Technical Notes for yesterday

U.S. Broker iShares $IAI moved above $99.27 extending an intermediate uptrend.

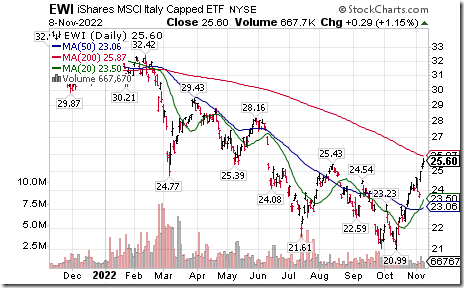

Italy iShares $EWI moved above $25.43 extending an intermediate uptrend.

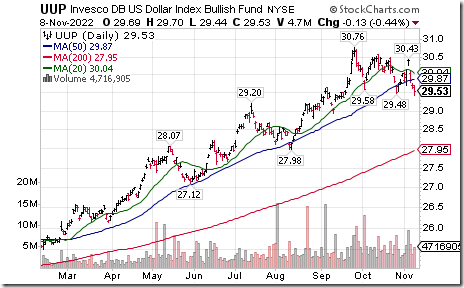

Precious metal prices and their related ETNs moved significantly higher yesterday in response to weakness in the U.S. Dollar Index and its related ETN: UUP.

Silver ETN SLV moved above $19.56 completing a reverse Head & Shoulders pattern

Gold equity ETFs on both sides of the border responded to higher gold and silver bullion prices.

Gold Miners ETF $GDX moved above $26.11 completing a reverse Head & Shoulders pattern.

Junior Gold Miners ETF $GDXJ moved above $32.35 completing a reverse Head & Shoulders pattern. TSX Gold iShares $XGD.TO moved above Cdn$16.10 extending an intermediate uptrend.

Big cap Canadian gold stocks led the advance in the TSX Gold Index and related ETF

Franco-Nevada $FNV a TSX 60 stock moved above US$127.66 and Cdn$172.93 extending an intermediate uptrend. Wheaton Precious Metals $WPM a TSX 60 stock moved above $35.29 completing a reverse Head & Shoulders pattern. Agnico-Eagle $AEM a TSX 60 stock moved above US$46.54 completing a base building pattern. Kinross $KGC a TSX 60 stock moved above US$4.07 and Cdn$5.53 extending an intermediate uptrend. Yamana $YRI.TO a TSX 60 stock moved above Cdn$6.89 extending an intermediate uptrend.

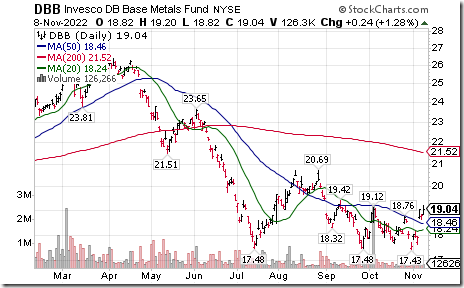

Invesco Base Metals ETN $DBB, one third weight each in copper, zinc and aluminum, moved above $19.12 extending an intermediate uptrend.

Base metals equity ETFs responded to higher base metal prices. Base Metals iShares XBM.TO moved above $18.47 completing a double bottom pattern. Copper Miners ETF $COPX moved above $32.89 completing a double bottom pattern.

Rio Tinto $RIO one of the world’s largest base metal producers moved above $59.58 completing a double bottom pattern.

Micron $MU a NASDAQ 100 stock moved above $57.44 extending an intermediate uptrend.

Take Two Interactive $TTWO a NASDAQ 100 stock moved below $101.85 after lowering fiscal 2022 guidance.

Royal Bank $RY.TO a TSX 60 stock moved above $128.61 completing a double bottom pattern.

Trader’s Corner

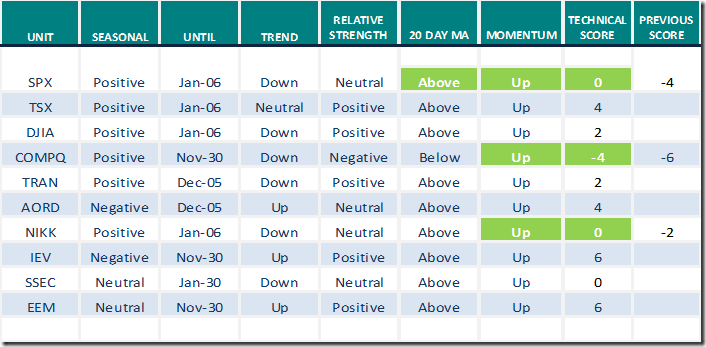

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for November 8th 2022

Green: Increase from previous day

Red: Decrease from previous day

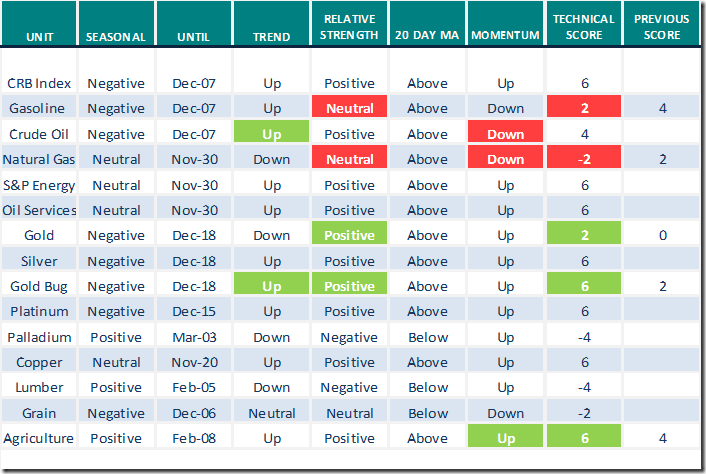

Commodities

Daily Seasonal/Technical Commodities Trends for November 8th 2022

Green: Increase from previous day

Red: Decrease from previous day

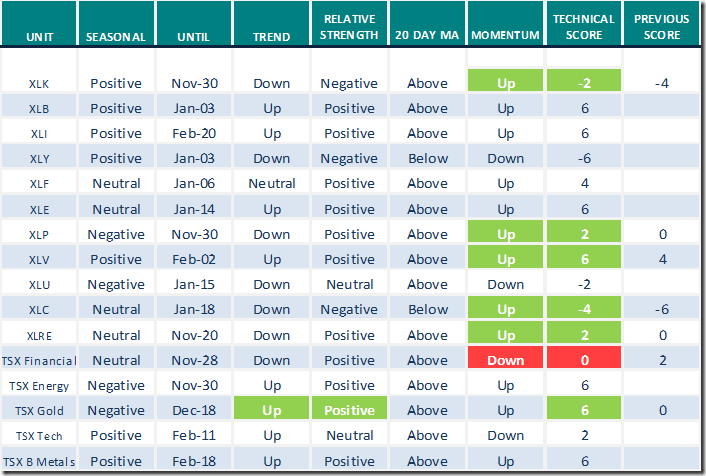

Sectors

Daily Seasonal/Technical Sector Trends for November 8th 2021

Green: Increase from previous day

Red: Decrease from previous day

Link offered by valued providers

Tom Bowley says “Transports coming back to life”. Note seasonal comparison between the Dow Jones Industrial Average and the NASDAQ Composite Index at the 15 minute mark in the video.

Transports Coming Back to Life | Tom Bowley | Trading Places (11.08.22) – YouTube

John Kosar discusses” The three keys to a year-end rally”.

The 3 Keys To A Year-End Rally | John Kosar, CMT | Your Daily Five (11.08.22) – YouTube

Chart of the day

Technical score on the Gold Bug Index (Symbol: $HUI increased significantly yesterday with strength in the price of gold. Intermediate trend changed from down to up on a move above $211.89 (Score changed from -2 to +2). Strength relative to the S&P 500 Index changed from Neutral to Positive (Score changed from 0 to +2). Price remained above its 20 day moving average (Score: 1). Daily momentum indicators (Stochastics, RSI, MACD) are trending higher (Score: 1). Total technical score increased from +2 to +6. Bonus: Strength relative to gold (GLD) also turned Positive yesterday, a technical sign that both have short term positive momentum.

S&P 500 Momentum Barometers

The intermediate term Barometer added 2.80 to 65.20. It remains Overbought. Uptrend was extended.

The long term Barometer added 0.80 to 41.40. It remains Neutral. Uptrend was extended.

TSX Momentum Barometers

The intermediate term Barometer gained 4.24 to 66.10. It remains Overbought. Uptrend was extended.

The long term Barometer advanced 3.39 to 40.68. It changed from Oversold to Neutral on a move above 40.00. Uptrend was extended.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed