by Carl R. Tannenbaum, Ryan James Boyle, Vaibhav Tandon, Northern Trust

The Northern Trust Economics team shares its outlook for inflation, growth, employment and interest rates.

Macroeconomic news has been front and center. Signs of cooling inflation have sparked market rallies, while investors are hanging on every word from the Fed. The sensitivity is well-placed: the end of the Fed’s tightening cycle is in sight, and fear of recession is pervasive.

As discussed in our global Annual Outlook for 2023, no economy is facing a promising year ahead. Balancing the objectives of fighting inflation while maintaining employment and output will be a universal challenge. The U.S. still has a path to achieving a soft landing, but it will not be a banner year. The outlook is for a slow, unsteady year, with inflation still elevated and moderate job losses likely.

U.S. workers and consumers have shown great resiliency throughout the shocks of COVID, an energy crunch, geopolitical uncertainty and high inflation. Reasons for pessimism have always been close at hand, but growth has prevailed. We hope to see that same spirit continue in the year ahead.

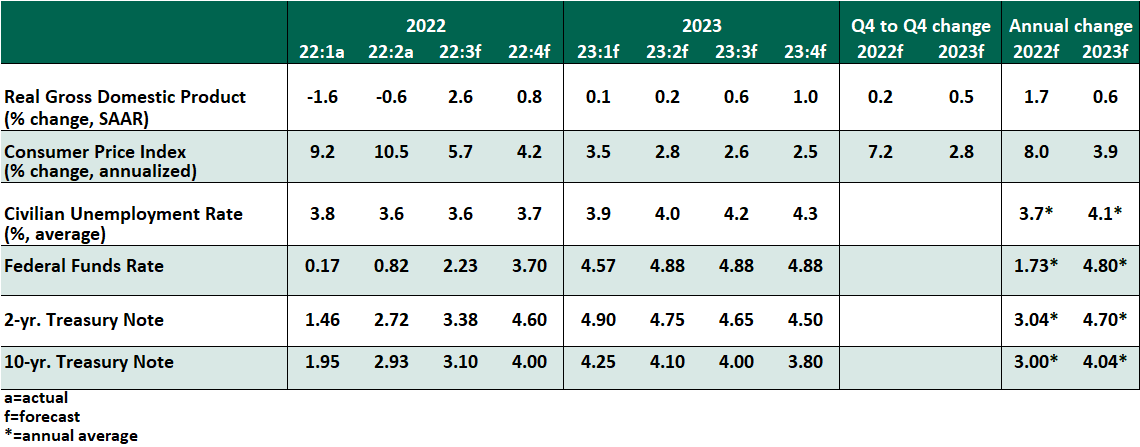

Key Economic Indicators

Influences on the Forecast

- At its November meeting, the Federal Open Market Committee (FOMC) executed its fourth hike of 75 basis points. The accompanying statement contained new wording suggesting that the Committee would consider the “cumulative tightening of monetary policy [and] the lags with which monetary policy affects economic activity and inflation.” This phrase was a clear signal that future hikes will be of a smaller magnitude, and an end to the tightening cycle will follow.

In the subsequent press conference, Chair Powell unambiguously stated that a pause in hikes would be premature, and that rates may go higher than previously signaled.

-

- Based on this intelligence, we have revised our Fed rate projection to reflect a 0.50% hike in December, two moves of 0.25% in the first quarter of 2023, followed by a pause. Eventual cuts will be possible as inflation recedes, but we expect loosening is more than a year away.

- The October consumer price index (CPI) affirmed that the peak of inflation is likely in the past, with headline inflation falling to 7.7% year over year, and core (excluding food and energy) to 6.3%. No categories showed upside surprises; as widely anticipated, inflation was strongest for shelter, food and gasoline. Though a step in the right direction, these rates remain too high for a policy change.

- Hot labor markets are cooling slowly. Payrolls grew by a strong 261,000 in October. Most encouragingly, average hourly earnings fell to a 4.7% annual gain, the first reading below 5% in the year to date; this inflationary force is receding. However, the household survey showed a decline in surveyed employment, and the labor force participation rate fell, holding below its pre-COVID norms. Anecdotes of layoffs are accumulating, especially in the technology sector, while openings are below the peak seen earlier in the year.

- In the third quarter, U.S. gross domestic product rose at an annualized rate of 2.6%, a welcome return to growth after two quarters of technical contraction. Investment in structures, both residential and by businesses, remains deeply depressed. Consumer spending continued to grow on an inflation-adjusted basis, but at a slowing pace.

- The rapid ascent of short-term rates has led to a full yield curve inversion, with yields on 3-month U.S. Treasury bills exceeding the yields of 10-year notes and even 30-year bonds. Full inversions have thus far been a reliable but unclear leading recession indicator, offering no insights into the cause or timing of a future contraction.

- Housing markets continue to cool, with national house price indices falling in July and August. The chill has spread to financial markets, with mortgage spreads (vs. 10-year Treasuries) more than doubling in the year to date. The Fed has ceased purchasing mortgage-backed securities, and banks’ appetites for mortgage bonds are waning, as well.

- Midterm elections do not bear on our outlook. Democrats’ loss of control of at least one chamber of Congress was a predictable outcome, and the Biden administration front-loaded its spending agenda in anticipation of a loss. We do not foresee any significant economic legislation in the next two years.

Copyright © Northern Trust