by John Mauldin, Mauldin Economics

No Escape

Shrinkflation

Rates Still Negative

LNG Boom

Manufacturing Moves

No Soft Landing

“This Is Normal Now”

What Will Jerome Do?

Fiona and Floods

We were a bit preoccupied here in Puerto Rico this week. Hurricane Fiona decided to camp out over the island, bringing mind-boggling amounts of rain. I am sure you have seen the flooding pictures. The entire island lost power and much of it is still down. Our oversized diesel generator, which I thought quite expensive but decided to get anyway, proved a good investment.

For today’s letter my team and I pulled together some brief notes on the less obvious aspects of our inflation wave. I think you’ll find them interesting, and in some cases surprising. At the end we’ll also talk about the Federal Reserve’s latest policy meeting.

No Escape

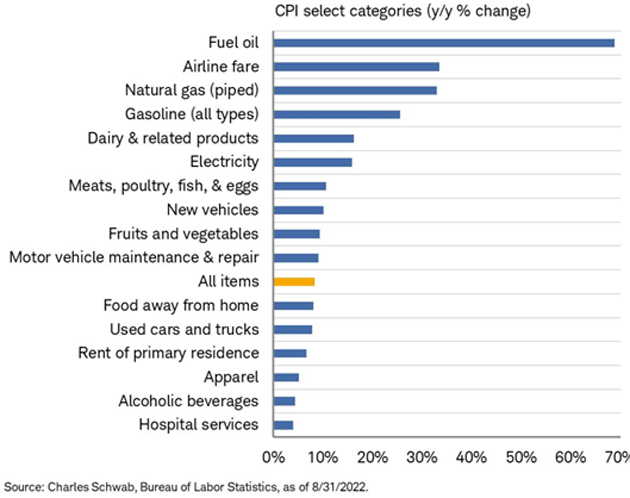

Price inflation is an individualized experience based on your spending patterns. It is increasingly difficult to escape completely, though. Almost every category of living costs is rising to some degree. You can see it in these charts from my friend Liz Ann Sonders of Charles Schwab.

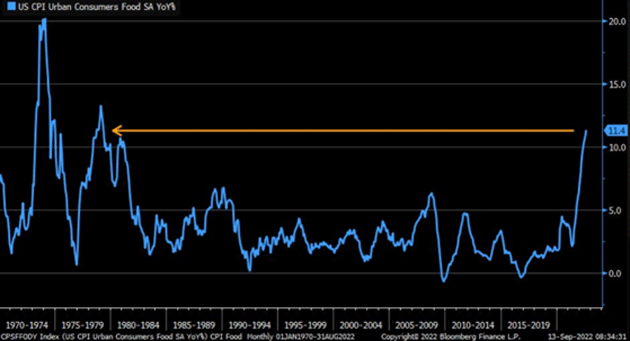

The food component of CPI just posted its biggest annual jump since 1979.

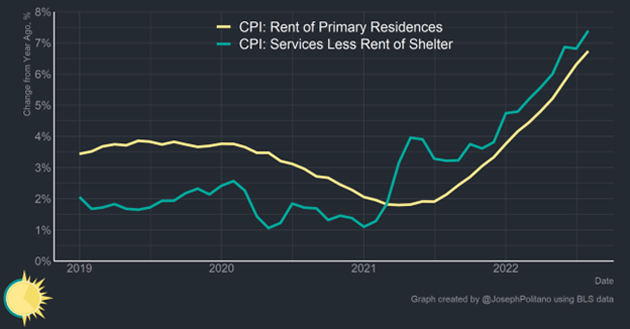

Last week I talked about rent increases driving service prices higher. That’s not the only problem. Services ex-rent are growing even faster.

These other services carry less weight in the CPI formula, so their impact is smaller. As we’ll see, though, they add up, particularly for those with chronic health conditions. Treatment services are expensive and getting more so.

[Monthly Subscriptions Now Available] Start building real wealth now with Jared Dillian’s Strategic Portfolio. This “done for you” investment portfolio is ready to go and could have you investing as early as tomorrow.

Take the stress out of investing—find out more by clicking here.

Shrinkflation

Most businesses hate raising prices. At some point they have no other choice, but it’s nerve-wracking because they don’t know how customers will respond. So, they find all manner of ways to camouflage what they’re doing, hoping no one will notice they are paying more.

Anas Alhajji recently posted some examples of “shrinkflation,” when companies keep prices the same but reduce the quantity sold.

- Folgers container: 51 ounces to 43.5

- Nescafe Azera Americano coffee: 100 grams to 90

- Kleenex: 65 tissues to 60

- Walmart Paper Towels: 168 sheets per roll to 120

- Crest 3D White Radiant Mint toothpaste: 4.1 to 3.8 ounces

- Dorito's: 9.75 ounces to 9.25

- Most “Party Size” Chips: 18 to 15.5 ounces

- Chobani Flips yogurts: 5.3 ounces to 4.5

- Burger King chicken nuggets: 10 to 8

- Like what you’re reading?

- Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

- Bounty Triples: 165 sheets to 147

- Tillamook ice cream: 56 ounces to 48

- Hefty's mega pack: 90 bags to 80

- Earth's Best Organic Sunny Day: 8 bars per box to 7

- Vim dish soap (India): 155 grams to 135

- Cottonelle Ultra Clean Care toilet paper: 340 sheets per roll to 312

- Pantene Pro-V Curl Perfection conditioner: 12 ounces to 10.4

- Royal Canin's cans of cat food: 5.9 ounces to 5.1

- Angel Soft: 425 sheets per roll to 320

I can’t verify all those but I’ve seen similar examples. Caffeine Free Diet Coke is now in 10-ounce cans instead of 12-ounce. Some of this shrinkflation amounts to 20%‒25% price increases in terms of the amount you get for your money.

These changes don’t fool CPI, which adjusts for quantities. They fool many customers, though, which could have a long-term cost when people see what happened and lose trust in the brand.

Rates Still Negative

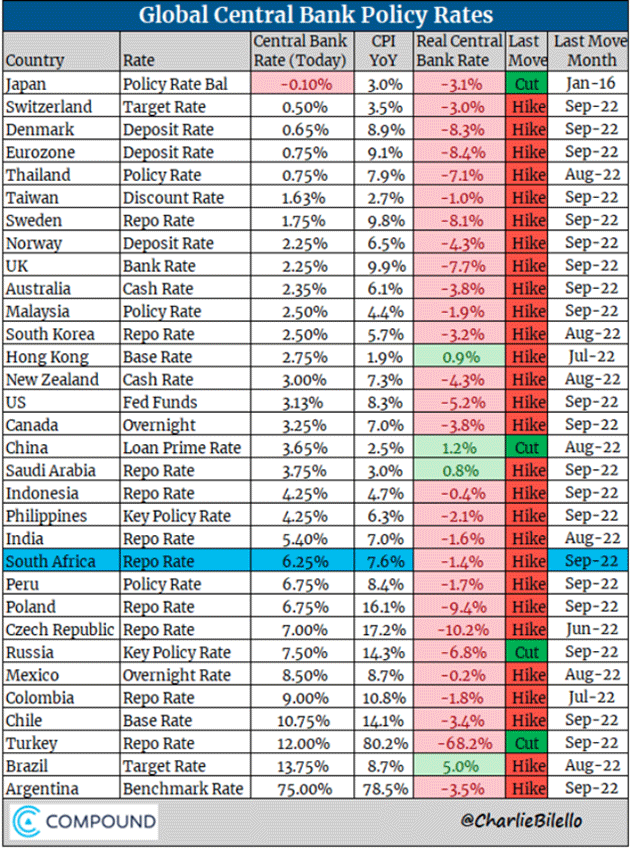

With this week’s 75-basis-point hike, the federal funds target rate is 3.25%. Annual inflation is running at 6.3% (PCE) to 8.3% (CPI). That means the real fed funds rate is still deeply negative, somewhere between -3.05% and -5.05% depending on which inflation figure you use.

I suppose it’s possible to control inflation while keeping real rates well below zero. Stranger things have happened. But more likely, reducing demand enough to squelch inflation will require raising real rates at least to 0%, and probably a bit higher.

This is a global situation. Here’s a chart from Charlie Bilello showing real rates around the globe.

Policy rates are still negative almost everywhere, the main exceptions being China, Brazil, Hong Kong, and Saudi Arabia. Mexico and Indonesia are almost there, too.

Those are policy rates, of course, which mainly affect interbank transactions. Household and business lending rates are typically higher, sometimes far higher. But to this point, they obviously aren’t high enough to meaningfully reduce inflation pressure in most countries… which means the central banks have a lot more work to do.

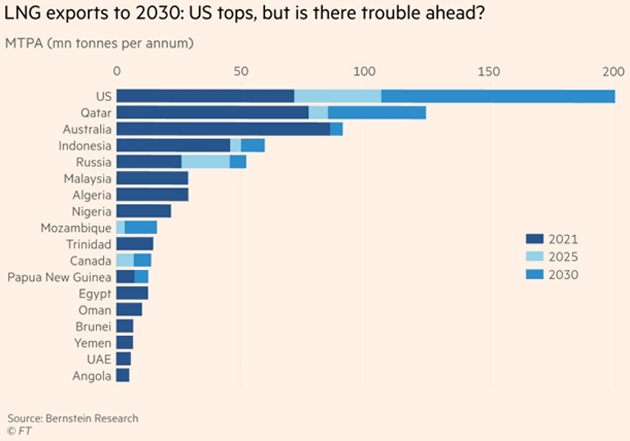

LNG Boom

Between preexisting inflation and then the Ukraine war, we all know about rising energy prices. Less attention is going to the way this is restructuring energy markets. It’s not just a matter of paying more. Simply getting the energy resources to where they’re needed requires many changes.

Some European countries made choices years ago that left their economies dependent on Russian natural gas. Now they want to eliminate that dependency—and do so quickly. This is a problem because the necessary pipelines to alternate sources don’t exist. Building them will take years and winter is coming. What to do? The immediate solution is to import natural gas from the US and other places via tankers. The challenge there is that moving gas by ship requires converting it to LNG (liquefied natural gas) when loaded and then a “regasification” process when unloaded.

All this takes expensive, specialized facilities that the Financial Times points out will become “stranded assets” if Europe later moves away from fossil fuel use before the costs can be recovered. So why should anyone invest in them? A sticky wicket, as my British friends say.

Meanwhile we have another problem in the US. Parts of New England have become more dependent on natural gas for electricity after retiring coal, oil, and nuclear plants. Demand has outgrown the region’s decades-old pipeline network, which local politicians have resisted expanding. They can’t buy LNG from other parts of the US because the Jones Act requires it be transported on US-flagged tankers, which don’t exist. So they’re buying it from overseas. Some areas may have to pay almost as much as European countries for power.

(The Jones Act also makes power and food and, well, everything, cost more here in Puerto Rico. For the sake of a few thousand union jobs, we raise prices on those least able to afford it. The Jones Act is an extremely regressive tax.)

LNG is quickly becoming a hot commodity, not because the US lacks natural gas production but because we lack ways to transport it. This winter the New England states will be competing with Europe and Asia for non-US LNG cargoes.

Electric rates are rising even in places like Texas with abundant resources and infrastructure. This may get much worse. US natural gas prices are lower than elsewhere because we produce a lot relative to our export capacity. It literally has nowhere else to go. Exporting more would bring down world prices but raise US prices. That’s not likely to play well with the public.

Manufacturing Moves

Europe’s energy problems are having another effect we didn’t foresee. As noted above, the US has enough oil and gas production to keep prices significantly lower here. That differential creates an incentive to relocate energy-intensive manufacturing to this side of the Atlantic. The Wall Street Journal reports this is starting to happen.

“While the US economy is facing record inflation, supply-chain bottlenecks and fears of a slowdown, analysts say, it has emerged relatively strong from the pandemic as China continues to enforce Covid lockdowns and Europe is destabilized by war. New spending by Washington on infrastructure, microchips and green-energy projects has heightened the US’s business appeal.

“Danish jewelry company Pandora A/S and German auto maker Volkswagen AG announced US expansions earlier this year. Last week, The Wall Street Journal reported Tesla Inc. is pausing its plans to make battery cells in Germany as it looks at qualifying for tax credits under the Inflation Reduction Act signed by President Biden in August.

“Europe remains a desirable market for advanced manufacturing and boasts a skilled industrial workforce, analysts and investors say. With pent-up demand from the pandemic, many companies that have seen exploding energy prices in recent months have passed them on to customers. The question is how long the higher natural-gas prices will last.

“Some economists have warned that natural-gas producers from Canada to the US and Qatar may struggle to fully replace Russia as a supplier for Europe in the medium term. If so, the continent could face high prices, at least for gas, well into 2024, threatening to make the scarring on Europe’s manufacturing sector permanent.”

Energy prices aren’t the only factor, either. The US government is starting to offer the kind of industrial subsidies and tax incentives that European countries once featured but perhaps can no longer afford. While this is problematic from a budget perspective, it changes the math for business decisions. Experts quoted in the WSJ piece think more of Europe’s manufacturing will move to the US if energy prices don’t come back down within a year or two.

This trend has giant implications if it continues, on everything from trade deficits to currency flows and fiscal stability. Stay tuned.

No Soft Landing

After this week’s Fed action, I continue to think Jerome Powell is quite serious about controlling inflation. I hope they don’t lose that focus too soon. Last week Ray Dalio noted this could take a long time because, for now, US households have enough cash to sustain spending. Here’s a surprising chart.

Source: Full Stack Economics

Focus on the blue line: the change in checking account balances since 2019 for the lower 25% income quartile. Even after a year of inflation, the poorest group still has more than 50% cash in the bank than it did before COVID. In percentage terms, their lot improved even more than the top quintile.

That’s good news for them; the combination of three stimulus packages plus higher wages seems to have put them in a much better financial position. But to fight inflation, the Fed needs to reduce aggregate demand. That’s harder when people have cash in their pockets and their wages are higher than ever and still rising.

Fed officials would like to stomp inflation without generating much pain. The problem is that the pain is what makes people change the behaviors that are sustaining demand, and therefore inflation. This is why I think “soft landing” is a pipe dream. We are not going to make this omelet without breaking some eggs.

Even Powell seems to be realizing this. He said in his news conference last week, "We have got to get inflation behind us. I wish there were a painless way to do that. There isn't."

“This Is Normal Now”

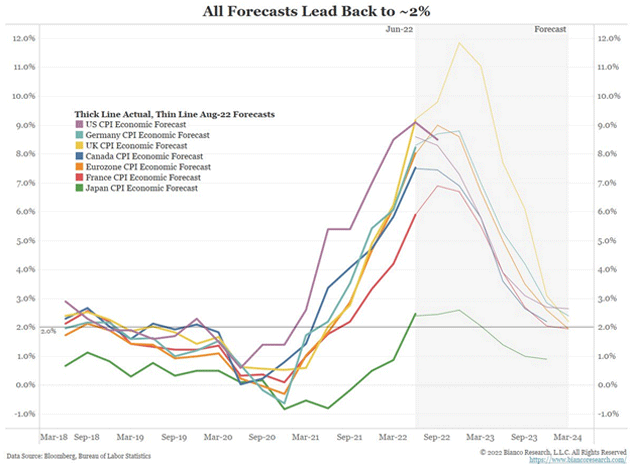

My friend Jim Bianco posted this short Twitter thread last Wednesday (before the FOMC news) which I think is exactly right. He says it so succinctly, I will just quote the whole thing.

“As we await the Fed, and the BoE tomorrow. Let me remind you what the weakest assumption is in the market.

“That this inflation is a one-time rise because of the shutdowns/reopening and will go away, FOR GOOD, in 18 to 24 months.

“Everyone thinks this, as this chart shows.

“Then we can return to 0%, with more printing, and soaring mkt indices (aka, FOMO/TINA).

[JM note: That means Fear of Missing Out/There Is No Alternative]“I have argued that this is a ‘post-pandemic economy’ and that what drove inflation to 2% and stay there for decades was ‘cheap labor, cheap goods, [via China and many emerging markets] and cheap energy’ (mainly via Russia).

“All these eras ended and we are now in an era of ‘persistent inflation.’

“Only when we recognize this is a new era and get about restructuring the economy can we return to low stable inflation again. This will take many years and trillions of dollars.

“But we are not starting this restructuring. Instead, we would rather argue whether this is a post-pandemic at all and prefer to ask when the economy is ‘returning to normal.’

“This is normal now!”

Inflation may improve at times. I think we’ll see waves where it gets better and worse. The point is we aren’t going back to the halcyon days of 1% and 2% inflation for years on end. That was never normal in our current monetary policy environment. Now it’s over.

Worse, this normalization process—what Jim Bianco calls “restructuring the economy”—is unlikely to go smoothly. It will more likely trigger problems and crises we haven’t yet imagined.

What Will Jerome Do?

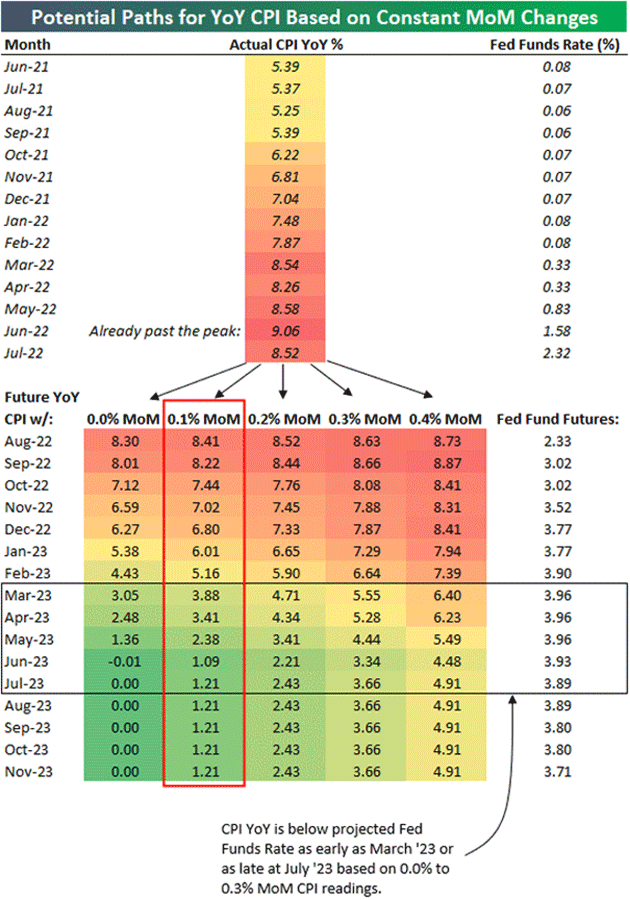

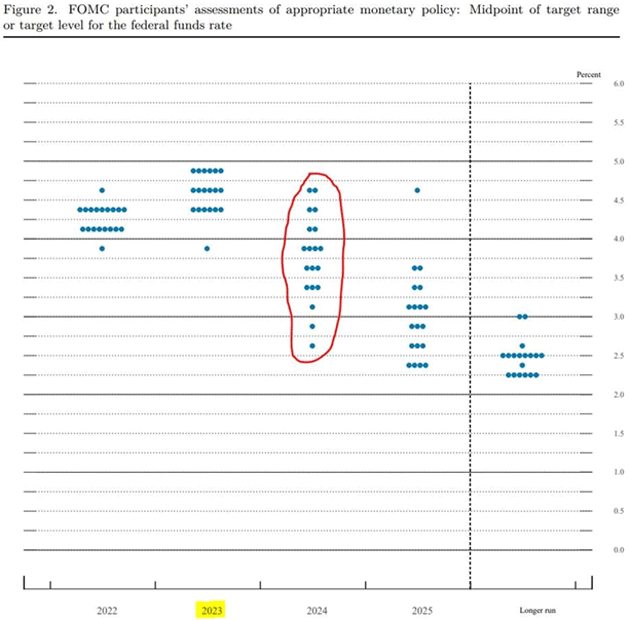

As noted above, the upper bound on the fed funds rate is now 3.25%. Powell said in his press conference the real debate at the FOMC was whether to raise rates 1% or 1.25% by the end of the year. The dot plots indicate the FOMC is split down the middle over that decision. So, the upper bound as we approach 2023 will either be 4.25% or 4.5%, to be followed by a few smaller hikes. The FOMC appears to assume it will be cutting rates later in 2023 and certainly in 2024. While they are willing to bring rates back to a “two handle” in 2025, there doesn’t seem to be any appetite to approach the zero bound. At least not now.

The Fed’s assumption seems to be that inflation will be under control later next year. You know what they say about assuming things, right? I highlighted this table last week that I want to bring back again because it is important.

This chart is from Bespoke Investment Group. Last month, inflation increased 0.1%. Bespoke shows that if inflation keeps increasing 0.1% a month, it will be March before yearly inflation drops below 4%—and May before it has a 2% handle. If inflation was absolutely zero, then by March we would be in an area where Powell might indeed think about pausing.

Absent some complete collapse of the economy in the fourth quarter, inflation is still likely to be 6% in December, with the fed funds rate at (or very close to) 4.5%. Given how high inflation will be, it is quite reasonable to project a future 5% fed funds rate.

Here is the Fed’s economic forecast.

Let me quote from my friend Sam Rines of CORBU.

“A 4.4% unemployment rate, a real GDP growth rate of 1.2% (4% nominal), and inflation at 2.8%? What unicorn metaverse do these projections live in? The FOMC left room to become far more hawkish at coming meetings. If needed, the FOMC can simply raise the unemployment rate projection—dramatically.

Project a >5% [unemployment] rate, and—maybe—it is believable. But 4.4%? Not buying it.”

Sam goes on to highlight part of the dot plot.

“The 2023 dots were used to kill any narrative of a pivot. The dispersion of the 2024 dots is an indication of the wild uncertainty around the conduct of monetary policy.

“Until the FOMC sees ‘tears in inflations eyes,’ there will be no meaningful transition from the current hawkish stance.”

I believe the Fed will eventually raise the policy rate to 5% and is willing to accept 5% unemployment (which not many decades ago was considered not so bad). They are going to keep raising rates until inflation is under control. That is not stock or bond market friendly. Or housing or any of a dozen market sectors.

The market has 4.5% and a pause before the Fed cuts as it has obviously forecasted. When it becomes clear that a 5% fed funds rate is a real possibility, what do you think will happen? The Fed is not going to stop until they break something, namely the back of inflation.

We are going to get a recession, and recessions always bring bear markets. I don’t think we are anywhere close to a market bottom. That is certainly what the seriously inverted yield curve is telling us. Remember, yield curves are like fevers. A fever doesn’t tell us what is wrong, just that something is.

Normally, an inverted yield curve means recession is roughly 12 months away. The yield curve has been inverted for quite some time. I think that perhaps the zero-rate bound is messing with the yield curve timing. At best, GDP will be flat for the third quarter. So far it has been a mild recession. More of a statistical anomaly. Going forward I think that is going to change as higher interest rates filter through the economy and unemployment rises.

The world will be going from an era of zero rates and loose monetary policy to higher rates and likely slower growth, except in certain sectors. Adjusting to this change will be both problematic and also full of potential opportunities. Broad-based adjustments always present opportunities because everybody is facing the same problems you are, and if you figure out a better way? Opportunity… and challenges.

Fiona and Floods

Prior to last week, I knew Fiona only as Shrek’s girlfriend in the animated movies. The current version has been far more devastating. The wind wasn’t so bad, but Fiona decided to basically camp on top of Puerto Rico for two days, dumping 24 inches of rain in less than 36 hours on the south side and 15‒18 inches here in the north. Every river flooded (and Puerto Rico has a lot of them).

As of Friday morning, 90% of the island still doesn’t have electricity though that is supposed to change soon. We just got our water back on this morning (I learned our 600-gallon cistern was not enough, or perhaps we didn’t conserve properly). Thousands of homes have been flooded and roads destroyed. Whole towns have been cut off as bridges collapsed.

Recovery is underway. We're taking in some guests as we have power. Many stores have opened, and people are going back to their routines as much as possible. Puerto Ricans are a resilient and happy people. Thanks to all who called or wrote to ask about us. Shane and I appreciate it.

And with that I will hit the send button. Thank you for following me on Twitter. I reached 50,000 followers this last week.