by William and Cole Smead, Smead Capital Management

We are at the point in this nasty bear market where those who are buying the glamour tech stocks of the last ten years (on the way down) are at a crucible. To understand the emotions of those owning the S&P 500 Index and growth-oriented common stocks we will look to the lyrics of the classic song, “At This Moment”:

What did you think

I would do at this moment?

When you’re standing before me

With tears in your eyes

Tryin’ to tell me that you

Found you another

And you just don’t love me no more

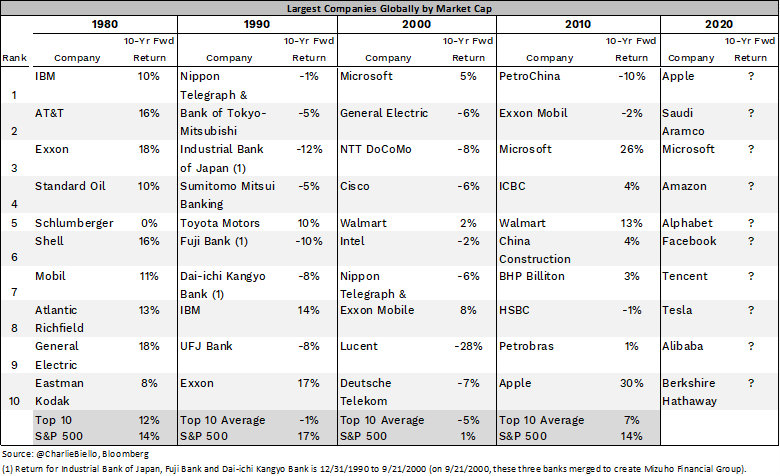

What did you think investors would do at this moment when deep cracks in the FAANG stocks have developed? The answer is they have done the same thing they did with tech stocks in 2000-2002, they bought them all the way down! Now they are “standing before me with tears in their eyes.” The bad news for the index investors is that they have not found another set of companies to love.

What did you think

I would say at this moment?

When I’m faced with the knowledge

That you just don’t love me

Did you think I would curse you

Or say things to hurt you

‘Cause you just don’t love me no more

What did you think we would say at this moment? At this point in the bear market, the liquidation is dragging down all stocks, and in the process “throwing the babies out with the bath water.” We are called as long-duration investors to buy the bargains which will be created by the capitulation of the masses during the next 12 months. We are loading up on the companies which could lead the next bull market, which history shows won’t be anywhere like the prior bull market.

Source: @CharlieBiello, Bloomberg.

Did you think I could hate you?

Or raise my hands to you?

Now come on girl you know me too well

How could I hurt you?

When darling I love you

And you know I’d never, never hurt you

Just so you know, we at Smead Capital Management never hate stocks because our goal is to get rich slowly. We have learned that these bear markets are necessary to purge the sins of the prior financial euphoria episode that preceded this current grief. We will pick among the rubble over the next twelve months in the shares of companies we avoided due to their popularity and the overestimation of their moats.

What do you think

I would give at this moment?

If you stay I’d subtract twenty years from my life

I’d fall down on my knees

Kiss the ground that you walk on

If I could just hold you again

I’d fall down on my knees

Kiss the ground that you walk on baby

If I could just hold you…

Again

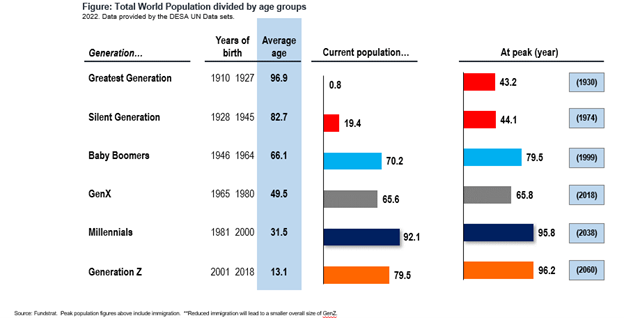

What do you think we will give at this moment if our investors stay in their chairs and ride through this? We think we can give them some of the leaders in the next bull market in sectors like oil and gas, home building, class A mall REITs, medicine and banking. These leaders will make their money providing necessities to the millennials who are in the 26-43-year-old age range when households are formed and babies are born. There have been more weddings so far in 2022 than any year in the prior ten years.

Source: FundStrat.

At this moment we are doubling down on our eight criteria for common stock selection and the bull market in commodities/land which broke out during the pandemic. What this means is that we are doing what we always try to do and that means that we expect to perform well going forward. Thank you for your confidence and trust. As always, fear stock market failure!

_______________________________________________

The recent growth in the stock market has helped to produce short-term returns for some asset classes that are not typical and may not continue in the future. Margin of safety is the difference between the intrinsic value of a stock and its market price. The price-earnings ratio (P/E Ratio or P/E Multiple) measures a company’s current share price relative to its per-share earnings. Alpha is a measure of performance on a risk-adjusted basis. Beta is a measure of the volatility of a security or a portfolio in comparison to the market. FAANG is an acronym for the market’s five most popular and best-performing tech stocks, namely Facebook, Apple, Amazon, Netflix and Alphabet’s Google. Growth investing is focused on the growth of an investor’s capital. Leverage is using borrowed money to increase the potential return of an investment. Momentum is the rate of acceleration of a security’s price or volume. The earnings yield refers to the earnings per share for the most recent 12-month period divided by the current market price per share. Profit margin is calculated by dividing net profits by net sales. Quality is assessed based on soft (e.g. management credibility) and hard criteria (e.g. balance sheet stability). Value is an investment tactic where stocks are selected which appear to trade for less than their intrinsic values. The dividend yield is the ratio of a company’s annual dividend compared to its share price.

The information contained herein represents the opinion of Smead Capital Management and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

Smead Capital Management, Inc.(“SCM”) is an SEC registered investment adviser with its principal place of business in the State of Arizona. SCM and its representatives are in compliance with the current registration and notice filing requirements imposed upon registered investment advisers by those states in which SCM maintains clients. SCM may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. Registered investment adviser does not imply a certain level of skill or training.

This newsletter contains general information that is not suitable for everyone. Any information contained in this newsletter represents SCM’s opinions, and should not be construed as personalized or individualized investment advice. Past performance is no guarantee of future results. There is no guarantee that the views and opinions expressed in this newsletter will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. SCM cannot assess, verify or guarantee the suitability of any particular investment to any particular situation and the reader of this newsletter bears complete responsibility for its own investment research and should seek the advice of a qualified investment professional that provides individualized advice prior to making any investment decisions. All opinions expressed and information and data provided therein are subject to change without notice. SCM, its officers, directors, employees and/or affiliates, may have positions in, and may, from time-to-time make purchases or sales of the securities discussed or mentioned in the publications.

This Newsletter and others are available at smeadcap.com