Technical Notes for yesterday

Gold ETN $GLD and related equity ETFs moved lower following the Federal Reserve news. GLD moved below $151.03 extending an intermediate downtrend. TSX Gold iShares moved below Cdn$14.31 extending an intermediate downtrend.

Barrick Gold $ABX.TO a TSX 60 stock moved below Cdn$18.83 extending an intermediate downtrend.

Palladium ETN $PALL moved below $165.87 extending an intermediate downtrend.

Fertilizer stocks dropped significantly after Nutrien $NTR reported lower than consensus third quarter results. Nutrien moved below Cdn$107.90 and US$77.78 extending an intermediate downtrend.

Microsoft $MSFT a Dow Jones Industrial Average stock moved below $219.13 extending an intermediate downtrend.

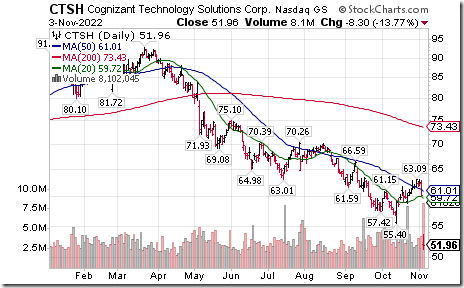

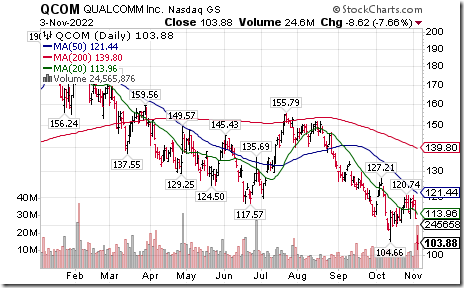

NASDAQ 100 stocks moving below support and extending intermediate downtrends included Cognizant $CTSH, PayPal $PYPL, Intuit $INTU and Qualcomm $QCOM.

Investors Digest

Don Vialoux was asked to offer a “Top Pick” for the next edition of Investors Digest to be released this weekend. Top pick was BMO Base Metals ETF (ZMT.TO).

Link offered by a valued provider

Tom Bowley asks “Does the Fed want a market crash”?

https://www.youtube.com/watch?v=gkhKiK5fPpM

Trader’s Corner

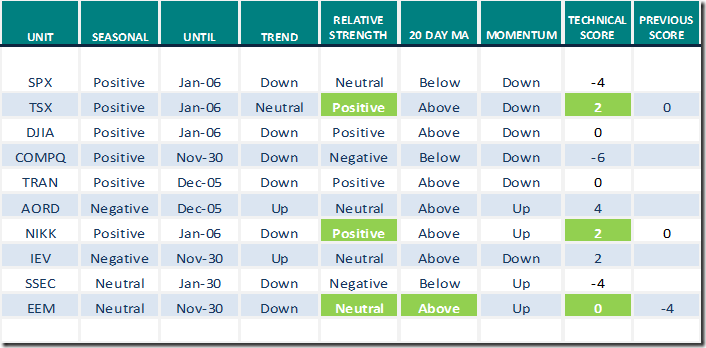

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for November 3rd 2022

Green: Increase from previous day

Red: Decrease from previous day

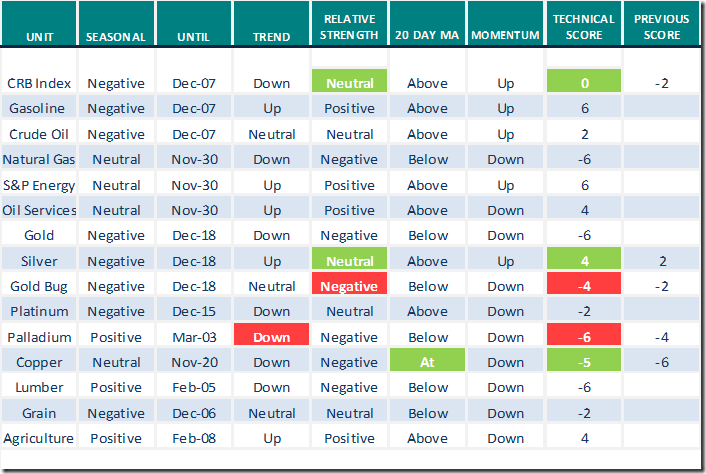

Commodities

Daily Seasonal/Technical Commodities Trends for November 3rd 2022

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for November 3rd 2021

Green: Increase from previous day

Red: Decrease from previous day

Chart of the Day

Communications Services SPDRs (XLC) moved below intermediate support at $46.47 extending an intermediate downtrend. Score on trend changed from Neutral (0) to Down (-2). Strength relative to the S&P 500 remained Negative (Score:-2). Price remained below its 20 day moving average (Score:-1). Daily momentum indicators are trending down (Score:-1). Total score changed from -4 to -6. Largest holdings include META, GOOG, GOOGL and NFLX.

S&P 500 Momentum Barometers

The intermediate term Barometer slipped 0.80 to 49.40. It remains Neutral.

The long term Barometer eased 0.60 to 33.80. It remains Oversold.

TSX Momentum Barometers

The intermediate term Barometer dropped 2.97 to 45.34. It remains Neutral.

The long term Barometer slipped 0.42 to 30.08. It remains Oversold.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed