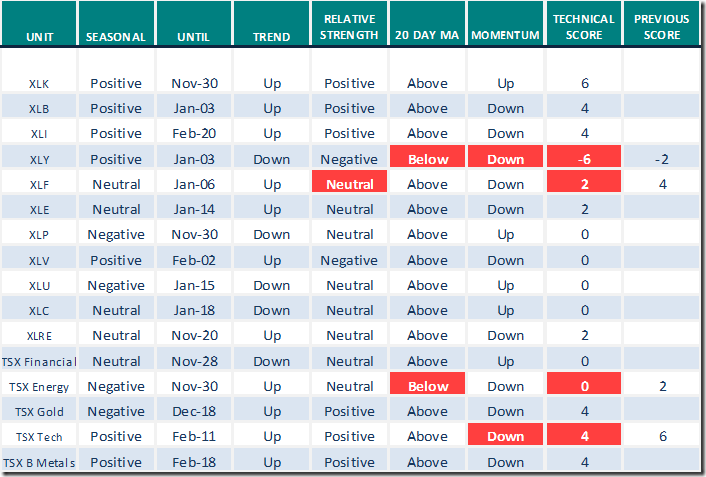

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for November 17th 2022

Green: Increase from previous day

Red: Decrease from previous day

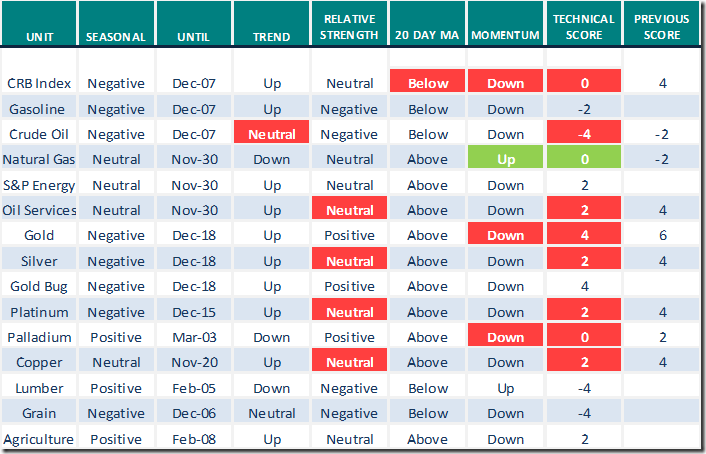

Commodities

Daily Seasonal/Technical Commodities Trends for November 17th 2022

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for November 17th 2021

Green: Increase from previous day

Red: Decrease from previous day

Links offered by valued providers

Tom Bowley says “Sentiment is pointing to an explosion upward”. Tom notes that downside pressure during the November options and futures expiry wind down period this week is setting up for an important upside move by U.S. equity prices starting next week.

https://www.youtube.com/watch?v=3592TfCQllk

S&P 500 Momentum Barometers

The intermediate term Barometer slipped 1.80 to 79.20. It remains Overbought.

The long term Barometer slipped 1.80 to 51.60. It remains Neutral.

TSX Momentum Barometers

The intermediate term Barometer slipped 1.89 to 71.19. It remains Overbought.

The long term Barometer dropped 2.97 to 41.10. It remains Neutral and has rolled over.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed