Next Tech Talk report

Tech Talk is taking a holiday tomorrow. Next report is released on Monday October 3rd.

Technical Notes for yesterday

Biogen $BIIB and Eli Lilly $LLY moved sharply higher on encouraging news on their Alzheimer’s drugs

Trader’s Corner

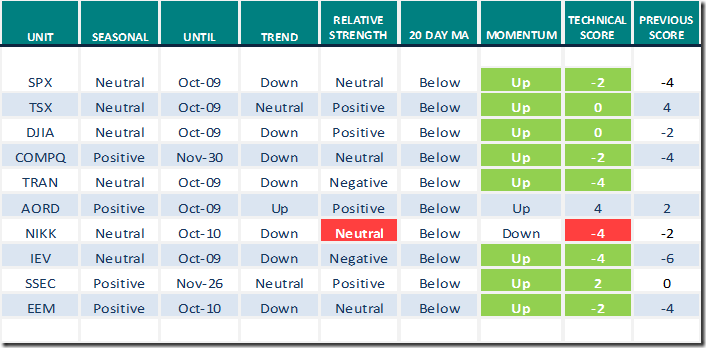

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for September 28th 2022

Green: Increase from previous day

Red: Decrease from previous day

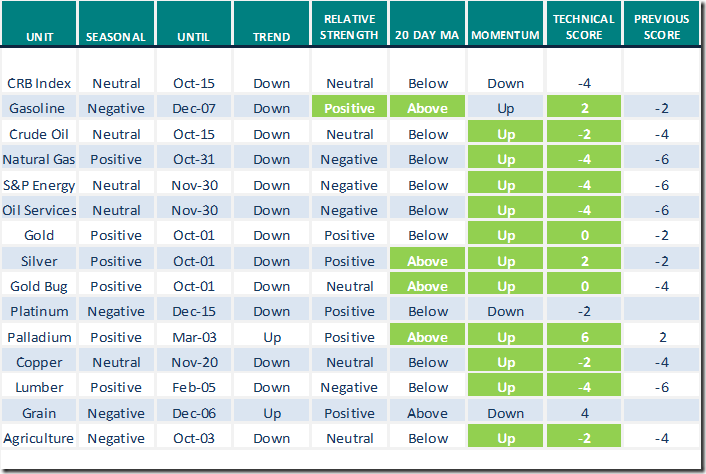

Commodities

Daily Seasonal/Technical Commodities Trends for September 28th 2022

Green: Increase from previous day

Red: Decrease from previous day

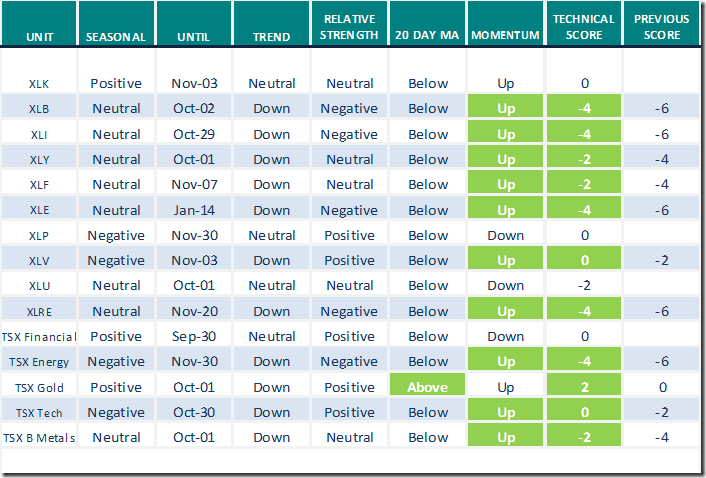

Sectors

Daily Seasonal/Technical Sector Trends for September 28th 2021

Green: Increase from previous day

Red: Decrease from previous day

Links offered by valued providers

Links from Mark Bunting and www.uncommonsenseinvestor.com

Inflation Has Little Impact on Franco-Nevada – Uncommon Sense Investor

Why the Sun Will Also Rise for the Stock Market – Uncommon Sense Investor

Greg Schnell says “Financials wobble”

Financials Wobble | Greg Schnell, CMT | Market Buzz (09.28.22) – YouTube

Jane Galina says “Time to ride the silver stallion”.

Time To Ride The Silver Stallion | Jane Gallina | Your Daily Five (09.28.22) – YouTube

Mish Schneider notes “A double bottom in semiconductors and transportation stocks?”

Double Bottom for Semiconductors? | David Keller, CMT | The Final Bar (09.28) – YouTube

S&P 500 Momentum Barometers

First sign of an intermediate bottom has appeared! The intermediate term Barometer added 4.20 to 7.00 yesterday. It bounced nicely from a deeply over Oversold level.

The long term Barometer also offered evidence of a recovery from an Oversold level. It recovered 4.00 to 15.40 yesterday.

TSX Momentum Barometers

More signs of an intermediate bottom! The intermediate term Barometer jumped 13.56 to 21.61 yesterday. It remains Oversold, but shows start of a recovery from deeply Oversold levels.

The long term Barometer also recorded a significant gain, up 2.97 to 20.34. It remains Oversold. Trend has turned up.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed