by Michael Rosborough, Portfolio Manager—Global Multi-Sector, Nicholas Sanders, CFA, Portfolio Manager—Global Multi-Sector, Ronit Walny, Head—Fixed Income Business Development, Multi-Sector; Head—Investment Innovation Center, AllianceBernstein

With inflation dominating the global landscape, asset-class diversification has been fleeting. It’s tempting for US investors to focus on their home-field yield advantage and forego opportunities abroad, but we believe that by expanding the fixed-income opportunity set globally, investors can capture some much-needed diversification, while still enjoying attractive yields.

Below are three key reasons why we think US investors should embrace the global bond market today.

1. Today’s diverging growth and policy scenarios widen global opportunities to add alpha.

Inflation is a global phenomenon. But, while the global outlook appears stormy, specific conditions and policy aggressiveness vary country by country. Central banks across the developed world differ in their ability to maneuver, their impact on local economies and their effectiveness in combatting inflation. The US Fed, for example, moved earlier and more aggressively than other central banks, having more maneuverability given its strong economic starting point.

In contrast, the EU inflation picture is bleaker. Energy prices are soaring, and inflation-fighting efforts are creating a much larger economic dent, making a recession almost inevitable. China continues to experience COVID-19 related disruptions, while Japan may unwind its yield-curve control policy. In Canada and Australia, where home mortgages roll every five years, policy response is more amplified than in the US, which has a 30-year loan standard.

Such diverging growth and inflation regimes create opportunities for investors to differentiate and add new sources of alpha.

For example, we like longer-term German Bunds. As the ECB accelerates its inflation fight, we expect it to drive the European economy into recession and flatten the yield curve further, with longer-maturity Bunds outperforming. Meanwhile, in Australia, the housing market is especially sensitive to rising interest rates due to the large number of floating-rate mortgages. So, we expect Australian government bonds to outperform others, including US Treasuries.

In contrast, we’re cautious on the UK market, where a large fiscal expansion to cap energy prices is likely to limit inflation’s impact on consumers’ purchasing power, keeping inflation aloft. The weakening pound also enhances inflation concerns for the Bank of England. Japan needs scrutiny as well, as diverging rates significantly weaken the yen and could pressure embedded caps on yields from its yield-curve control policy.

2. The global bond market is less volatile and supplies bigger diversification benefits than the US bond market—especially in today’s environment.

The global bond universe is much larger and more diverse than the US bond market. Not only does it offer more opportunities from which an active manager can choose, but its differing landscapes provide significant variety and diversification sources.

Bond returns differ greatly country by country and year to year because of varying economic cycles, monetary cycles, business cycles, inflation regimes, geopolitical concerns and yield curves. Today this is even more evident as countries like China pursue a more accommodative stance, while the UK is combatting very high inflation at the expense of long-term growth.

Sector returns also vary across countries and regions. For instance, manufacturers in the US are responding to a different environment than those in Europe, including labor availability and electricity costs and supply. More broadly, the deglobalization super trend makes it important to diversify regionally.

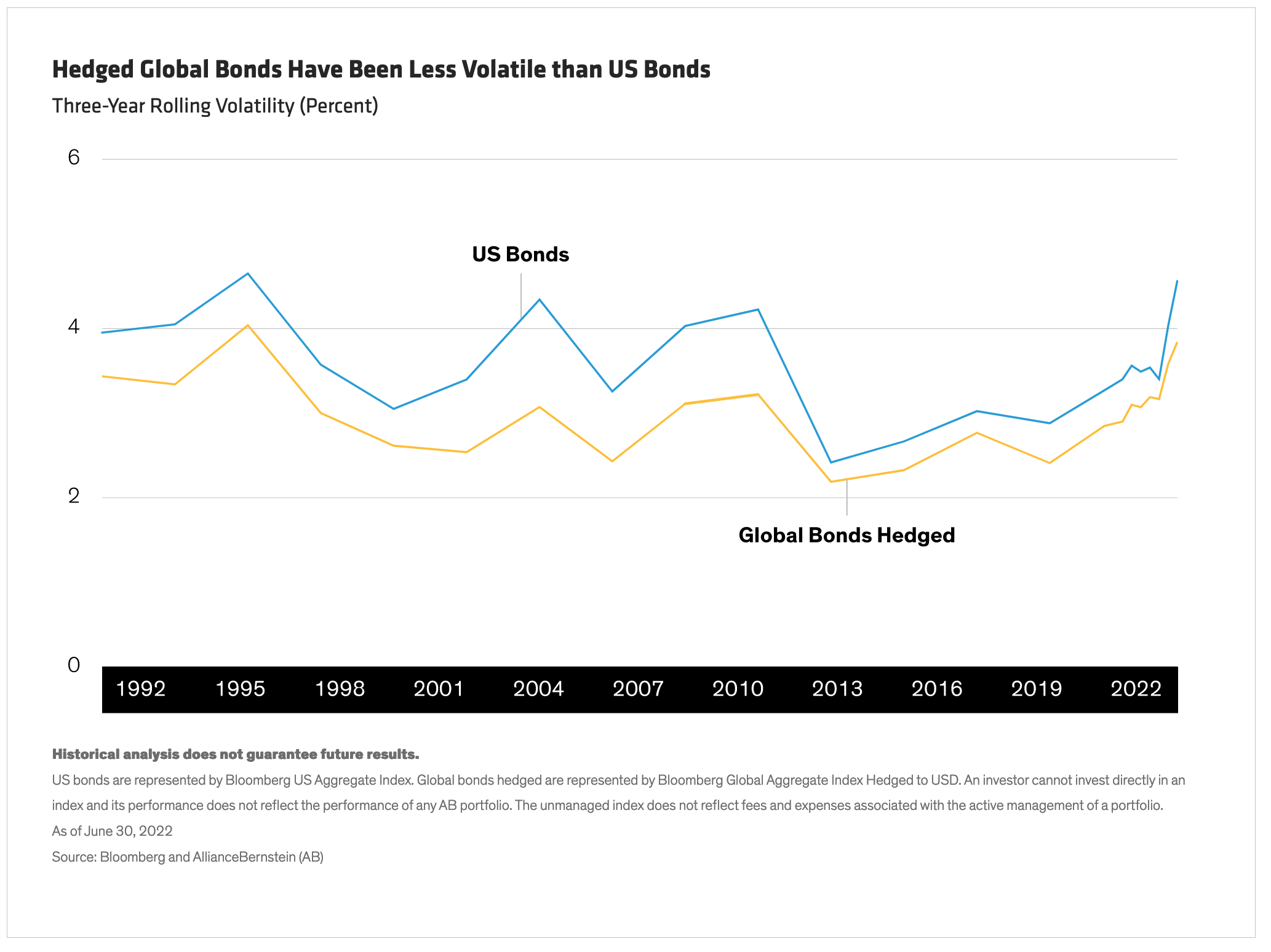

Historically, the hedged global bond market has generated higher returns with less volatility than the US bond market. For example, over the 30 years ending June 30, 2022, the Bloomberg Global Aggregate Index (hedged into US dollars) posted an average annualized return of 5.0%, versus 4.8% for the Bloomberg US Aggregate Index. And it did so with less volatility (Display). The divergence was even more acute this year, as the global bond market outperformed the US bond market by more than 1.5% through August.

That’s not all. Both the US and global bond markets provide a nice offset to the volatility of US stocks. Between February 1985 and July 2020, the US bond market and hedged global bond market both averaged very low correlations to the S&P 500, at 0.16 and 0.15, respectively.

But the real power in global bonds comes during extreme down periods for stock markets. During months when US stocks fell by more than one standard deviation, US bonds saw correlations to the S&P 500 fall to –0.10, while the correlations of hedged global bonds to stocks fell to –0.17.

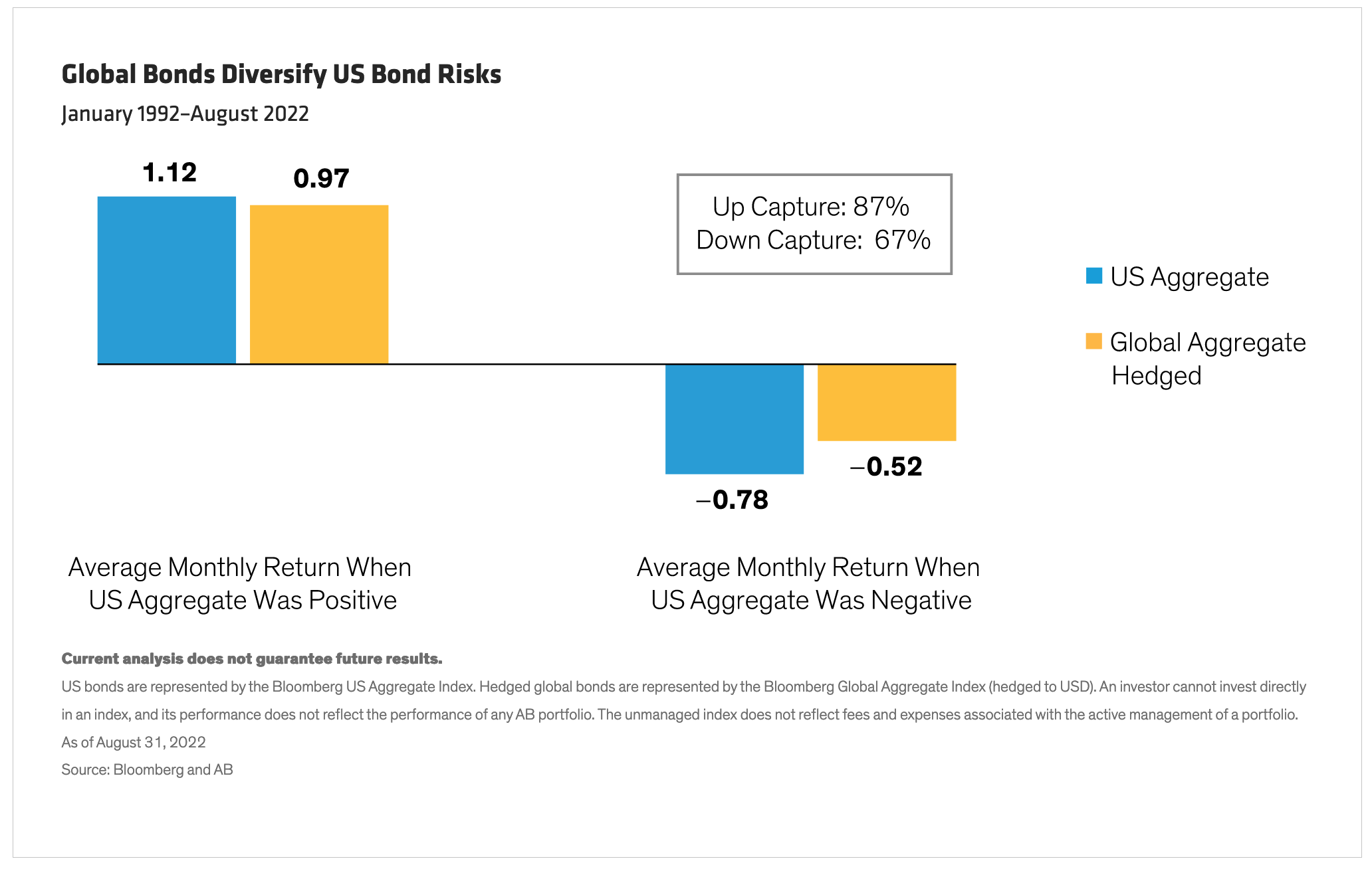

Lastly, bond investors didn’t miss out on US bond market rallies by investing in global markets. But they also didn’t concede as much when US bond markets fell. In other words, global bonds have historically provided attractive up/down capture ratios versus the US bond market (Display).

Since 1992, during months when US bonds rallied, hedged global bonds captured 87% of positive returns. Conversely, when US bonds sold off, hedged global bonds preserved more capital, experiencing just 67% of that downturn.

3. Hedging into US dollars can boost low yields.

Why invest globally when so much of the global government bond market is trading with lower yields? Because, depending on the differences between countries’ short-term interest rates, currency hedging can either raise or lower a bond’s yield.

Hedging can be implemented cheaply and effectively with currency forwards and futures. In fact, the currency forward markets are among the most liquid markets in the world, making transaction costs very small.

Hedging foreign currency back into US dollars accomplishes two things. First, it lowers the volatility of a global bond portfolio while preserving global bonds’ diversification benefits. Second, in today’s markets, the currency hedge leads to higher yields (Display).

In fact, after accounting for the yield pickup from hedging back to the US dollar, the yields of the Bloomberg US Aggregate and Bloomberg Global Aggregate bond indices become comparable. Today, on a hedged basis, nearly all non-US government bonds provide higher yields than the US. For example, at the end of August, currency hedging into US dollars lifted the low-yielding German Bund yield from 1.5% to 4.0%—77 basis points above the 10-year US Treasury yield. The key is actively managing these exposures because hedging relationships change.

In short, active investors should keep the full range of global bond options on the table—and stay nimble to take advantage—especially in today’s environment. Given its return, volatility and diversification advantages and its unique opportunities for adding alpha, we think an allocation to global bonds makes sense.

The authors wish to thank Stephen Zurlo, Product Analyst—Fixed Income, for his contribution to this blog.

About the Authors

Michael Rosborough

Michael Rosborough is a Senior Vice President and Portfolio Manager on the Fixed Income team at AB, primarily focusing on Global Multi-Sector Strategies. He started his investment career in 1985. Prior to joining AB in 2020, Rosborough was an investment director at California Public Employees' Retirement System (CalPERS) in the Trust Level Portfolio Management (TLPM) division, focused primarily on strategic asset-allocation, proprietary portfolio management and benchmarking issues across the fund. Before moving to TLPM in 2019, he was a senior portfolio manager in the Global Fixed Income unit, where he was in charge of the fund's international, emerging markets, and inflation-linked fixed-income investments and the commodities program, collectively comprising over $37 billion in assets under management. Rosborough also served as a member of the CalPERS Portfolio Allocation Committee, advising the CIO on tactical asset-allocation issues. As part of his fixed-income duties, he also oversaw management of the CalPERS foreign exchange management activity. Prior to joining CalPERS, Rosborough worked in London as an investment strategist and proprietary trader for Citigroup and CIBC World Markets. In 2000, he joined Moore Capital Management, a New York-based hedge fund, as a portfolio manager in the fixed-income fund. In 1994, Rosborough joined PIMCO in Newport Beach, California, as a portfolio manager, founding the firm's emerging markets fixed-income practice after co-heading its international department. He began his career with RBC Capital Markets in Toronto, first as a trader, and later heading its Asian fixed-income sales and trading group in Tokyo. Rosborough holds a BA (Hons) in economics from the University of British Columbia, where he was awarded a Mackenzie King Scholarship, an MSc in economics from the London School of Economics and Political Science, and an MBA from Harvard Business School, where he graduated with distinction. Location: New York

Nicholas Sanders, CFA

Nicholas Sanders is a Vice President and Portfolio Manager at AB, and a member of the Global Fixed Income, Absolute Return, UK Fixed Income and Euro Fixed Income portfolio-management teams. Since 2013, he has been responsible for the analysis of sovereign and other liquid markets globally, with a focus on the European market. Prior to that, he worked as an associate portfolio manager on the Asian Fixed Income team, where he was responsible for analysis of and trade execution for local and global fixed-income markets. Sanders joined AB in 2006, and served as team leader of Servicing & Controls within the Australian & New Zealand Operations Group. Before joining the firm, he worked in both Australia and London as a pricing and valuation analyst. Sanders holds a BBus in economics and finance from the Royal Melbourne Institute of Technology (RMIT) and is a CFA charterholder. Location: London

Ronit Walny

Ronit Walny is Head of Fixed Income Business Development, Multi-Sector, leading the team of global multi-sector, rates, emerging markets and regional strategies (Asia, Europe, Canada) fixed-income product experts. She is also Head of the Investment Innovation Center at AB, which is focused on incubating new and transformative investment solutions, including investment opportunities and operational efficiencies leveraging the blockchain technology and the digital asset ecosystem. Prior to joining the firm in 2019, Walny worked in various roles focused on building, managing and growing impactful investment solutions across the investment-management industry. As a product manager, she held roles at PIMCO and MacroMarkets. Walny also has over a decade of portfolio-management, trading and market-making experience, spanning the fixed-income, inflation and commodity markets at firms including Neuberger Berman, Kellogg Capital and Northern Trust. She began her career in finance in 1994 in the eurodollar and bond option trading pits. Walny holds a BBA in finance from Loyola University Chicago and is a CFA charterholder. Location: Nashville

Copyright © AllianceBernsteinalli