by Tony DeSpirito, Managing Director, Fundamental Active Equity Investment Team, Blackrock

Balancing acts. As the Fed walks the line between curbing inflation and averting recession, anxious investors are seeking to balance the two risks. Amid the uncertainty, we believe stock selection matters more. As Q4 begins, we see:

- Heightened volatility as inflation seeks a landing spot

- A continued case for value as the economic cycle evolves

- Attractive opportunity in select growth stocks

Market overview and outlook

Inflation peaks and market rallies often go hand in hand. Since 1927, the average S&P 500 return in the 12 months following an inflation crest was 11.5%, as shown in the chart below. June’s Consumer Price Index (CPI) reading of 9.1% may well have marked the high for this cycle, and we saw a relief rally in equities in anticipation of July’s lower figure. But a peak in inflation does not mean a return to the low-rate environment we saw post the Global Financial Crisis (GFC).

The question now is how fast can inflation fall and where does it come to rest? We don’t see a quick retrenchment or a return to the once familiar 2%, keeping the Fed in hiking mode. This implies more volatility and a need for caution and balance in equity allocations.

Macro dislocations and portfolio allocations

Macro dislocations and portfolio allocations

As the Fed aims to tame inflation without sending the U.S. economy into a deep recession, equity investors are grappling with their own balancing act ― how to factor competing risks into their portfolios. We believe the answer is to own both growth and value stocks.

A time for growth and value

Value stocks have a history of outperforming growth amid high (4.5% and above) and even moderate (1.1%-4.4%) inflation, based on our analysis of data back to 1927. We see inflation contracting slowly and settling above the roughly 2% level seen in the prior 10 years, a still supportive backdrop for value.

Meanwhile, recession is a growing risk as the Fed remains laser focused on combating inflation through higher rates, which crimp economic growth. In this scenario, growth stocks typically have a performance edge given their potential to outpace the slow-growing macro environment.

Without making a call for one style over the other, we do see a compelling case for a combination of the two.

Besting the broad market

Owning the broad market can work when the coast is relatively clear and a rising tide is lifting all boats. But we’re not in that environment today. We believe the complexities of the current backdrop argue for a selective approach, and one that favors the two ends of the spectrum ― growth and value ― versus the stocks in between that hew more closely to market averages.

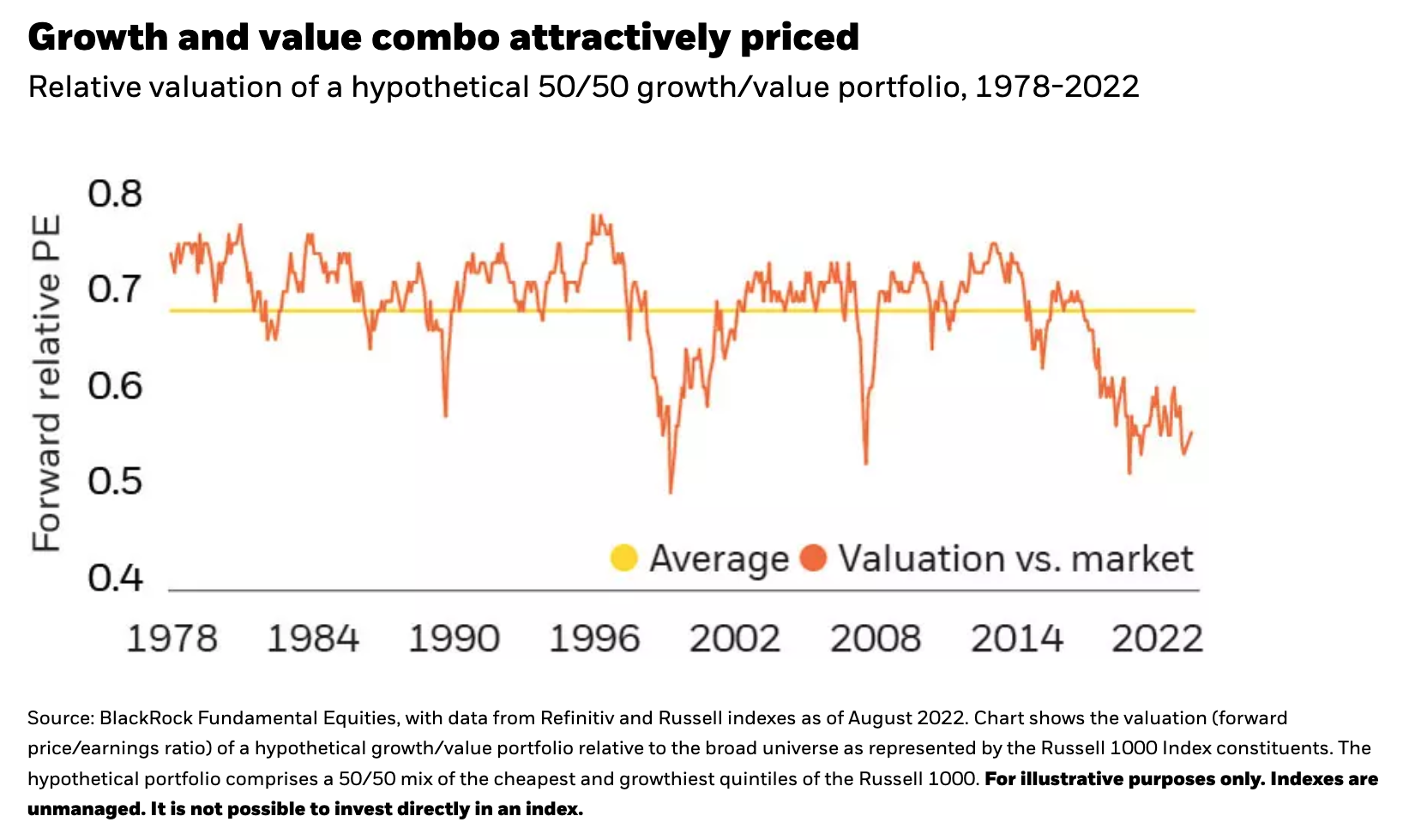

To test our view, we looked at a hypothetical portfolio comprising a 50/50 mix of the top quintiles of value and growth in the Russell 1000 Index. Pricing was attractive: We found the hypothetical portfolio to trade at a meaningful discount to the broad market today, as shown in the chart below. As expected, all names in the value bucket were cheaper than the market median, as were nearly a quarter of the highest-growth stocks. The thesis bore out for the top two quintiles in each category as well.

Performance also was compelling: The hypothetical portfolio outperformed the broad market in the 12 months following four of the six inflation peaks we studied from 1978.

We also see a diversification benefit to a well-constructed hybrid portfolio when you consider that index concentration is very high today. Data from Refinitiv shows the top-five companies in the Russell 1000 represented 18.5% of the index’s total weight as of Aug. 31, thereby driving an outsized share of index performance. Top-five leadership has been elevated since 2020 and touched an all-time high of 19.8% in August of that year.

Be choosy; choose quality

We believe a stock-by-stock approach is important today, even in the growth/value scenario described above. Our analysis found enhanced results when using 12-month-forward analysis, meaning investors with the skill to accurately forecast companies’ future earnings growth rates and position accordingly had potential for greater outperformance.

The ongoing transition in the economy and markets is likely to be bumpy. At this early stage, with inflation just having peaked, investors may be overestimating the speed at which shorter-term dislocations in the economy can normalize (e.g., strong employment alongside high inflation) and underestimating the magnitude and duration of the longer-lasting components of inflation (e.g., wages and shelter costs). Further confirmation of an easing in headline CPI could be supportive of equity markets in the near term, but we are watching company earnings for signs of stress as Fed rate hikes impact the real economy with a lag.

Businesses, whether priced as value or growth, will weather this chapter in history with varying degrees of success. This reinforces the need for selectivity and further argues for a focus on companies with quality characteristics ― particularly strong balance sheets and healthy free cash flow to offer a buffer in the case of a slowdown or profit squeeze. Quality stocks continue to be priced at a discount to the market and, we believe, have potential to outperform as investors look to enhance portfolio resilience amid the prevailing uncertainty.

“

Today’s market is complicated ― it’s full of risks and rewards. We believe active stock selection can add real value here.

”

Maintaining a long-term lens

Uncertainty is high and daily volatility can test investors’ fortitude. We believe these are the moments when active, fundamental-based stock selection and thoughtful portfolio construction can provide a measure of solace and have a profound impact in the pursuit of long-term financial goals.

Tony DeSpirito, BlackRock Fundamental Active Equity Investment Team

Antonio (Tony) DeSpirito, Managing Director, is Chief Investment Officer, U.S. Fundamental Equities. In addition, he is head of the U.S. Income & Value Team ...