Technical Notes for yesterday

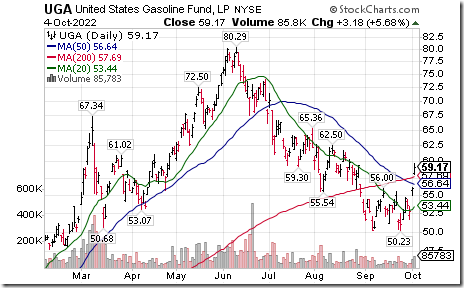

Gasoline ETN $UGA moved above $56.00 completing a base building pattern.

Precious metal prices and related equities continued to move higher on U.S. Dollar weakness

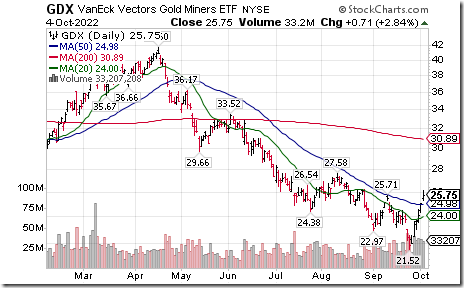

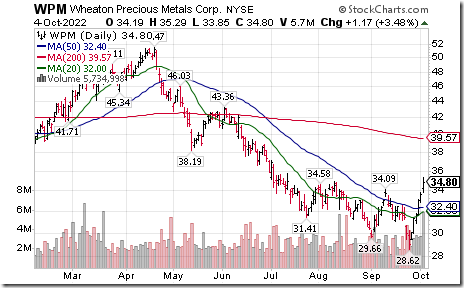

Silver ETN moved above $19.22 extending an intermediate uptrend. Platinum ETN $PPLT moved above $85.78 completing a double bottom pattern. Palladium ETN moved above $212.80 extending an intermediate uptrend. Gold Miners ETF $GDX moved above intermediate resistance at $25.71.Yamana $YRI.TO moved above $6.68 extending an intermediate. Wheaton Precious Metals $WPM moved above intermediate resistance at $34.09 and $34.58.

Trader’s Corner

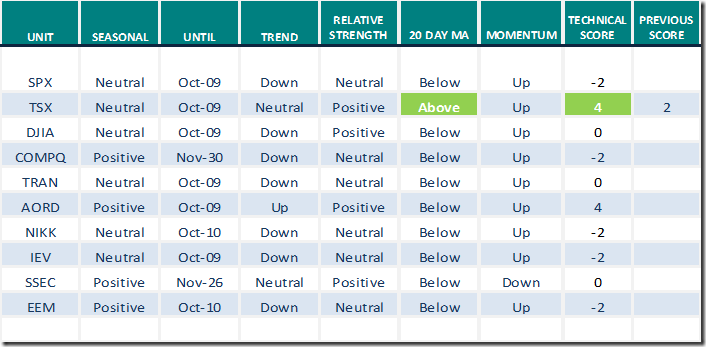

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for October 4th 2022

Green: Increase from previous day

Red: Decrease from previous day

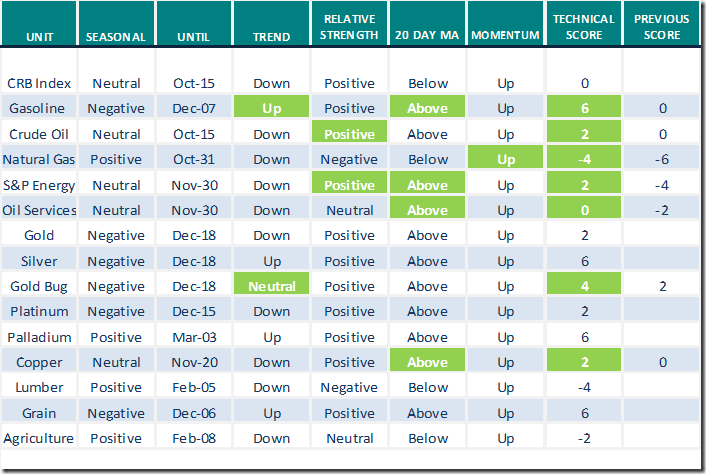

Commodities

Daily Seasonal/Technical Commodities Trends for October 4th 2022

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for October 4th 2021

Green: Increase from previous day

Red: Decrease from previous day

Hello CATA Members,

Just a reminder about our October Conference on Saturday October 15th. We have a great lineup of speakers and hope you can join us.

As we will be extending invitations to our Speaker’s members to join our Zoom meeting, we wanted to give you (our members) a reminder that you need to Register to get the Zoom meeting link. As Zoom limits us to 100 attendees, you should Register Now to claim your spot.

Link offered by a valued provider

Tom Bowley says “Extremely bearish sentiment lifts stocks”. Note seasonality comment and chart on U.S. Financials.

https://www.youtube.com/watch?v=nY2n8nO8Rpc

S&P 500 Momentum Barometers

The intermediate term Barometer jumped 12.60 to 21.20 yesterday. It remains Oversold. Trend remains up.

The long term Barometer advanced 6.00 to 22.80 yesterday. It remains Oversold. Trend remains up.

TSX Momentum Barometers

The intermediate term Barometer jumped 13.98 to 46.61 yesterday. It changed from Oversold to Neutral on a move above 40.00. Trend remains up.

The long term Barometer advanced 6.36 to 32.20 yesterday. It remains Oversold. Trend remains up.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed