Pre-opening Comments for Thursday September 8th

U.S. equity index futures were mixed this morning. S&P 500 futures were unchanged in pre-opening trade.

Equity index futures were unchanged after the European Central Bank raised its lending rate to major banks by 0.75% to 1.25%.

Game Stop advanced $2.51 to $25.55 after reporting a smaller than expected quarterly loss. Wedbush lowered its target price from $7.50 to $6.00.

American Eagle Outfitters dropped $1.68 to $9.91 after reporting a second quarter loss. The company also stopped its dividend payment.

Roku added $0.71 to $66.25 after Pivotal Research upgraded the stock from Sell to Hold.

EquityClock’s Daily Comment

Headline reads “Abrupt downfall of oil creates uncertainty in the energy sector, but this one energy sector industry continues to look good”.

http://www.equityclock.com/2022/09/07/stock-market-outlook-for-september-8-2022/

Technical Notes for yesterday

Crude Oil ETN $USO moved below $69.51 completing a Head & Shoulders pattern.

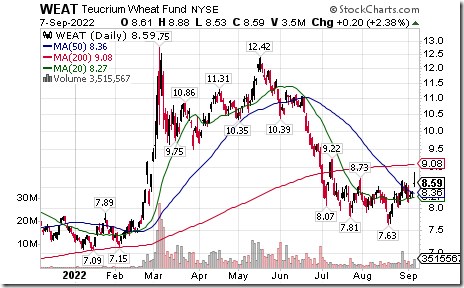

Wheat ETN $WEAT moved above $8.67 and $8.73 extending an intermediate uptrend.

Lululemon $LULU a NASDAQ 100 stock moved above $335.71 extending an intermediate uptrend.

Trader’s Corner

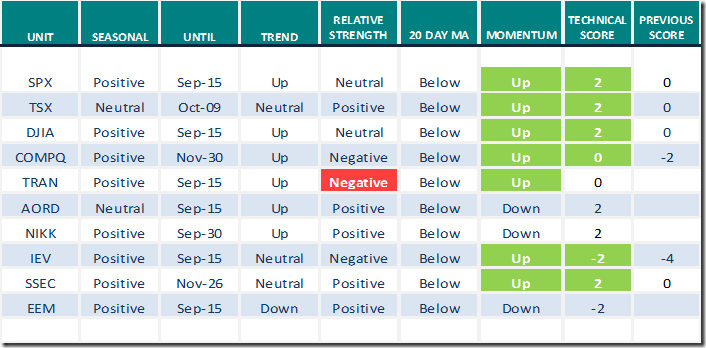

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for September 7th 2022

Green: Increase from previous day

Red: Decrease from previous day

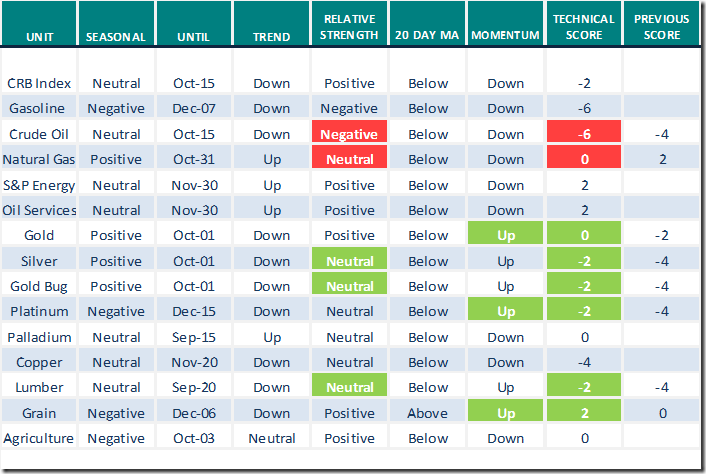

Commodities

Daily Seasonal/Technical Commodities Trends for September 7th 2022

Green: Increase from previous day

Red: Decrease from previous day

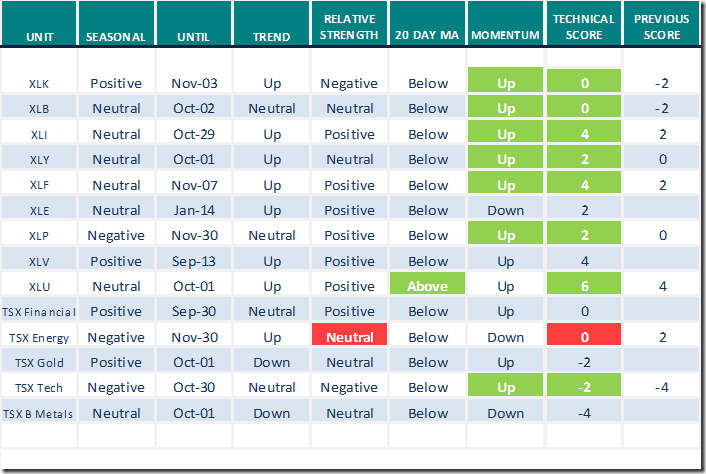

Sectors

Daily Seasonal/Technical Sector Trends for September 7th 2021

Green: Increase from previous day

Red: Decrease from previous day

Links offered by valued providers

Thank you to Mark Bunting and www.uncommonsenseinvestor.com for the following link:

Historian: "The 2020s Could Actually Be Worse" Than the 1970s – Uncommon Sense Investor

Greg Schnell discusses “Turbulence in the housing markets”.

Turbulence in Housing Market | Greg Schnell, CMT | Market Buzz (09.07.22) – YouTube

Greg Schnell asks “Are these stocks ready to pop”?

Are These Charts Ready to Pop? | Greg Schnell, CMT | Your Daily Five (09.07.22) – YouTube

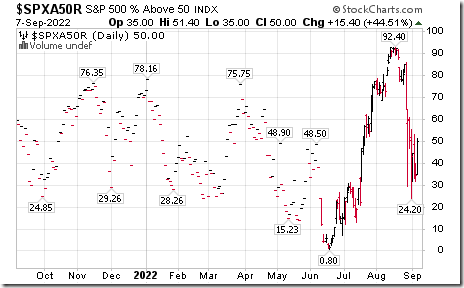

S&P 500 Momentum Barometers

The intermediate term Barometer jumped 15.40 to 50.00 yesterday. It changed from Oversold to Neutral on a recovery above 40.00.

The long term Barometer advanced 6.00 to 33.80 yesterday. It remains Oversold.

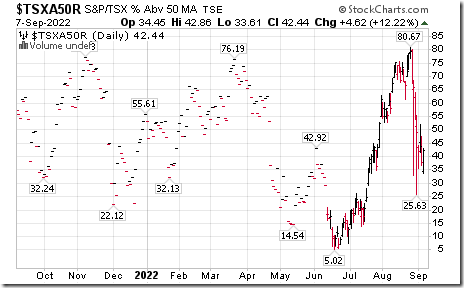

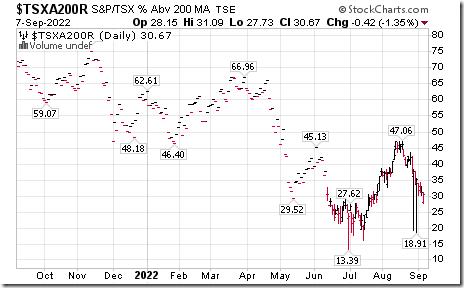

TSX Momentum Barometers

The intermediate term Barometer jumped 4.62 to 42.44 yesterday. It changed from Oversold to Neutral on a recovery above 40.00.

The long term Barometer slipped 0.42 to 30.67 yesterday. It remains Oversold.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed