by Talley Léger, Senior Investment Strategist, Invesco

Key takeaways

|

U.S. economy U.S. real gross domestic production growth rebounded to 2.6% in the third quarter of 2022. |

Stocks Share prices lead production, not the other way around. |

Positioning Investors shouldn’t be distracted by further potential economic challenges. |

At first blush, it looks like the U.S. economy rebounded to a better-than-expected 2.6% pace of growth in the third quarter of 20221. In other words, the “technical recession” — consisting of two consecutive quarters of negative real gross domestic production (GDP) growth — appears to have ended in June.

Isn’t the economy supposed to bottom after stocks?

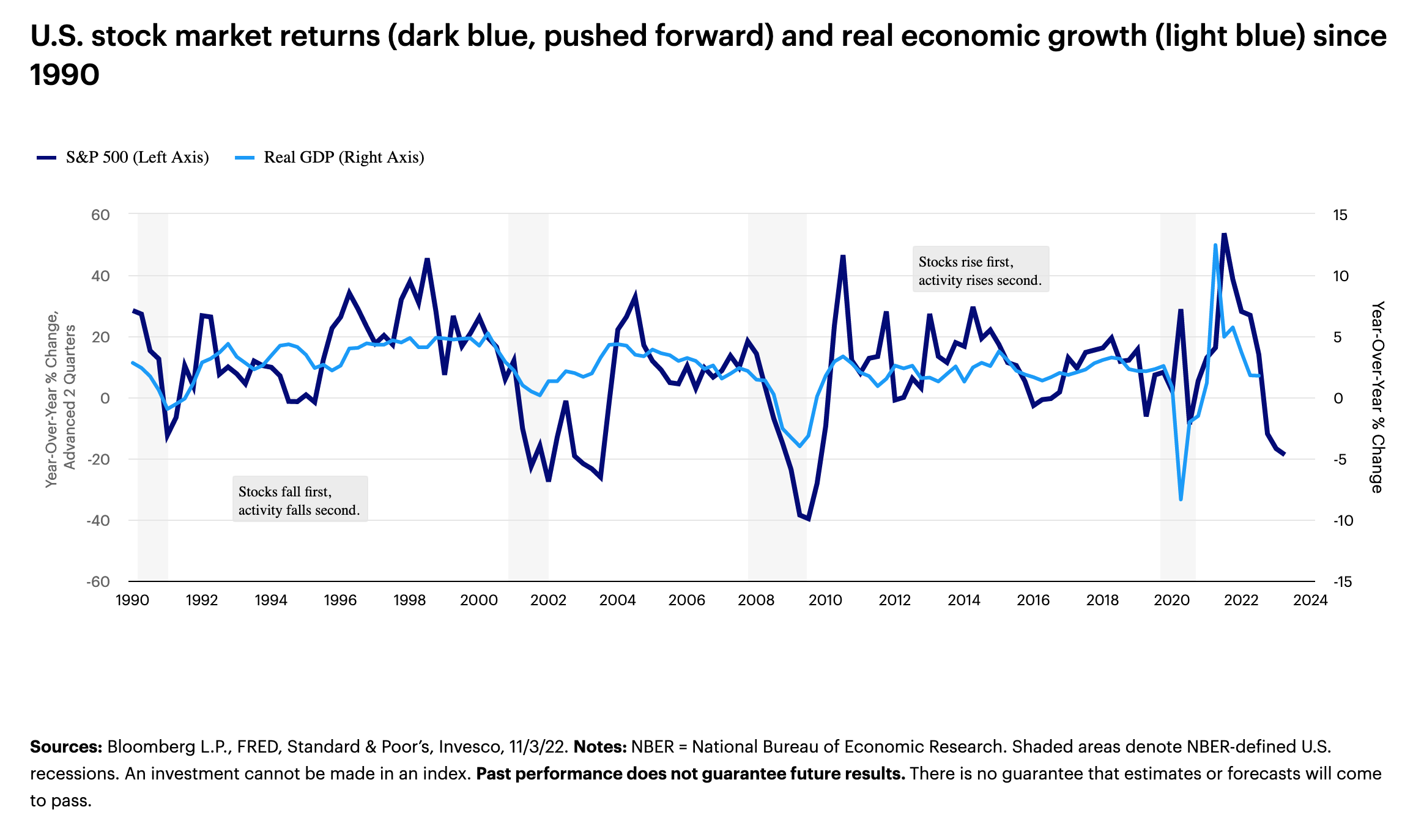

Yes, the historical relationship between S&P 500 price returns (pushed forward by half a year) and real GDP growth suggests more economic and earnings challenges may lie ahead of us. In my view, however, investors shouldn’t let that distract them. While far from perfect, stocks are decent leading indicators of inflation-adjusted business activity, meaning the dark blue line (S&P 500) is suggesting where the light blue line (real GDP) is likely heading (Figure 1).

As the Great One, Wayne Gretzky, said “I skate to where the puck is going to be, not where it has been.”

However, it’s worth mentioning that U.S. stocks fell more this year (-17% year-over-year through September 2022) than they did near the 2020 recession, which seems consistent with the notion of at least a short business cycle contraction.

But the same delayed relationship between stocks and GDP also argues that a market rally in the present could be followed by an economic recovery about half a year in the future.

Are we there yet?

Admittedly, this market drawdown has felt like an “everything” bear market, especially for growthy U.S. technology stocks.

By contrast, I think that a blossoming recovery trade – including international, cyclical small-cap value stocks – has started to gain the support of four key developments:

- A falling U.S. dollar

- Declining bond yields

- A slower pace of interest rate hikes from central banks, and

- An improving global economic outlook

I’m seeing signposts along the road to recovery and progress on my technical checklist of market bottom indicators. As such, I would caution longer-term investors against getting too much more bearish on stocks. From my lens, the discount rate for U.S. stocks has come down noticeably, helped by a welcome turn in the inflation cycle.

Footnotes

1 Source: Bureau of Economic Analysis: Gross Domestic Product