by Caglasu Altunkopru, Head of Macro Strategy—Multi-Asset Solutions, Aditya Monappa, CFA, Global Head—Multi-Asset Business Development, AllianceBernstein

With inflation still near 40-year highs, multi-asset investors continue to grapple with an exceptional macro backdrop. Higher-for-longer global inflation in the wake of the COVID-19 pandemic and the Russia-Ukraine war has eroded consumer confidence and triggered strong central bank responses.

Although consumers are benefiting from robust labor markets and strong balance sheets, they appear reluctant to buy high-cost durable goods. Moreover, the spike in energy prices alone has likely siphoned about 1% from personal consumption. Housing markets have started to cool, with mortgage-rate spikes further eroding affordability. Uncertainty about the path of interest-rate hikes and the degree of economic slowdown needed to cool inflation has dented corporate confidence and elevated market volatility.

Given this landscape, the path of inflation from current high levels can have a big impact on both the economic backdrop and capital markets. If inflation cools, it can free up disposable income and improve visibility around financial conditions. Conversely, further upside inflation surprises will likely mean more economic damage.

Emerging Evidence of an Inflation Peak, but Still Near Historical Highs

Recent signs of inflation relief are giving markets some confidence that central bank policy can be effective and are reducing concerns about tail risks along the rate-hike path. Commodity prices seem to have peaked, and broader supply-demand imbalances that raised the cost of goods in the pandemic’s aftermath continue to improve.

Meanwhile, economic growth has slowed substantially from its post-pandemic highs. Key activity data, such as the OECD composite leading indicator and the Purchasing Managers’ Index, now point to below-trend and slowing growth. Among the key contributors to the slowdown are fading of pent-up post-COVID-19 demand, tighter monetary policy, and deteriorating consumer and corporate confidence. Below-trend growth should help support a lower inflation trajectory, though we expect the growth slowdown to remain relatively shallow, barring surprises in monetary tightening.

Inflation’s path will likely be a major driver of asset-class performance going forward, so multi-asset investors should monitor changing signals as they maneuver this challenging period.

To Defend Against Inflation, Start Where You’re Most Vulnerable

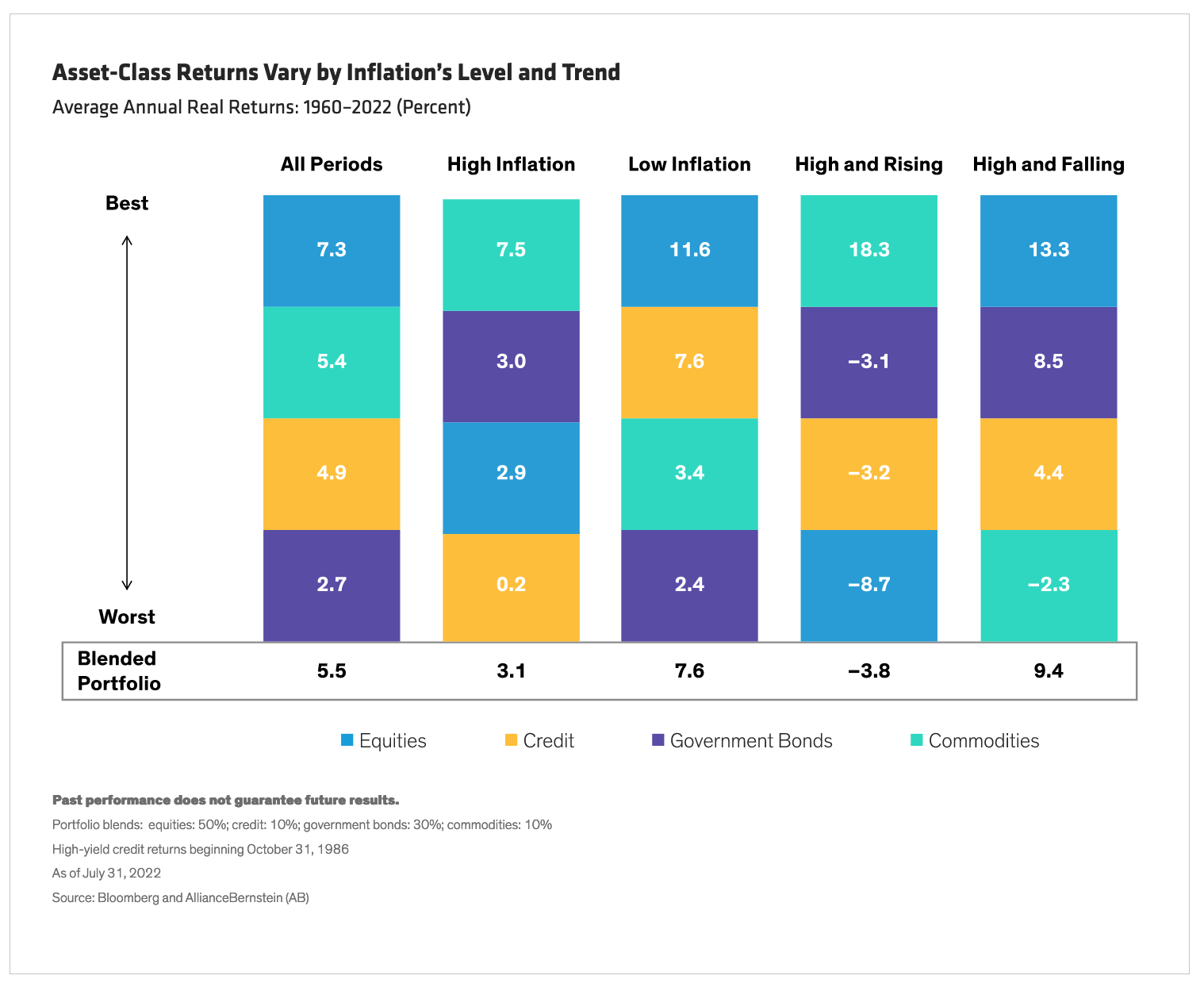

A key to navigating inflation risk is understanding its relationship with asset-class returns. Historically, high-inflation episodes posed a significant headwind for asset-class performance. Rapidly rising prices impair real—or inflation-adjusted—returns, leaving investors with few places to hide. As a result, real returns for key asset classes (equities, government bonds and corporate credit) have all been below average in high-inflation settings, with only commodities generating above-average returns (Display).

In fact, since 1960, the average annual real return for a blended portfolio of stocks, corporate bonds, commodities and US Treasuries was 5.5% across all periods, but only 3.1% in periods when inflation exceeded the 3.1% historical average.

In periods when it’s been high, inflation’s trend has mattered as much as its level. When inflation was high and rising, equities, credit and US Treasuries all posted negative real returns. In these environments, markets price in future interest-rate hikes, resulting in rising sovereign yields, which have generally hurt bond returns. Rising yields also weigh on growth prospects, resulting in subpar equity performance. Investors tend to gravitate to real assets such as commodities, which have been effective inflation defenders when used selectively.

Moreover, equities and fixed income tend to track each other more closely when inflation is high and rising, reducing the traditional diversification benefits from bonds.

The reverse has been true in high-and-falling inflation periods, with equities, government bonds and credit all posting strong positive real returns (double-digit performance for equities). Falling inflation enables monetary policy to become less restrictive—making bonds more attractive—while yields fall. Lower yields help bolster growth prospects, which supports equities. Credit typically benefited from both falling rates and declining credit spreads. Commodities, meanwhile, tended to generate negative real returns during high-and-falling inflation periods.

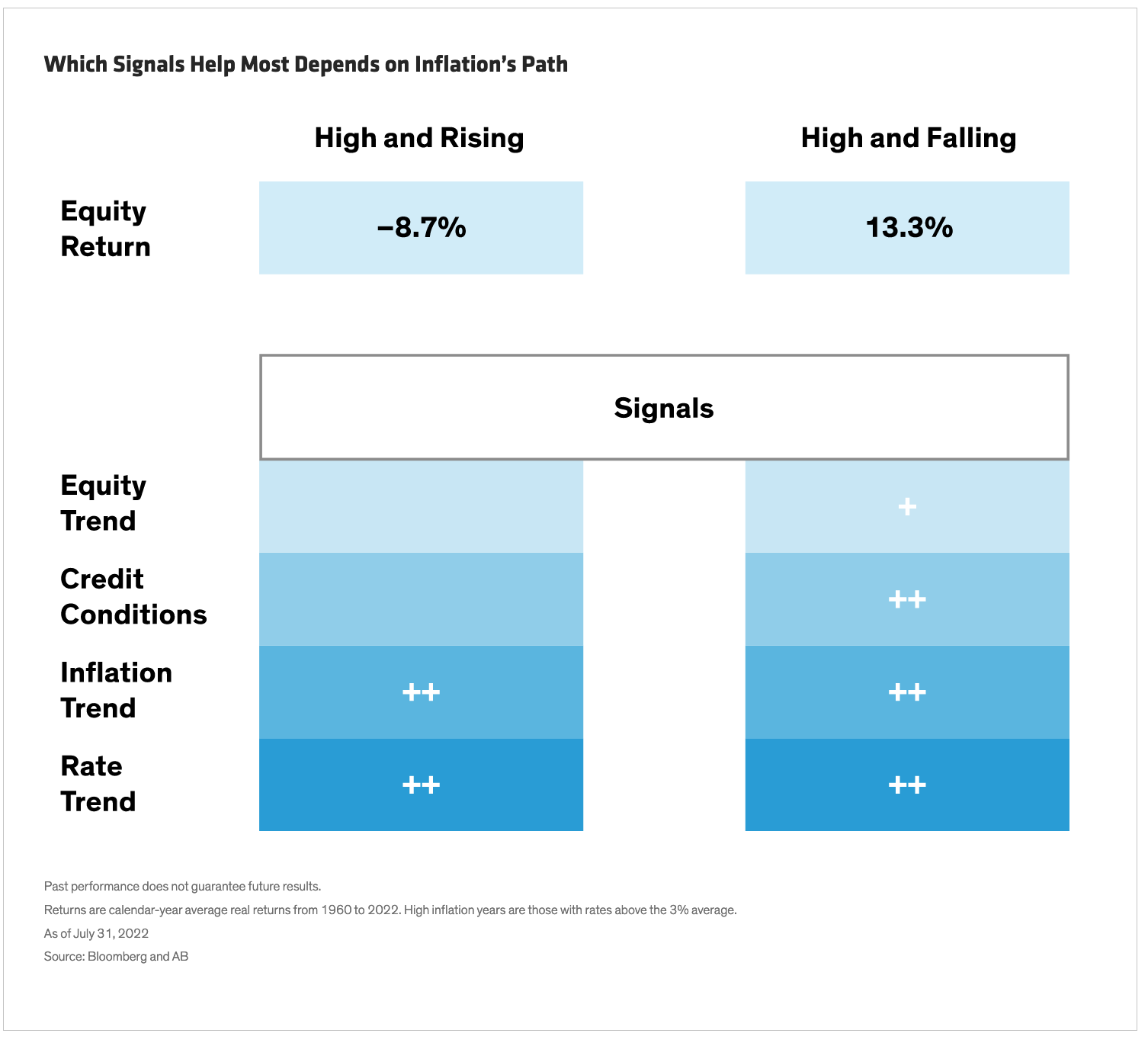

Systematic signals also help multi-asset investors adapt equity allocations as inflation trends evolve. Consistent with our observations above, the inflection in inflation trends has been the most effective indicator in timing equity exposure, along with yield (rate) trends, which can help confirm the inflation signal. The equity trend and credit conditions have been somewhat less effective indicators compared with inflation signals, considering that inflation signals are the most directly linked to the overall inflation backdrop (Display).

What’s Next for Inflation: A Battle Between Two Forces

Approaching the last quarter of 2022, we’re assessing a variety of short- and long-term crosscurrents for insights on where inflation is headed.

Supply-demand imbalances, which have been a key contributor to today’s high-inflation environment, are showing signs of improvement. The consumption mix between goods and services has been reverting to normal, logistics pressures have been easing, and inventories and backlogs are closer to historical levels.

Another, more idiosyncratic driver of high inflation has been the commodity-price shock from the Russia-Ukraine war. As the conflict continues, a potential natural-gas supply disruption is looming over Europe. However, global supply is starting to adjust through alternative sourcing of fossil fuels, rerouting of Russian supplies, accelerated adoption of renewables. Countries are also ramping up conservation efforts. As a result, commodity prices are now about 15% below their June 2022 peak.

Global tightening of fiscal and monetary policy should clearly accelerate the process of inflation normalization. Even though inflation has climbed to multi-decade highs, inflation expectations have not substantially dislocated, which speaks highly of continued central bank credibility.

Further out, new technology adoption accelerated by the COVID-19 crisis should continue to help ramp up productivity and production, lowering costs over the long term. Deglobalization could intensify costly trade wars, but it’s too early to tell the extent of the impact. It’s also not yet clear whether the adjustment will happen through reshoring (returning supply chains to home countries) or friend-shoring (shifting supply chains to friendly nations).

If inflation gradually decelerates over the next several quarters, it will likely prove to be a tailwind to risk assets. Below-trend economic growth should help ease supply-demand imbalances, and we’ll monitor the next round of inflation reports, which may confirm an inflection point.

Companies on Solid Ground, but See Bumps Ahead

Recent corporate reports offer some reinforcement of post-pandemic normalization themes: the consumption mix is rebalancing, inventories are catching up to sales, and employment gaps are narrowing. Yet more companies express worry over macro uncertainty.

Many firms are reporting intentions to slow new hiring, but labor markets have remained strong. US payrolls are roughly in line with pre-pandemic levels, despite real output levels rebounding to 3% above pre-COVID levels. Given high margins, companies may be willing and able to “hoard” labor.

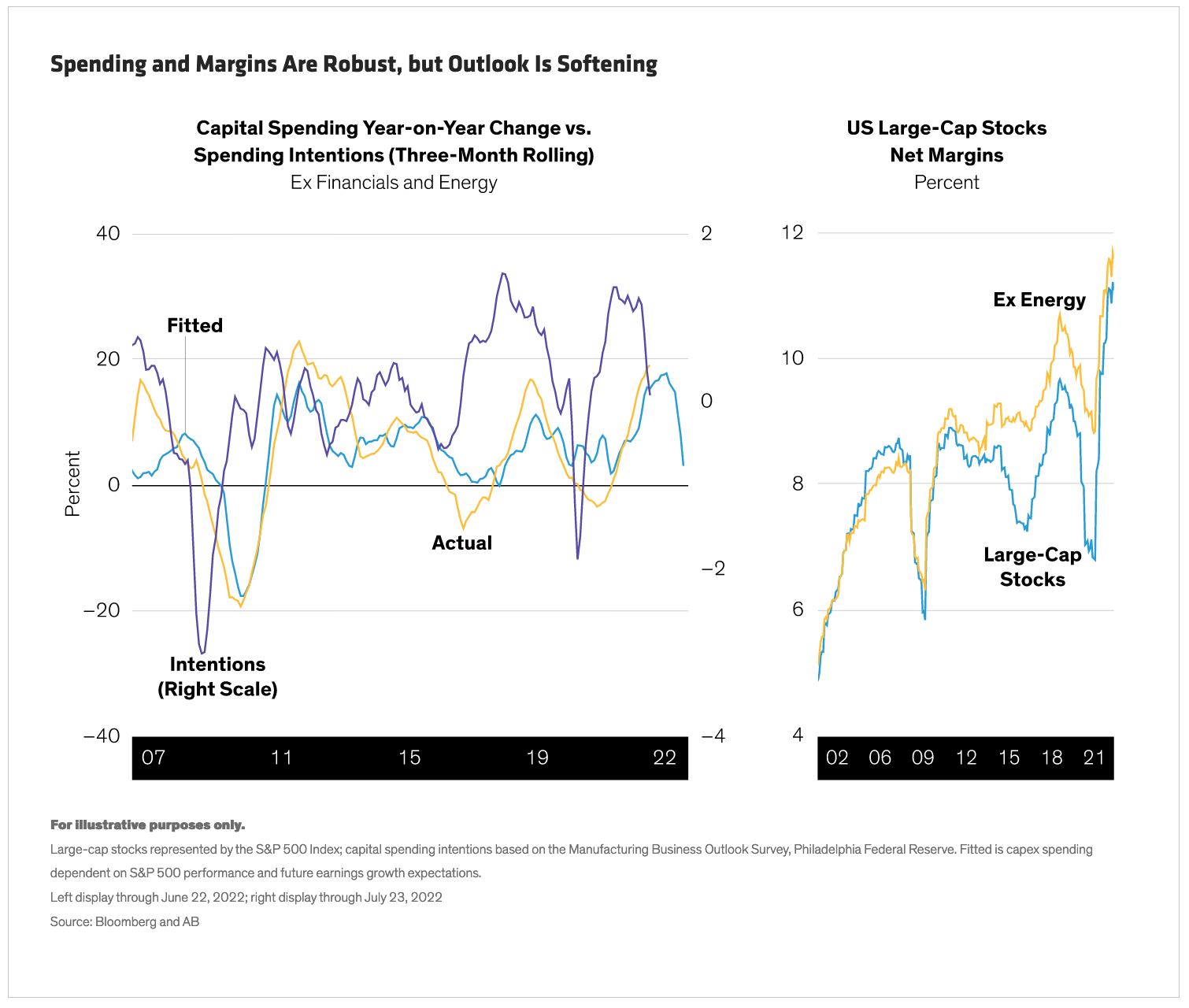

Capital spending intentions—a leading indicator of expected business investment—suggest that investment growth is likely to slow from current levels (Display, left). Still, we observe a lack of excess across corporate investment and employment, which could indicate limited downside to activity, barring extreme policy outcomes.

Corporate profit margins remain well above pre-pandemic levels, raising concerns about margin sustainability (Display, right), though patterns vary by sector. Energy and auto profit margins, for example, are well above historical levels, but consumer cyclicals still have room to improve before they return to pre-pandemic levels. As commodity prices peak, we could see energy sector margins roll over while consumer goods margins improve. Housing is showing some cracks, but homebuilders may be willing to yield somewhat on recent price gains, given that margins are high versus history and supply remains tight.

We’ll continue to balance inflation risks relative to changes in the business cycle and seek confirmation that inflation has peaked. Given the likely transition to a high-and-falling inflation regime, we think it makes sense to reduce underweight exposure to equity and duration. In our view, a near-neutral asset allocation is warranted. Global sovereign bonds have now priced in significant expected rate hikes beyond those already implemented. Long commodity exposure, on the other hand, looks much less appealing now, given slowing growth, adjustments in supply and potential for a shift in inflation regime.

There are signs that inflation may be easing in spots, and the jury is still out on whether a full-blown recession is inevitable. An effective inflation-resilient multi-asset strategy, in our view, requires tapping into a broad range of asset classes and the agility to shift tactically as conditions rapidly evolve.

About the Authors Caglasu Altunkopru

Caglasu Altunkopru

Caglasu Altunkopru is Head of Macro Strategy in the Multi-Asset Solutions Group at AB. She was previously a sell-side analyst at AB, covering equity portfolio strategy for six years. Altunkopru joined the firm in 2005, covering the European Household and Personal Care sector, and her team was ranked among the top three in Institutional Investor and Extel surveys. Prior to joining AB, she worked as a management consultant with The Boston Consulting Group, Bain & Co. and McKinsey, serving clients in the consumer goods and financial services sectors. Altunkopru holds a BS in mathematics from the Massachusetts Institute of Technology and an MBA from Harvard Business School. Location: New York

Aditya Monappa is Global Head of the Multi-Asset Business Development team. In this role, he leads a team of investment and product strategists who engage with clients to represent market views and investment strategies for AB's Multi-Asset Solutions (MAS) business. Monappa is also involved in setting the strategic priorities and goals for the global MAS business. Prior to joining the firm in 2018, he was head of Asset Allocation & Portfolio Solutions for Standard Chartered Bank. As part of that role, Monappa was responsible for the design of global asset-allocation models and multi-asset-class portfolio solutions for both the private and priority segments. He was a key member of the bank's Global Investment Council and also acted as an advisor to the Discretionary Portfolio Management division. Previously, Monappa was head of Wealth Management Analytics for RiskMetrics Group, responsible for its asset allocation and portfolio construction offering. Prior to RiskMetrics, he worked with J.P. Morgan, first in the Investment Management division, followed by three years with J.P. Morgan Advisory Services, a division of J.P. Morgan Private Bank. Monappa holds an MBA from INSEAD and an MS in financial engineering from Columbia University. He is a CFA charterholder. Location: Singapore