by Fidelity Viewpoints

When inflation is up and many stocks are down, dividend-paying stocks may offer investors some unique benefits.

Key takeaways

- Dividends have accounted for 40% of stock market returns since 1930 and 54% during decades when inflation has been high1.

- When inflation has been high, the stocks that have increased their dividends the most have outperformed the overall market.

- Dividend payments may help make a stock's total return less volatile.

History shows that owning stocks has helped protect investors against inflation because stock prices have often gone up along with consumer prices. But so far this year, inflation is up and the overall stock market is down. That doesn’t mean that stocks no longer work as hedges against inflation, but it does suggest that not all stocks may perform equally well when consumer prices are rising.

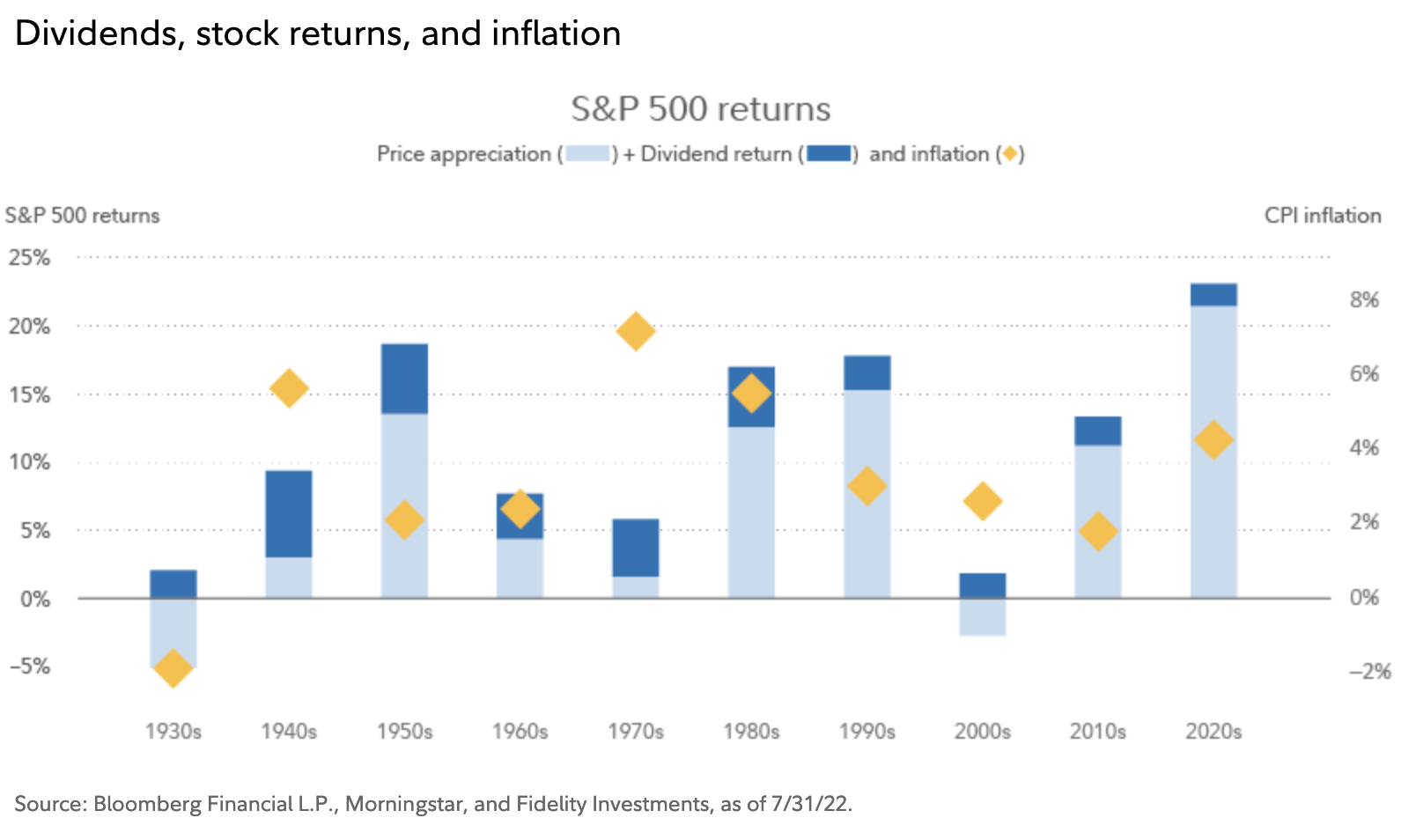

One way to get the inflation-fighting benefits of stocks may be to look for types of stocks that have historically outperformed when inflation has been high. One key characteristic to look for is whether or not they pay dividends. Dividends have contributed roughly 40% of the total return of the S&P 500 since 1930. But during the 1940s, 1970s, and 1980s when inflation averaged 5% or higher, dividends produced 54% of that total return1, says Naveed Rahman, co-manager of the Fidelity® Equity-Income Strategy.

Zach Turner manages the Fidelity® Dividend Growth Fund (US).

He says that dividend-paying stocks have been overshadowed over the past decade by high-priced growth stocks, particularly those of technology companies. Now, though, dividend stocks’ combination of regular income and inflation hedging may make this a good time to get to know them better.

How dividends fight inflation

Unlike many bonds and other investments that pay a previously determined rate of interest to investors who own them, stocks’ dividends can—and often do—rise when inflation does. Companies typically pay dividends each quarter and they often adjust them based on a variety of factors.

Denise Chisholm, director of quantitative market strategy, studies historical patterns in the markets. She says that during periods of high inflation, stocks that increased their dividends the most outperformed the broad market, on average. "Based on history, if high inflation is here to stay, I believe dividend growth stocks look likely to outperform," she says.

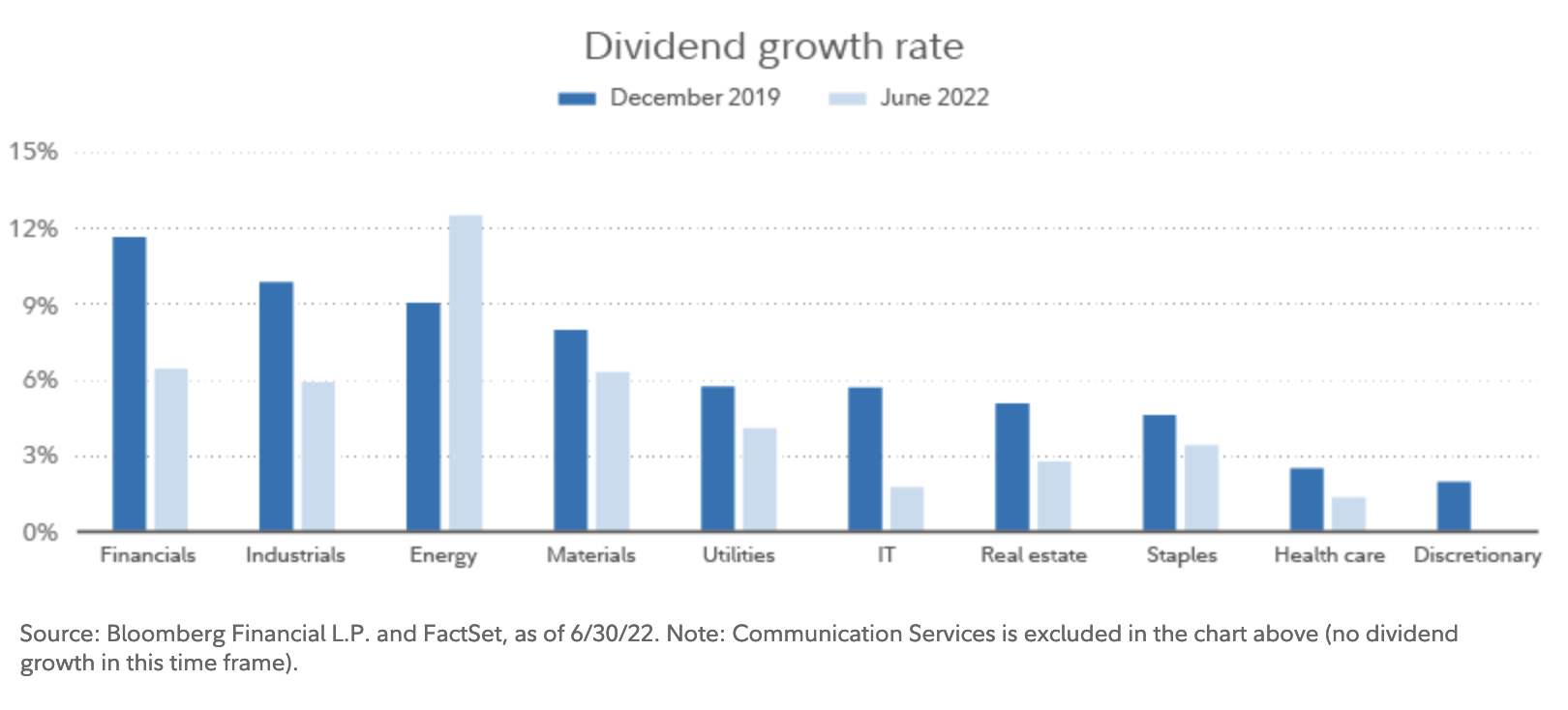

While the past suggests that dividend paying stocks may thrive in the inflationary present and future, Rahman points out that the best performing dividend stocks today will not necessarily be found in the same industries or sectors as those in the past. “Of course, market leadership often shifts among dividend-paying stocks, as do expectations for dividend cuts and suspensions. Just before the onset of the pandemic, financials generated the fastest dividend growth. Now, energy sits in the pole position,” he says.

Many of these stocks are those of companies who are able to raise the prices they charge their customers to offset their own rising costs of doing business. "Companies that pay a sustainable and growing dividend also have the potential to grow their cash flows to keep up with inflation," says Adam Kramer, manager of the Fidelity® Multi-Asset Income Fund, which invests in dividend-paying stocks.

How dividends may help when stocks struggle

Dividends may also help investors at times when many stocks’ prices are down from their highs as they’ve been much of this year. Though the media and even some investors seem to focus only on rising—or falling—stock prices when they assess the health of the market, dividends are also an important source of stock returns. For example, stock prices of the S&P 500 fell during the 1930s and 2000s, but dividends almost completely offset that decline. In the 1940s and 1970s, when inflation surged, dividends accounted for 65% and 71% of the S&P 500's return, respectively. In fact, Fidelity research shows that since 1930, dividends have accounted for roughly 40% of the total return of US stocks.2

A smoother ride

If inflation hedging and higher returns in choppy markets aren’t enough for you, keep in mind that dividend payments also may help to reduce the volatility of a stock's total return. The mere fact that a company pays a dividend means it is profitable and has excess free cash flow, qualities that may help to buttress its stock during challenging times.

What to know about dividends

Successful dividend stock investors need to understand several concepts. The first is dividend yield, which measures how much income the stock will produce. Dividend yield is a stock's annual dividend expressed as a percentage of its price. For example, a company paying an annual dividend of $3.48 and trading at $147 per share would have a dividend yield of 2.37%. That means you could expect $2.37 in annual dividends for every $100 invested.

It's also important to understand that a stock's price and its dividend yield move in opposite directions as long as the dollar amount of the dividend doesn't change. For example, if the stock price in our example dropped from $147 per share to $100, its dividend yield would rise from 2.37% to 3.48%.

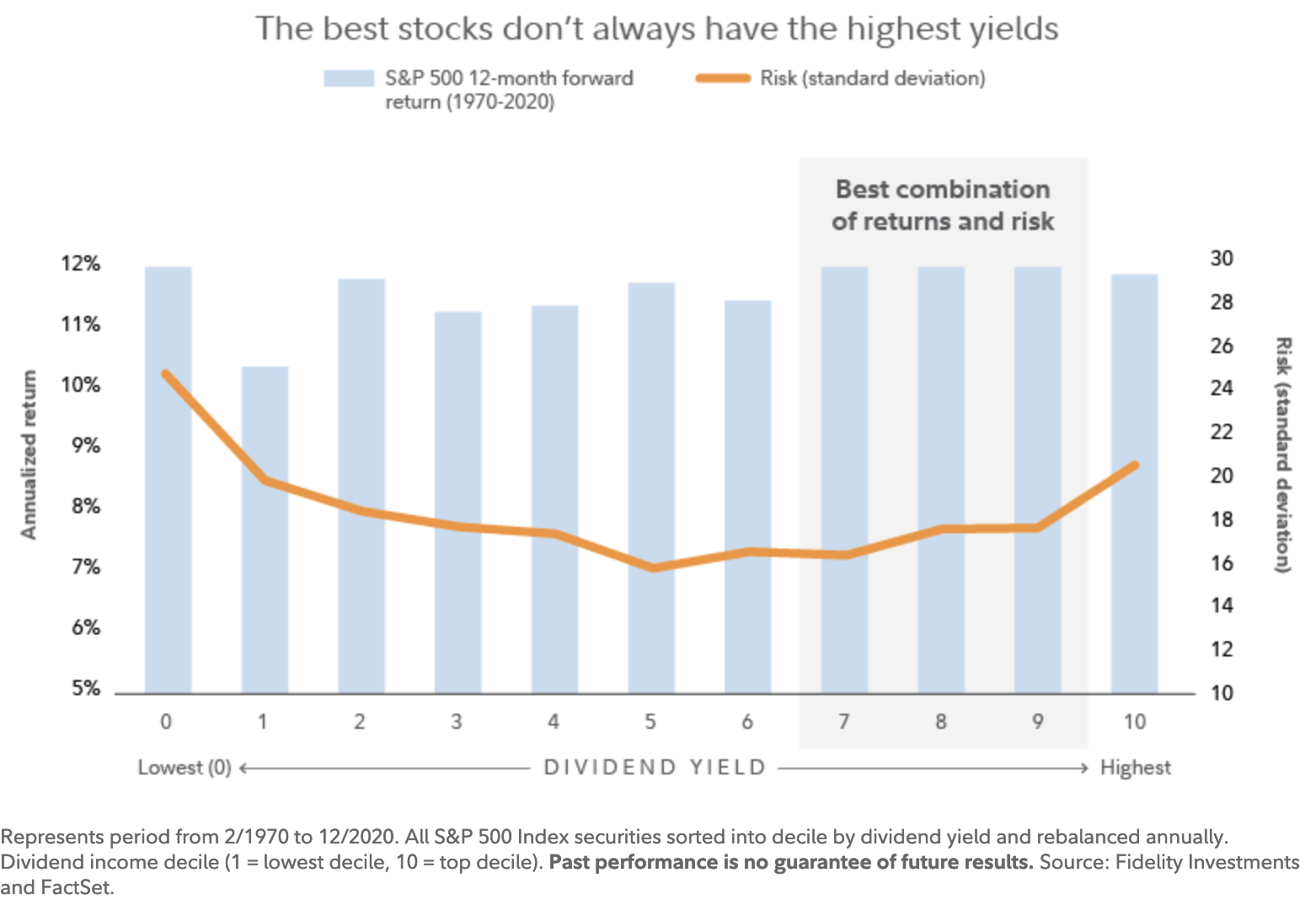

That means a high dividend yield may be a red flag. "A high dividend yield might seem attractive, but you have to be careful," says Turner. "When a yield is high, there's usually a good reason."

A stock's yield may be high because business weakness is weighing down the company's share price. In that case, the company's challenges may even cause it to lower or stop its dividend payments. And before that happens, investors are likely to sell off the stock.

Fidelity research has found that stocks that reduce or eliminate their dividends historically have underperformed the market by 20% to 25% during the year leading up to the cut.3

Would-be dividend investors should also know to look at the company's payout ratio. That refers to the amount of its net income or free cash flow that it pays in dividends. Low is usually good: A low ratio suggests the company may be able to sustain and possibly boost its payments in the future. "It's important to analyze the stability of a company’s cash flows when assessing the level of payout. When the payout ratio is more than 50%, you always stress test that ratio," says Kramer.

Finding ideas

You can gain exposure to divided-paying shares in 3 primary ways:

1. Individual dividend-paying stocks. Check their dividend policy statement so you know how much to expect and when. Be sure to diversify to help manage risk if you want to build a portfolio of individual stocks. Invest across sectors rather than concentrating on those with relatively high dividends, such as consumer staples and energy.

2. Index funds and ETFs. Passive funds offer exposure to dividend stocks with low costs. Some strategies emphasize current income, others focus on dividend growth.

3. Actively managed funds. In today's markets, professional managers may be able to identify companies that are likely to increase their dividends and avoid those likely to cut them. Rahman says active management offers a similar advantage when looking to stay ahead of inflation: "To know if a company can raise its dividends faster than inflation, you have to understand business fundamentals like brand equity and pricing power. You can only do that stock by stock."

Copyright © Fidelity Investments