by Russ Koesterich, JD, CFA, Blackrock

Russ Koesterich, CFA, Managing Director and Portfolio Manager, of the Global Allocation team discusses why the longer-term outlook for growth stocks is encouraging.

It didn’t last. After a brutal six months, during which the Russell 1000 Growth Index fell more than 32%, growth stocks finally found a floor in June before rebounding. While the rally was already running out of steam by mid-August, the real death knell occurred on August 26th. Federal Reserve Chairman Jerome Powell used his speech at the annual summer conference in Jackson Hole to put to rest any hopes for a quick end to the Fed’s tightening campaign.

Although tech and other growth stocks may suffer through more September volatility, the longer-term outlook is more encouraging. The economy is softening, not collapsing, valuations are more interesting and real rates have already adjusted. It’s worth recounting then why the summer rally faded, and fall weakness presents an opportunity.

Too much, too soon. After bottoming in June, tech and broader growth indexes surged 25%. Some segments, notably semiconductors and internet commerce, staged even bigger rallies, advancing 30% and 40% respectively. Given the magnitude of those gains, a pause was always likely. That the rally should stall in late August in the face of still tightening financial conditions and weak seasonality should not come as a shock.

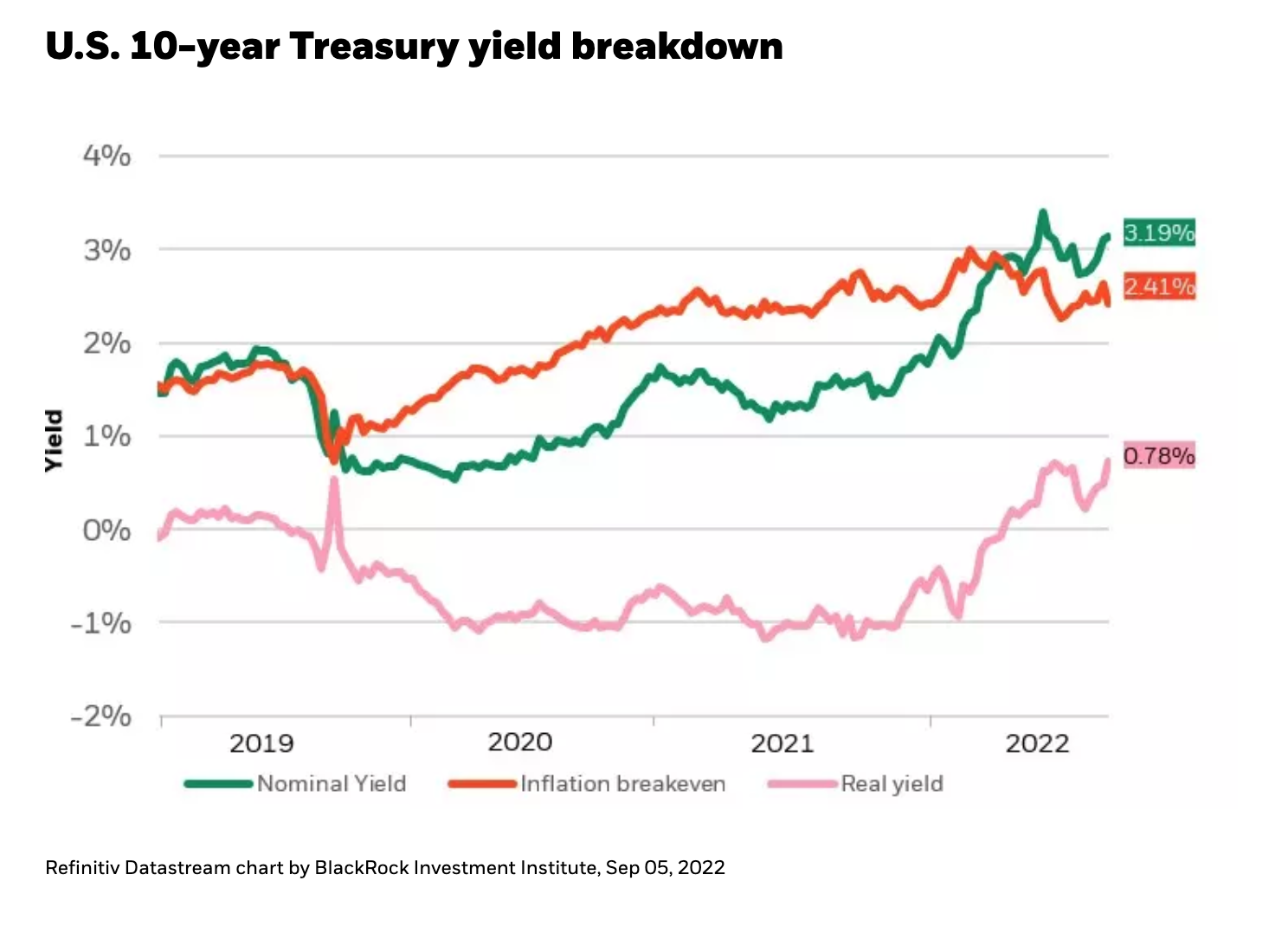

The pivot will have to wait. The late summer sell-off accelerated once it became clear that the Fed had no intention of pivoting away from tighter monetary policy. Investors got the message and immediately began driving real -- or inflation-adjusted -- rates higher. Real long-term yields, already backing up before the conference, spiked to more than 0.80%, the previous high from June (see Chart 1). While higher real rates are a headwind for the broader market, they are particularly punishing for growth stocks, where earnings tend to be more concentrated in future years.

More tightening already baked-in

September is not over and is rarely kind to investors. That said, looking further ahead there is reason for optimism. Real rates have already priced in an aggressive tightening campaign. In less than a year, long-end real rates have risen by more than 200 bps. At current levels, real yields are roughly double last decade’s average. And while rates have risen, rate volatility has remained well below the summer peak. This is important as volatility in rate markets can be as damaging as higher interest rates. Finally, a slower economy is, at least on a relative basis, supportive of growth stocks, which tend to command a higher premium when earnings growth is harder to find.

Given this dynamic, I would use September weakness to add to rather than retreat from the space. But rather than try to bottom-fish in the most volatile and speculative names, I would focus on stable growth names, i.e., those companies with consistent earnings, high cash flow generation and strong pricing power.

Russ Koesterich, CFA, is a Portfolio Manager for BlackRock's Global Allocation Fund and the lead portfolio manager on the GA Selects model portfolio strategies.

Copyright © Blackrock