The Bottom Line

Technical evidence last week of an intermediate peak by the U.S. Dollar Index prompted higher North American equity and commodity prices. Focus this week is on news from the FOMC meeting released at 2:00 PM EDT on Wednesday.

Consensus for Earnings and Revenues for S&P 500 Companies

Despite encouraging third quarter results released last week, analysts once again lowered earnings estimates beyond the third quarter. According to www.factset.com third quarter earnings on a year-over-year basis are expected to increase 2.2% (versus previous estimate at 1.5%) and revenues are expected to increase 9.3%. (versus 8.5% last week). Fourth quarter earnings are expected to increase 0.5% (versus previous 2.7%) and revenues are expected to increase 4.9% (versus previous estimate at 5.4%). For 2022 earnings are expected to increase 6.1% (versus previous 6.7%) and revenues are expected to increase 10.4% (versus previous 10.6%).

Preliminary estimates for 2023 also moved lower. According to www.factset.com first quarter 2023 earnings are expected to increase 3.2% (versus previous estimate at 5.1%) and revenues are expected to increase 4.3% (versus previous estimate at 4.7%). Second quarter 2023 earnings are expected to increase 2.0% (versus previous estimate at 3.5%) and revenues are expected to increase 1,6% (versus previous estimate at 1.9%). For all of 2023, earnings are expected to increase 6.4% (versus previous estimate at 7.3%)) and revenues are expected to increase 3.7% (versus previous estimate at 4.0%).

Economic News This Week

October Chicago PMI released at 9:45 AM EDT on Monday is expected to increase to 47.0 from 45.7 in September.

September U.S. Construction Spending released at 10:00 AM EDT on Tuesday is expected to drop 0.5% versus a decline of 0.7% in August.

October ISM Manufacturing Purchase Manager Index released at 10:000 AM EDT on Tuesday is expected to slip to 49.9 from 50.9 in September.

FOMC Decision on interest rates and quantitative tightening is released at 2:00 PM EDT on Wednesday. Consensus calls for a 0.75% increase in the Fed Fund Rate to 3.75%-4.00% rate. Consensus for asset purchases is continued purchases at a $95 billion monthly. Conference call is offered at 3:00 PM EDT.

Bank of England’s interest rate for large banks released at 8:00 AM EDT on Thursday is expected to increase from 2.25% to 3.00%.

Third quarter Non-farm Productivity released at 8:30 AM EDT on Thursday is expected to increase 0.5% versus a drop of 4.1% in the second quarter.

U.S. September Trade Deficit released at 8:30 AM EDT on Thursday is expected to increase to $71.10 billion from $67.40 billion in August.

Canadian September Merchandise Trade released at 8.30 AM EDT on Thursday is expected to increase to $3.45 billion from $1.52 billion in August.

October ISM Non-Manufacturing Purchase Managers Index released at 10:00 AM EDT on Thursday is expected to slip to 55.4 from 56.7 in September.

October U.S. Non-farm Payrolls released at 8:30 AM EDT on Friday is expected to drop to 200,000 from 263,000 in September. October Unemployment Rate is expected to increase to 3.6% from 3.5% in September. October Average Hourly Earnings are expected to increase 0.3% versus a gain of 0.3% in September. On a year-over-year basis, October Average Hourly Earnings are expected to increase 4.7% versus a gain of 5.0% in September.

Canadian October Employment released at 8:30 AM EDT on Friday is expected to increase 5,000 versus a gain of 21,100 in September. October Unemployment Rate is expected to increase to 5.3% from 5.2% in September.

Selected Earnings News This Week

Over half of S&P 500 companies have reported third quarter results to date. Another 167 S&P 500 companies (and two Dow Jones Industrial Average company) are scheduled to report this week. Fifteen S&P 60 companies are scheduled to report this week.

Trader’s Corner

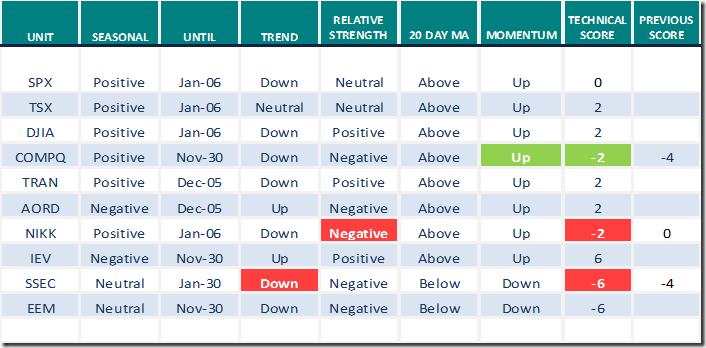

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for October 28th 2022

Green: Green: Increase from previous day

Green: Green: Increase from previous day

Red: Decrease from previous day

Commodities

Daily Seasonal/Technical Commodities Trends for October 28th 2022

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for October 28th 2021

Green: Increase from previous day

Red: Decrease from previous day

Links offered by valued providers

Greg Schnell videos ..

5 Charts To Be Aware Of Now | Greg Schnell, CMT | Your Daily Five (10.28.22) – YouTube

Smooth-Running Engine or Friction Ahead? | The Canadian Technician | StockCharts.com

How the stock market will react after the U.S. mid-term election

https://www.youtube.com/watch?v=tpRZwwy0hCU

Michael Campbell’s Money Talks for October 29th

Michael Campbell’s MoneyTalks – Complete Show (mikesmoneytalks.ca)

Bruce Fraser and David Keller offer “The perfect chart for navigating 2022”.

The Perfect Chart for Navigating 2022 | The Mindful Investor | StockCharts.com

Links offered by Mark Bunting and www.uncommonsenseinvestor.com

"Roaring ’20s" Still Possible After "Mother of All Melt-ups" & Meltdown – Uncommon Sense Investor

https://uncommonsenseinvestor.com/davis-rea-conference-call/

10 Best Stocks You’ve Never Heard Of | Kiplinger

Canada’s housing bubble has burst: David Rosenberg | Financial Post

Technical Scoop for October 31st

John Hopkins says “There’s More Room to the Upside”

The VIX Shows There’s More Room to the Upside | Top Advisors Corner | StockCharts.com

Mary Ellen McGonagle says ”Breadth in the markets is expanding”.

Tom Bowley says “Today marks the beginning of an overwhelming bullish period”.

Mish Schneider asks “Can investors trust this rally”?

Weekend Daily: Can Investors Trust This Rally? | Mish’s Market Minute | StockCharts.com

David Keller notes that “Tech drives SPX above 3,900”.

Tech Drives SPX Above 3900 | David Keller, CMT | The Final Bar (10.28.22) – YouTube

Mark Leibovit comment for October 26th

Will the Fed Hike Rates? – HoweStreet

Bob Hoye comment for October 28th

Choppy Markets But Precarious – HoweStreet

Rick Mills on the outlook for copper

Copper: the most important metal we’re running short of | Kitco News

Special Report

Don Vialoux appeared as a guest investment analyst on “Wolf on Bay Street” on Corus Radio 640 AM at 7:00 PM EDT on Saturday. The interview was taped last Thursday. Prior to the appearance, notes for the interview were developed. Some, but not all of the notes were discussed during the interview. Following are the notes:

U.S and Canadian equity markets have just entered their strongest period of seasonal strength in the year. During the past 102 years, the Dow Jones Industrial Average has advanced 83% of the time from October 28th to January 11th. Equities respond favourably to increasing economic activity during the Christmas buying season.

U.S. equity indices closely are following their mid-term U.S. Presidential election year cycle this year: During the past 25 mid-term U.S. Presidential election years, the Dow Jones Industrial Average has gained an average of 5.6% per period from September 28th to January 1st. Intermediate and long term momentum data for the S&P 500 Index and TSX Composite Index bottomed on schedule this year on September 27th.

Short term events are expected to have a significant impact on North American equity prices.

- The FOMC report on U.S. inflation and interest rates on November 2nd. Consensus is that the Fed will increase the Fed Fund Rate by 0.75% to 3.75%-4.00% and will continue to purchase assets at a $95 billion per month rate. The FOMC signalled early last week prior to entering a “black out” pre-release period that additional increases in the Fed Fund Rate likely will be paused after November 2nd until market response to recent increases are examined.

- The U.S.mid-term Congressional elections on November 8th. Consensus says that Republicans will gain majority control of the House of Representatives. Consensus also calls for a “dead heat” in the Senate election with 50 seats each won by Democrats and Republicans.

- Third quarter corporate earnings and revenue reports by major U.S. and Canadian companies. Results to date generally have been slightly better than expected after analysts reduced consensus estimates prior to their release. (Exceptions are big cap technology companies such as Alphabet and Microsoft that reported less than consensus results last week). Responses to results generally have been strongly positive: Since lows reached in early October, the TSX Composite has gained 8% and the S&P 500 has advanced 10%.

Currency trends are starting to have an impact on share prices of selected sectors. The U.S. Dollar Index has a history of reaching a seasonal peak in the second week in November. This year, the peak likely was reached in mid-October. The move by the U.S. Dollar Index below 110 last Wednesday completed a double top pattern with a technical target of 105. Weakness was triggered by expectations that the FOMC will delay or slow its monetary tightening policies beyond November 2nd.

Canadian investors can take advantage in the short term by:

- Owning Canadian investment assets instead of U.S. investment assets when an equivalent investment is available.

- Owning U.S. and Canadian sector investments that benefit from a decline in the U.S. Dollar relative to the Canadian Dollar. All of the following sectors have an improving technical profile and have favourable seasonal profiles until at least early January.

- Base metal stocks and ETFs that benefit from rising commodity prices triggered by U.S. Dollar weakness (e.g. copper, zinc, nickel). Easiest way to invest in the sector is to hold an ETF that tracks the base metal sector: XBM.TO or ZMT.TO in Canadian Dollars and PICK or XME in U.S. Dollars.

- Agriculture product ETFs. Selections include COW.TO in Canadian Dollars and MOO in U.S. Dollars

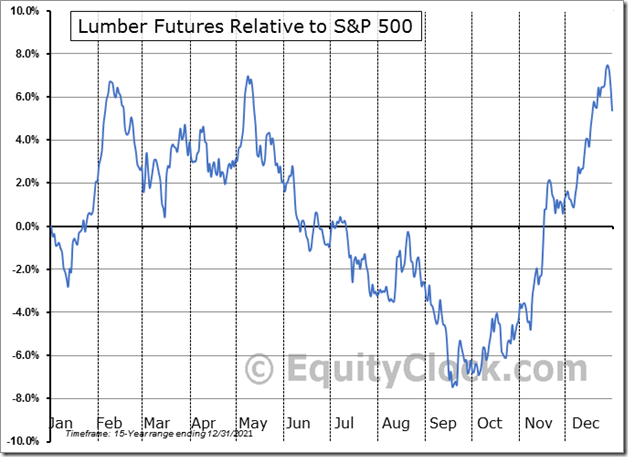

- Forest product ETFs. Selections include WOOD and CUT trading in U.S. Dollars

Technical Scores

Calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

(Higher highs and higher lows)

Intermediate Neutral trend: Score 0

(Not up or down)

Intermediate Downtrend: Score -2

(Lower highs and lower lows)

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower

Changes Last Week

Technical Notes for Friday

Insurance iShares $IAK moved above $88.43 resuming an intermediate uptrend.

Amazon.com $AMZN moved below $105.35 after reporting lower than consensus quarterly revenues.

S&P 100 stock breakouts! Colgate Palmolive $CL moved above $74.41 and Bristol-Myers $BMY moved above $75.42 extending their intermediate uptrend.

NASDAQ 100 stocks moving above resistance and extending intermediate uptrends included: DexCom $DXCM , T Mobile $TMUS, Gilead $GILD and Biogen $BIIB.

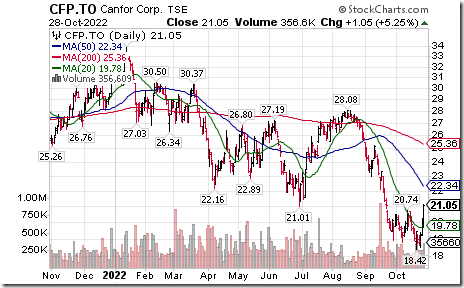

Canadian forest product stocks: Interfor $IFP.TO, West Fraser Forest $WFG.TO, Canfor $CFP.TO moved strongly higher on Friday, completing short term base building patterns.

Seasonal influences for lumber and lumber stocks are exceptionally strong on a real and relative basis between now and early February.

S&P 500 Momentum Barometers

Editor’s Note: Data for Friday indicated on the next four charts is suspect and could be adjusted.

The intermediate term Barometer dropped 16.60 on Friday, but added 5.00 last week. It briefly moved from Oversold to Neutral on a move above 40.00, but returned to Oversold on Friday on a return below 40.00.

The long term Barometer dropped 10.20 on Friday and 0.60 last week to 22.00. It remains Oversold.

TSX Momentum Barometers

The intermediate term Barometer dropped 22.46 on Friday and 5.09 last week to 30.08. It changed from Oversold to Neutral on Thursday on a move above 40.00, but returned to Oversold on Friday on a drop below 40,00.

The long term Barometer dropped 12.29 on Friday and 7.21 last week to 21.61. It remained Oversold.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed