by Russ Koesterich, CFA, JD, Blackrock

Russ Koesterich, CFA, JD, Managing Director and Portfolio Manager, of the Global Allocation team discusses why the dollar has become an effective equity hedge.

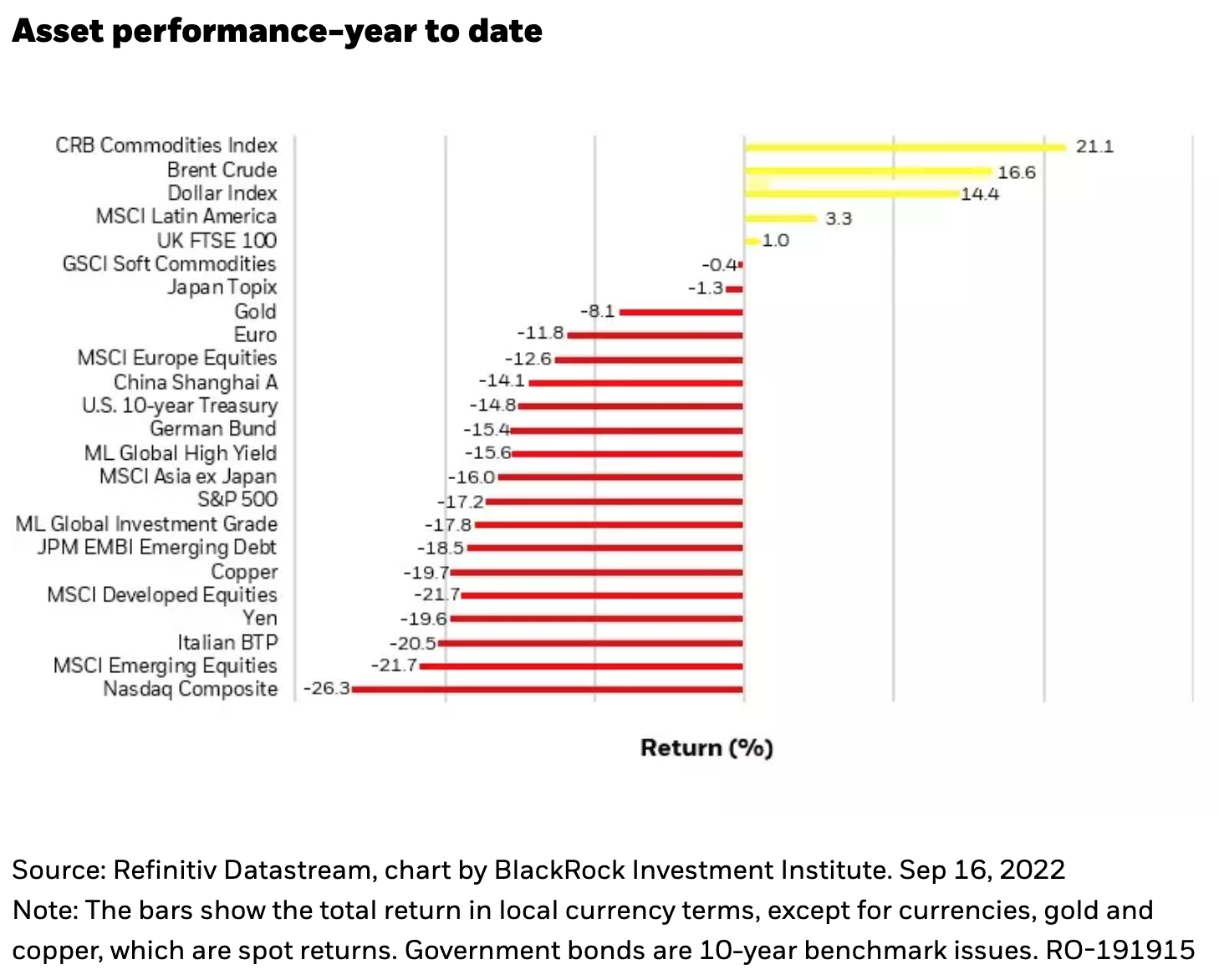

The list of assets that have risen year-to-date is both short and odd: energy, broad commodity indexes and the dollar (see Chart 1). No surprise that energy and commodities should rally in a high inflation environment. The surge in the Dollar Index (DXY), now at a 20-year high, is less obvious.

While it may seem strange that the dollar should rally as its purchasing power plunges, the move makes more sense in the context of the Federal Reserve’s reaction to rising prices. Given this unprecedented shift from monetary laxity to the most aggressive tightening campaign in decades, the dollar has not only surged but also supplanted U.S. Treasuries as the most effective hedge against equity drawdowns.

I first wrote about the dollar’s role as a hedge in the summer of 2021. At the time investors were starting to adjust to a profound shift in the relationship between stocks and U.S. Treasuries, the traditional hedge for equity risk. This shift was a function of a concern investors had not faced in years: too much rather than too little growth.

By the fall of 2021 it was becoming obvious that record stimulus, both monetary and fiscal, had created a robust recovery and, along with disruptions to global supply chains, the seeds for future inflation. As this risk became clearer, rate volatility started to rise, followed in short order by a spike in actual interest rates. In barely six months two-year real yields, derived from the TIPS market, surged from -3% to 1.70%, the highest since late 2018.

As rates erupted higher the relationship between stocks, bonds, and the dollar began to shift. In the two years before the start of the pandemic, stock/bond correlations were consistently negative, averaging around -0.4. In contrast, the correlation between the dollar and stocks was effectively zero. As real rates began to normalize from negative levels, these relationships flipped.

Today it is Treasuries that have no meaningful correlation with stocks. In contrast, higher real rates are crushing stocks but supporting the dollar. This shift has resulted in a statistically significant -0.50 correlation between stocks and the dollar, making the dollar an unusually reliable hedge.

Fed is the key

What could flip this relationship back to the pre-pandemic norm? The most likely catalyst would be a pivot by the Fed, which would require a meaningful and steady drop in inflation, probably coupled with some softness in labor markets. As recent data has made clear, we’re not there yet.

In the meantime, investors should consider how the dollar can help mitigate risk. Potential strategies include higher-than-normal cash balances, lower international exposure and for any remaining foreign holdings, vehicles that hedge the currency exposure. When the dust eventually settles and the Fed finally signals all-clear, dollar/stock relationships are likely to mean revert. But for now, the dollar remains the last hedge standing.

*****

Russ Koesterich, CFA, is a Portfolio Manager for BlackRock's Global Allocation Fund and the lead portfolio manager on the GA Selects model portfolio strategies.

Copyright © Blackrock