Technical Notes for yesterday

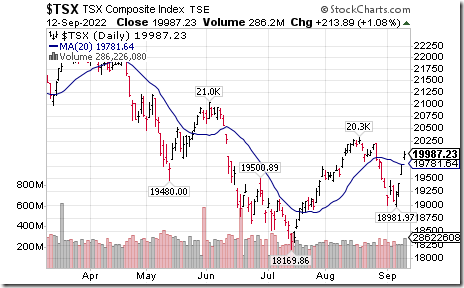

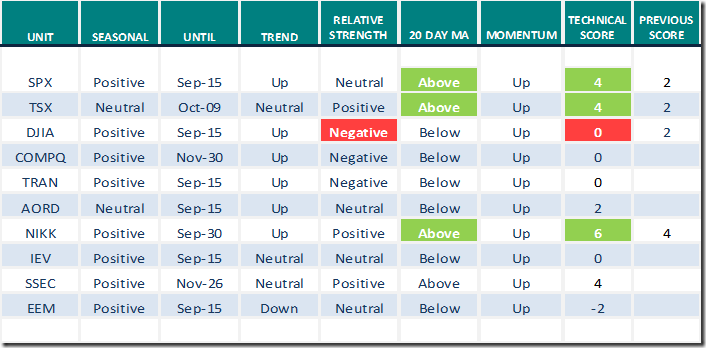

The S&P 500 Index and TSX Composite Index closed above their 20 day moving average.

India ETF $PIN moved above $25.68 extending an intermediate uptrend.

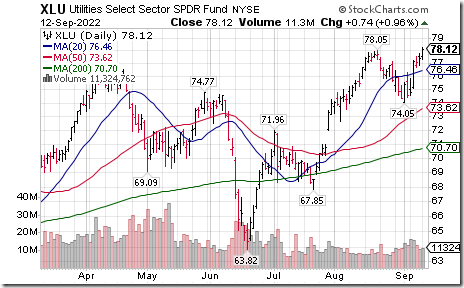

Utilities SPDRs $XLU moved above $78.05 to an all-time high extending an intermediate uptrend.

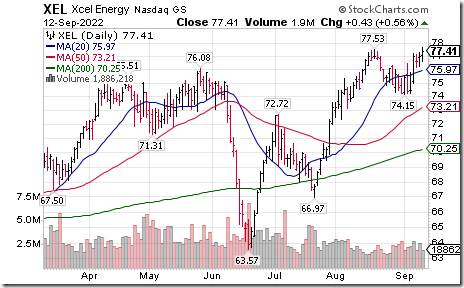

Xcel Energy $XEL a NASDAQ 100 stock moved above $74.15 to an all-time high extending an intermediate uptrend.

Ross Stores $ROST a NASDAQ 100 stock moved above $94.11 extending an intermediate uptrend.

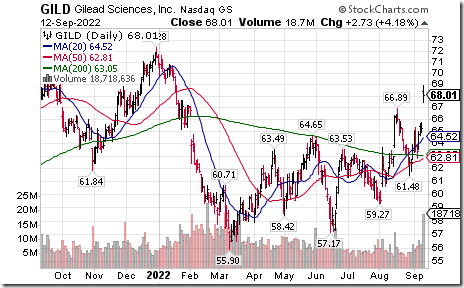

Gilead $GILD a NASDAQ 100 stock moved above $66.89 extending an intermediate uptrend.

Metlife $MET an S&P 100 stock moved above $68.12 extending an intermediate uptrend.

Toronto Dominion Bank $TD.TO a TSX 60 stock moved above $88.62 extending an intermediate uptrend.

Gildan Activewear $GIL.TO a TSX 60 stock moved above $42.76 extending an intermediate uptrend

Base metal stocks on both sides of the border were leading gainers yesterday. Lundin Mining $LUN.TO moved above $7.43 completing a double bottom pattern.

First Majestic Silver $FR.TO moved above Cdn$10.98 and US$8.60 completing a reverse Head & Shoulders pattern.

Trader’s Corner

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for September 12th 2022

Green: Increase from previous day

Red: Decrease from previous day

Commodities

Daily Seasonal/Technical Commodities Trends for September 12th 2022

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for September 12th 2021

Green: Increase from previous day

Red: Decrease from previous day

Next Canadian Association for Technical Analysis Meeting

Next meeting is offered at 8:00 PM EDT this evening. Speaker is Robert Ramy. Interested in joining? See https://canadianata.ca/

Chart of the Day

Technical score for XBM.TO increased from -2 to 2 after units moved above their 20 day moving average and strength relative to the S&P 500 changed from Neutral to Positive.

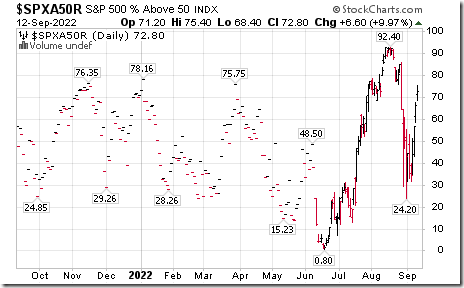

S&P 500 Momentum Barometers

The intermediate term Barometer added 6.60 to 72.80 yesterday. It remains Overbought. Trend remains up.

The long term Barometer added 1.80 to 40.80 yesterday. It changed from Oversold to Neutral on a move above 40.00. Trend remains up.

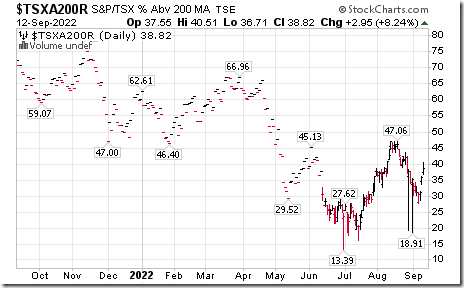

TSX Momentum Barometers

The intermediate term Barometer advanced 14.35 to 73.00 yesterday. It changed from Neutral to Overbought on a move above 60.00. Trend remains up.

The long term Barometer added 2.95 to 38.82 yesterday. It remains Oversold. Trend remains up.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed