by Drew O'Neil, Raymond James

It is difficult to convince yourself that if things are going a certain way they will not continue down the same path indefinitely. While deep down we know this isn’t the case, it is sometimes hard for the rational part of our brain to convince the irrational, trend following part of our brain that things will change. If your favorite team is on a 10-game winning streak, it seems like a given that they are going to win their next game. If you drive through seven stoplights on your commute home from work and hit a red light at the first six, you’ll probably start subconsciously tapping your breaks as you approach the seventh. If you’re playing blackjack and the dealer busts five times in a row, you’re probably going to go into the next hand with a little more confidence than you probably should. The trend likely has too much sway over what should be our rational thinking. Your team could lose the next game, the seventh light could stay green, and the house still has the advantage, yet we “feel” like none of these things are likely.

The trend right now in fixed income is higher and higher rates. It “feels” like rates are going to keep going up forever even though rationally we know that the current trend is not sustainable. Every time yields are trending higher like they are right now, there are a few things that are almost a certainty. One is that no matter how high yields are, you will always be able to find someone making an argument that yields are going to continue higher. Another is that some investors are going to try to time the market and wait for the absolute peak in interest rates before investing. The third thing that inevitably follows #2 is that many of these would-be market timers are left upset with themselves because they missed the peak and yields are now heading back lower. That’s the difficult thing about trying to invest at the “best” moment, you likely don’t know what the “best” moment to invest was until it’s behind you.

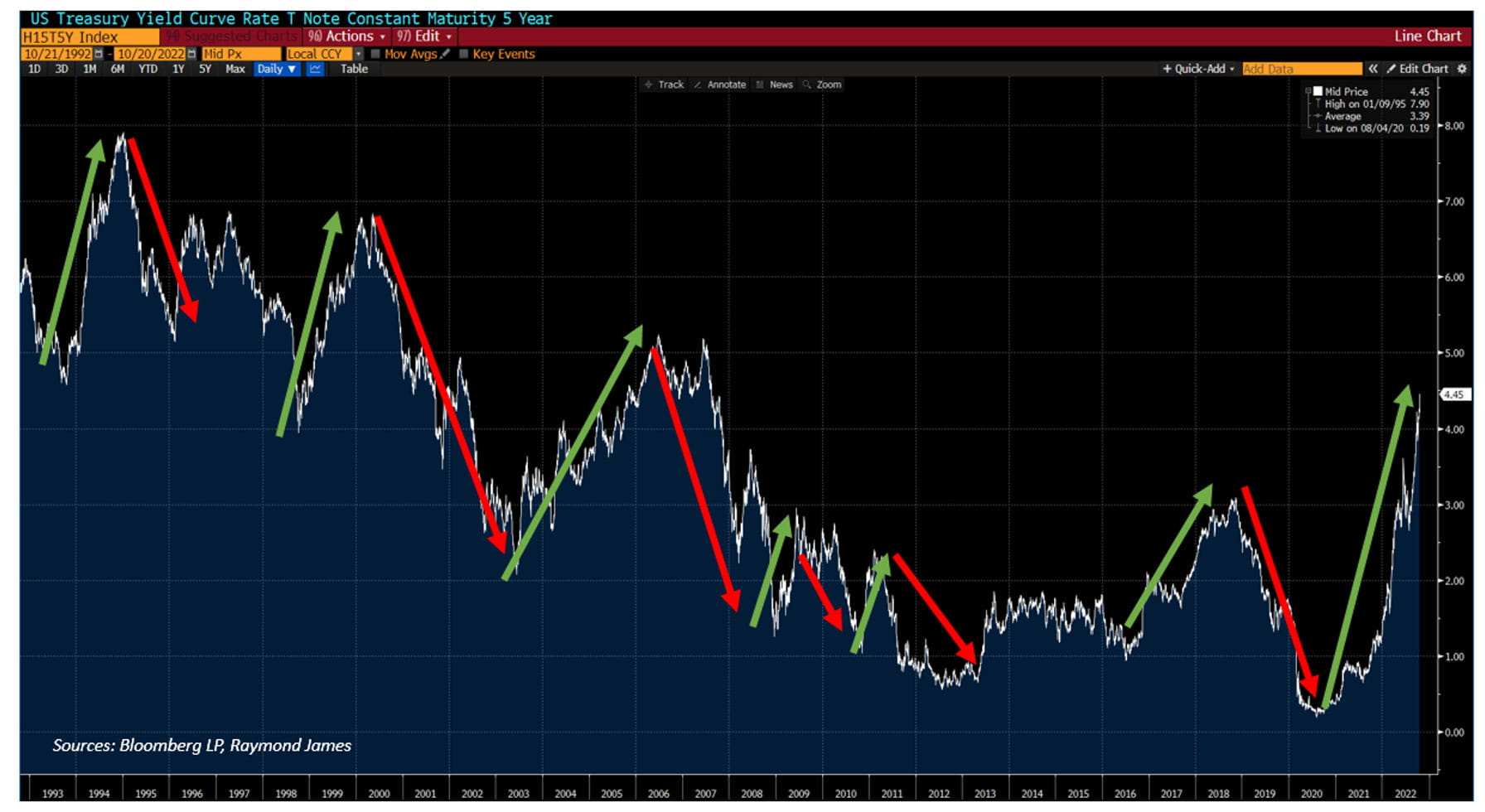

To put a picture around this idea, the graph below shows the 5-year Treasury yield for the past 20 years. As the green arrows highlight, we have been through a fair number of “yields are trending higher” markets over this timeframe. In every one of those timeframes, there were undoubtedly investors trying to time the market and invest at the absolute peak in yields, who ended up missing the boat because their crystal ball was broken and it turned out that yields can trend both higher and lower. The red arrows remind us that this trend can change quickly.

While many investors have been taking advantage of the higher yield environment we currently find ourselves in, there is also a cohort of investors who remain on the sidelines because they are convinced that yields will keep edging higher. So what’s the takeaway? As much as we all like to think of ourselves as being smarter than the market, no one knows when the market is going to turn. Yields across the fixed income landscape are at some of the most attractive levels in over a decade. Can you accomplish your goals with the yields that are currently available? If so, why wait?

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Securities Industry and Financial Markets Association’s Project Invested website and Investor Guides at www.projectinvested.com/category/investor-guides, FINRA’s Investor section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.