by William Smead, Smead Capital Management

Dear fellow investors,

We marveled for years listening to Sir John Templeton talk about the stock market. His best advice was shared during the most difficult stock market environments of the 1980s, 1990s, and 2000s on “Wall Street Week” with Louis Rukeyser.

Templeton edict No. 1

“Bull markets follow Bear markets and Bear Markets follow Bull markets!”

John was invested for decades and believed in getting rich slowly. He understood that you were going to get much better long-term performance by being optimistic in bear markets and cautious in bull markets.

Templeton edict No. 2

Well-selected stocks at value prices were more interesting to Sir John than the shares of more popular securities. The Templeton Way was all about buying meritorious companies at fire-sale prices. He wrote the book on “value investing” and had the track record to show for it.

Templeton edict No. 3

Buy at the point of maximum pessimism!

Our favorite Sir John quote, “If you can see the light at the end of the tunnel, you are too late.” He had no inhibitions about being early and knew that was the price of admission for getting rich slowly.

Templeton edict No. 4

Look for bargains where others aren’t looking.

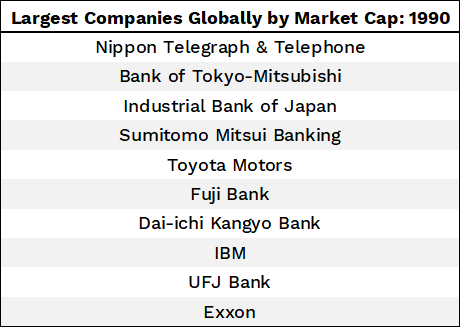

Templeton began buying Japanese shares in the 1950s and 1960s when sentiment was negative, few positive cases could be made, and little research was done. As a result, he was able to purchase shares at very depressed prices and held many of them for decades. Look at the chart below of the ten largest capitalization companies in the world in 1990:

Source: @CharlieBiello, Bloomberg

Sir John and his investors got gloriously rich by acquiring shares others were afraid to buy in a country that provided the most popular stocks in the world by the end of 1990! When oil prices skyrocketed in the 1970s, Datsun (Nissan) and Toyota automobiles had the gas mileage to attract budget-conscious Americans to their cars. The Japanese market and economy were the envy of the world in 1990.

What does this review of the “Sir John Templeton Way” tell us about the current bear market that we are sitting through?

First, shares purchased between now and the end of this bear market are likely to get rewarded in the future. Second, the shares we own today trade at very low multiples of earnings, book value, and free cash flow. It doesn’t matter in a market suffering indiscriminate selling, but it should matter a great deal over the next 5-10 years.

Third, bear markets bottom on a rotational basis just like bull markets do on the upside. We like buying very depressed mall REITs like Simon Properties (SPG), home builders like D.R. Horton (DHI), e-commerce yard sales like eBay (EBAY), and oil and gas companies like Occidental Petroleum (OXY).

Lastly, in the remainder of this bear market in stocks, there will be companies that fit our eight criteria for common stock selection which become available for purchase. We will get interested when the folks who have owned them on the way down give up and professional and amateur investors are afraid to go there.

In conclusion, this is a very difficult bear market with an unknown end date. However, just like the Crash of 1987, the Dotcom Bear of 2000-2003, and the Financial Crisis Bear of 2007-2009, this too shall pass. When it does, we believe that stock selection will be at a premium and valuation will matter dearly as it did for Sir John Templeton.

Fear stock market failure,

William Smead

The information contained in this missive represents Smead Capital Management’s opinions, and should not be construed as personalized or individualized investment advice and are subject to change. Past performance is no guarantee of future results. Bill Smead, CIO, wrote this article. It should not be assumed that investing in any securities mentioned above will or will not be profitable. Portfolio composition is subject to change at any time and references to specific securities, industries and sectors in this letter are not recommendations to purchase or sell any particular security. Current and future portfolio holdings are subject to risk. In preparing this document, SCM has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. A list of all recommendations made by Smead Capital Management within the past twelve-month period is available upon request.

©2022 Smead Capital Management, Inc. All rights reserved.

This Missive and others are available at www.smeadcap.com