Stock Market Outlook for September 30, 2022

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

First Trust Nasdaq Food & Beverage ETF (NASD:FTXG) Seasonal Chart

SPDR S&P China ETF (NYSE:GXC) Seasonal Chart

Fox Corporation (NASD:FOXA) Seasonal Chart

NLIndustries, Inc. (NYSE:NL) Seasonal Chart

Universal Technical Institute, Inc. (NYSE:UTI) Seasonal Chart

American Software, Inc. (NASD:AMSWA) Seasonal Chart

Lawson Products, Inc. (NASD:LAWS) Seasonal Chart

Applied Materials, Inc. (NASD:AMAT) Seasonal Chart

L.B. Foster Co. (NASD:FSTR) Seasonal Chart

Korn Ferry Intl (NYSE:KFY) Seasonal Chart

Juniper Networks (NYSE:JNPR) Seasonal Chart

Magic Software Enterprises Ltd. (NASD:MGIC) Seasonal Chart

Banco Santander SA (NYSE:SAN) Seasonal Chart

Fastenal Co. (NASD:FAST) Seasonal Chart

Walt Disney Co. (NYSE:DIS) Seasonal Chart

The Markets

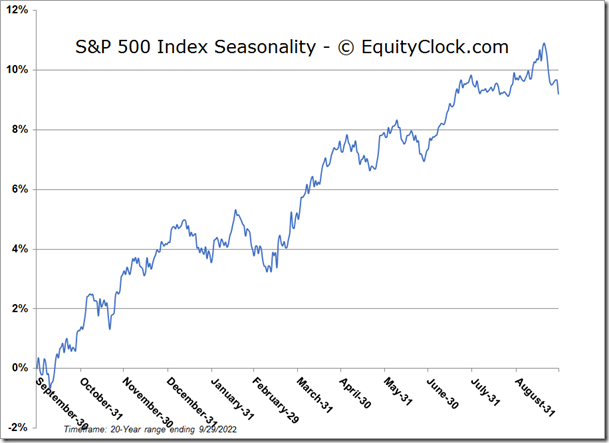

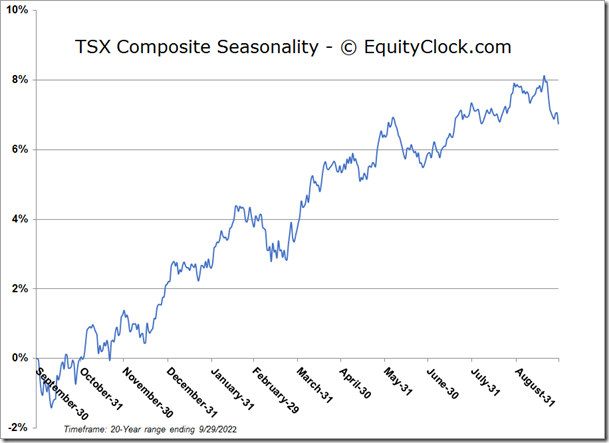

Equity markets remained on edge on Thursday as the euphoria surrounding the bond market rebound on Wednesday was short-lived. The S&P 500 Index slipped back to the lows of the year, falling by 2.11% to close within mere points of the June intraday low at 3636. The relative strength Index (RSI) briefly slipped back into oversold territory below 30, although early indications remain that momentum indicators are bottoming. The MACD histogram has started to narrow as the spread between the technical indicator and the signal line converges on one another. Major moving averages continue to roll over, providing levels of resistance over multiple timeframes that warrant selling into. Despite the break of the June lows, we are still on the lookout for evidence of a shift of the intermediate-term trend, as naive as that may sound given the overwhelming negativity in the market, but waiting for that turn in order to ramp up equity exposure for the traditional seasonal strength that spans the last couple of months of the year remains prudent. We have ample cash/bonds in our Super Simple Seasonal Portfolio and in the Seasonal Advantage Portfolio that we manage on behalf of clients in partnership with Castlemoore, but we are anxious to put this cash hoard to work in stocks given the extremes that many market metrics are flashing. Theoretically, we are near that turning point, particularly as we enter the new month and quarter, but we can’t rely solely on theory or what is normal in what is clearly an abnormal fundamental backdrop with the Fed showing its greatest aggression in decades. This market is in desperate need of a sentiment refresh.

Today, in our Market Outlook to subscribers, we discuss the following:

- The peak of seasonal equity market volatility

- The election year cycle low for stocks

- Weekly Jobless Claims

- Canada Gross Domestic Product (GDP)

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for September 30

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Just released…

Our monthly report for October is out, providing you with everything that you need to know to navigate through the month(s) ahead.

Highlights in this report include:

- Equity market tendencies in the month of October

- Sentiment and positioning

- Significant rebound of shipping volumes in August

- Downfall of couriers, rise of warehousing

- Jobless claims as a coincident indicator of economic activity

- Credit spreads pointing to fading financial stress compared to the June lows

- Searching for clues as to the direction of stocks in the slope of earnings expectations

- Lacklustre demand persisting in the consumer economy

- Inflationary pressures easing on aggregate, but the devil is in the details

- Agriculture still expected to grow into year-end

- Business sentiment surveys continue reiterate a manufacturing economy that is in decline

- The bull case for Technology

- Investors not positioned in a manner consistent ahead of prior economic downturns

- Things to lookout for to determine if and when the change of the intermediate-term direction of stocks is realized

- Former alpha generators through the first half of the year showing significant topping patterns

- Gauges of risk sentiment holding steady

- Energy sector vulnerable as it enters its weakest time of the year

- Energy sector alternative continues to fuel strength in portfolios

- Financials attracting attention

- REITs struggling as their weakest time of the year gets underway

- Copper

- Bonds

- Positioning for the months ahead

- Sector Reviews and Ratings

- Stocks that have Frequently Gained in the Month of October

- Notable Stocks and ETFs Entering their Period of Strength in October

Subscribers can look for this report in their inbox or in the report archive at the following link: https://charts.equityclock.com/

Not subscribed yet? Signup now to receive this and other regular reports, along with full access to our chart database. The most profitable time of the year, historically, for stocks is nearly upon us, and you don’t want to miss out on the potential opportunities ahead.

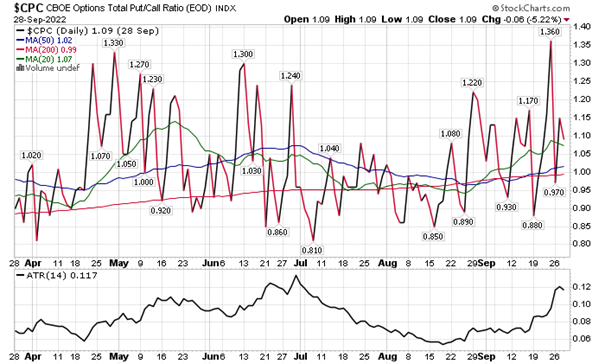

Sentiment on Thursday, as gauged by the put-call ratio, ended bearish at 1.13

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite