Technical Notes for yesterday

U.S. Aerospace and Defense ETFs $ITA and $PPA advancing their positive technical profiles. ITA moved above $108.64 extending an intermediate uptrend.

General Electric $GE an S&P 100 stock moved above $81.19 extending an intermediate uptrend.

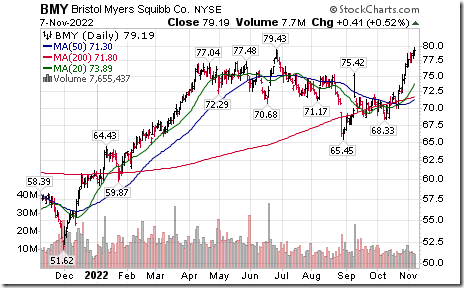

Bristol-Myers Squibb $BMY an S&P 100 stock moved above $79.43 to an all-time high extending an intermediate uptrend.

Tesla $TSLA a NASDAQ 100 stock moved below $198.59 extending an intermediate downtrend.

Canadian bank stocks and related ETF (e.g. ZEB.TO) are showing positive technical action.

Toronto Dominion Bank $TD.TO a TSX 60 stock moved above Cdn$87.92 extending an intermediate uptrend. National Bank $NA.TO, a TSX 60 stock moved above $64.69 extending an intermediate uptrend.

Metro $MRU.TO a TSX 60 stock moved above $72.66 to an all-time high extending an intermediate uptrend.

Advantage Energy $AAV.TO, a “gassy” stock moved above Cdn$12.18 to a 16 year high extending an intermediate uptrend.

Gildan Activewear $GIL.TO a TSX 60 stock moved below intermediate support at $38.01.

Trader’s Corner

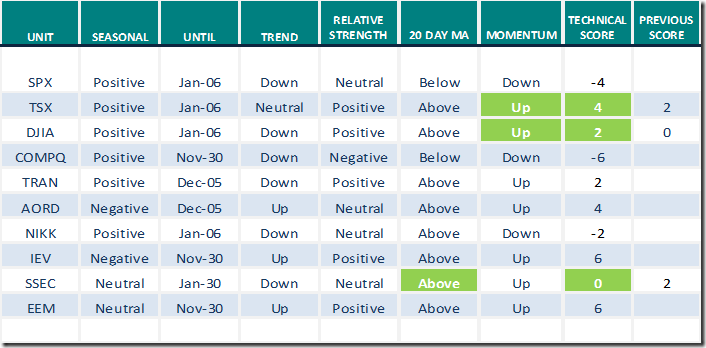

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for November 7th 2022

Green: Increase from previous day

Red: Decrease from previous day

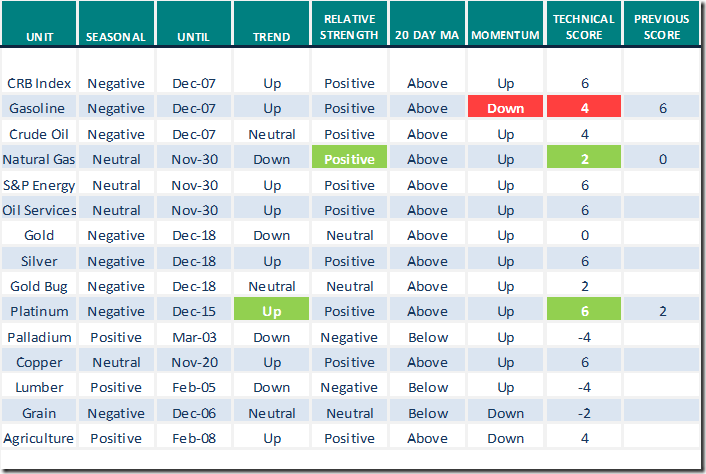

Commodities

Daily Seasonal/Technical Commodities Trends for November 7th 2022

Green: Increase from previous day

Red: Decrease from previous day

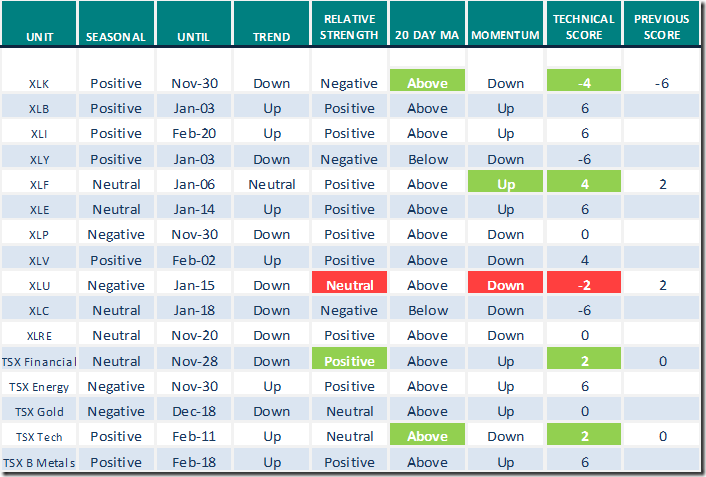

Sectors

Daily Seasonal/Technical Sector Trends for November 7th 2021

Green: Increase from previous day

Red: Decrease from previous day

S&P 500 Momentum Barometers

The intermediate term Barometer added 4.60 to 62.40. It changed from Neutral to Outperform on a move above 60.00.

The long term Barometer added 3.40 to 40.60. It changed from Oversold to Neutral on a move above 40.00. Upward trend was extended.

TSX Momentum Barometers

The intermediate term Barometer added 5.93 to 61.86. It changed from Neutral to Overbought on a move above 60.00. Upward trend was extended.

The long term Barometer added 2.54 to 37.29. It remains Oversold. Upward trend was extended.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed