The Bottom Line

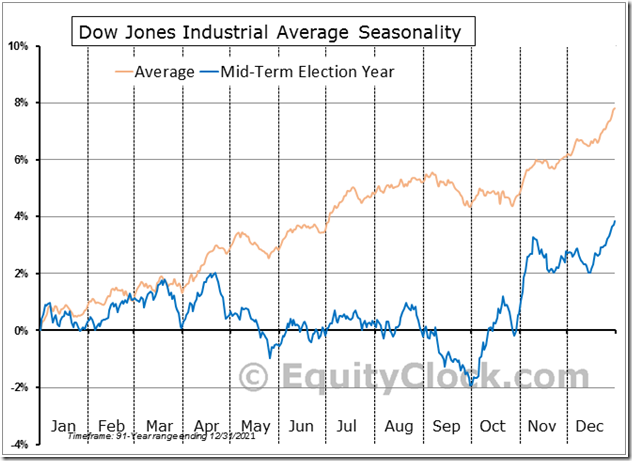

Initial encouraging technical signs of an intermediate low by U.S. and Canadian equity markets appeared last week. They appeared at a time when seasonal influences historically have turned positive for a significant upside move between now and at least yearend.

Response to the U.S. August PCE Price Index released at 8:30 AM EDT on Friday was mixed. The Index slipped to 6.2% from 6.3% in July, but was higher than consensus at 6.0%. Excluding food and energy, the Index was in line with consensus at 4.7%.

The VIX Index has started to roll over from an intermediate peak, an encouraging sign for U.S. equity market indices

Seasonal influences suggest that U.S. equity indices normally reach an important intermediate low at the end of September during a mid-term election year in the U.S. Presidential Election Cycle. Will history repeat?

Meanwhile, North American equity markets are extremely oversold by several measures: The CNN Fear & Greed Index dropped to 16 on Friday from 24 on the previous Friday and remains at the “Extreme Fear” level. See: https://www.cnn.com/markets/fear-and-greed Intermediate and long term Barometers for S&P 500 and TSX Composite stocks available at the end of this report also are extremely oversold. They recovered slightly last week and are now showing early technical evidence of bottoming (particularly the TSX)..

Consensus for Earnings and Revenues for S&P 500 Companies

Analysts lowered earnings estimates significantly last week. According to www.factset.com third quarter earnings on a year-over-year basis are expected to increase 2.9% (versus previous estimate at 3.2%) and revenues are expected to increase 8.7%. Fourth quarter earnings are expected to increase 4.0% (versus previous estimate at 4.5%) and revenues are expected to increase 6.2% (versus previous estimate at 6.4%). For 2022 earnings are expected to increase 7.4% (versus previous estimate at 7.7%) and revenues are expected to increase 10.7%.

Preliminary estimates for 2023 also moved lower. According to www.factset.com first quarter 2023 earnings are expected to increase 6.5% (versus previous estimate at 7.2%) and revenues are expected to increase 5.9% (versus previous estimate at 6.1%). Second quarter 2023 earnings are expected to increase 5.5% (versus previous estimate at 6.0%) and revenues are expected to increase 3.3% (versus previous estimate at 3.4%). For all of 2023, earnings are expected to increase 7.9% (versus previous estimate at 8.1%) and revenues are expected to increase 4.4% (versus previous estimate at 4.5%).

Economic News This Week

August U.S. Construction Spending released at 10:00 AM EDT on Monday is expected to drop 0.3% versus a drop of 0.4% in July.

September ISM Manufacturing PMI released at 10:00 AM EDT on Monday is expected to drop to 49.0 from August at 52.8.

August Factory Orders released at 8:30 AM EDT on Tuesday is expected to increase 0.3% versus a decline of 1.0% in July.

August U.S. Trade Deficit released at 8:30 AM EDT on Wednesday is expected to slip to $68.00 billion from $70.70 billion in July.

August Canadian Merchandise Trade released at 8:30 AM EDT on Wednesday is expected to be a surplus of $3.50 billion versus a surplus of $4.05 billion in July.

September ISM Non-manufacturing PMI released at 10:00 AM EDT on Wednesday is expected to slip to 56.0 from 56.9 in August.

September U.S. Non-farm Payrolls released at 8:30 AM EDT on Friday is expected to slip to 250,000 from 315,000 in August. September Unemployment Rate is expected to remain unchanged from August at 3.7%. September Average Hourly Earnings are expected to increase 0.3% versus a gain of 0.3% in August. On a year-over-year basis, September Average Hourly Earnings are expected to increase 5.1% versus a gain of 5.2% in August.

Canadian September Employment released at 8:30 AM EDT on Friday is expected to increase 20,000 versus a drop of 39,700 in August. September Unemployment Rate is expected to remain unchanged at 5.4%.

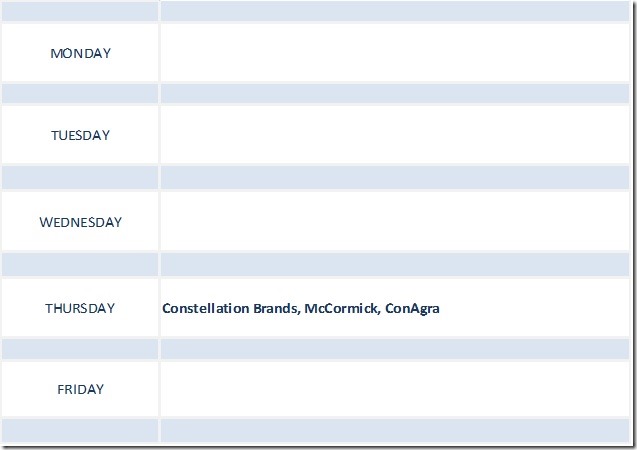

Selected Earnings Reports This Week

Trader’s Corner

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for September 30th 2022

Green: Increase from previous day

Red: Decrease from previous day

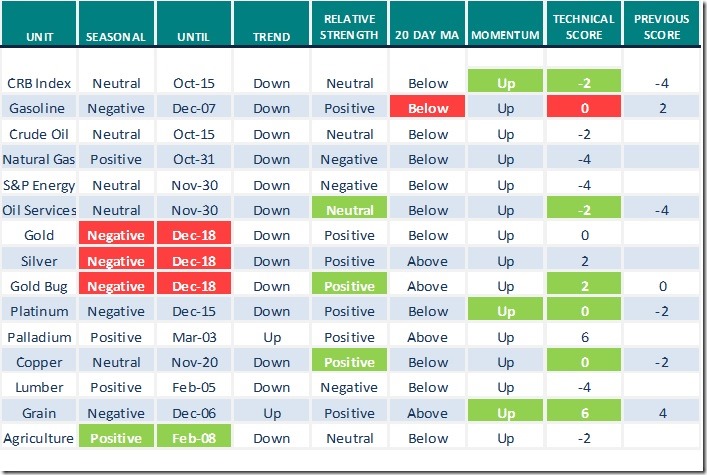

Commodities

Daily Seasonal/Technical Commodities Trends for September 30th 2022

Green: Increase from previous day

Red: Decrease from previous day

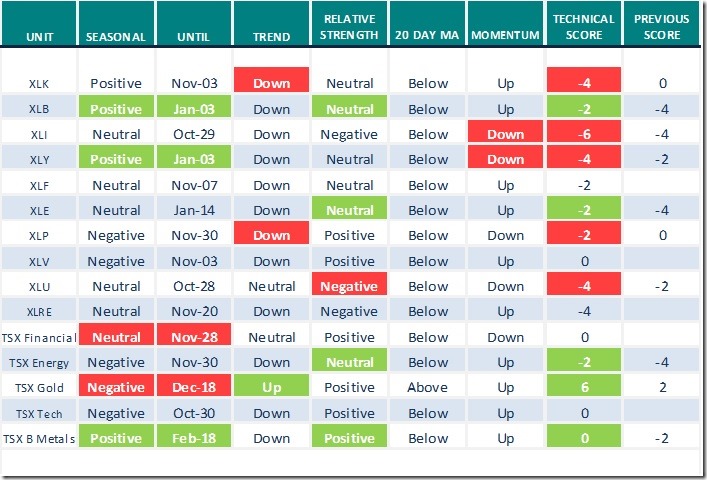

Sectors

Daily Seasonal/Technical Sector Trends for September 28th 2021

Green: Increase from previous day

Red: Decrease from previous day

Links offered by Valued Providers

Greg Schnell is “Staring at the quarterly charts”.

Staring At The Quarterly Charts | The Canadian Technician | StockCharts.com

Erin Swenlin notes “NYSE and SPX new lows confirm price bottom”

NYSE and SPX New Lows Confirm Price Bottom | DecisionPoint | StockCharts.com

Michael Campbell’s Money Talks for October 1st

Mike’s Content (mikesmoneytalks.ca)

Mark Leibovit’s Comment on September 29th

Making Money in a Declining Market, Solar Flares – HoweStreet

Victor Adair’s Trading Desk Notes for October 1st

https://victoradair.ca/trading-desk-notes-for-october-1-2022/

Links offered by Mark Bunting and www.uncommonsenseinvestor.com

Can You Tolerate Volatility? – Uncommon Sense Investor

Five Incredible Charts That Explain the Market Turbulence – Uncommon Sense Investor

Jim Cramer summarizes technical analysis comment by Ralph Vince showing signs of a bottom

https://www.youtube.com/watch?v=_eOHl-rnS2A

Technical Scoop from David Chapman and www.enrichedinvesting.com

Technical Scores

Calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

(Higher highs and higher lows)

Intermediate Neutral trend: Score 0

(Not up or down)

Intermediate Downtrend: Score -2

(Lower highs and lower lows)

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower

Changes Last Week

Technical Notes for last Thursday

and Friday

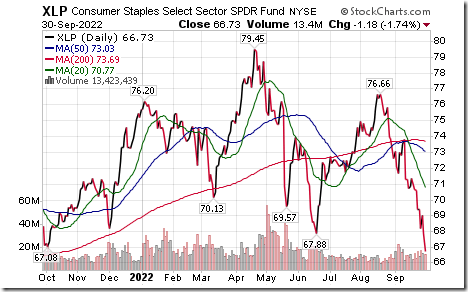

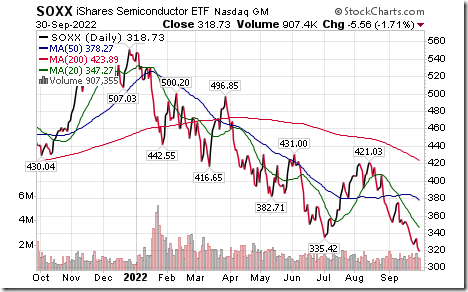

ETFs that broke intermediate support on Thursday and Friday: SPY, XLK, XLP, SOXX, PPA, XRT

S&P 100 stocks that broke intermediate support on Thursday and Friday:

BLK, AMT, CL, PG, DUK, ABBV

NASDAQ 100 stocks breaking intermediate support on Thursday and Friday

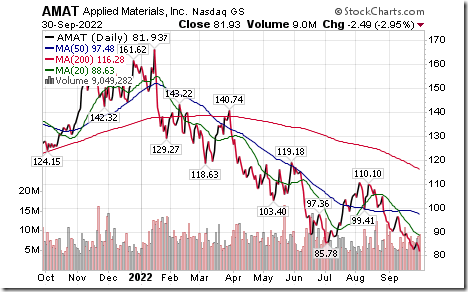

MRNA, ANSS, LULU, AMAT, TSLA

TSX 60 stocks breaking intermediate support on Thursday and Friday

MG, SAP, BIP, BAM.A, T

TSX Gold Index and ETF completed double bottom patterns, led by double bottom patterns by Kinross and Yamana.

S&P 500 Momentum Barometers

The intermediate term Barometer slipped 2.40 on Friday and 2.00 last week to 3.20. It remains extremely Oversold and shows early signs of bottoming.

The long term Barometer slipped 1.00 on Friday and 2.80 last week to 12.20. It remains extremely Oversold and shows early signs of bottoming.

TSX Momentum Barometers

The intermediate term Barometer added 5.36 on Friday and 13.05 last week. It remains Oversold. Trend has turned up.

The long term Barometer slipped 0.42 on Friday and 0.85 last week. It remains Oversold.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed