by Carl Tannenbaum, Chief Economist, Northern Trust

Scarcity and trade frictions are leading to major supply chain realignments.

Shores are a popular vacation destination. People are drawn to them because of their beauty, and the activities they support. The weather is often more temperate at the waterfront…and if it isn’t, you can always take a dip. That’s why people flock to Surfer’s Paradise, the Copacabana, Monaco…and Seaside Heights, New Jersey.

Shorelines provide vistas to gaze over the horizon, and ruminate about what may be on the other side. Shores have also been the subject of rumination in economic circles recently. After decades of moving activity offshore, firms are considering bringing it closer to home. “Re-shoring” would have a significant impact on economic performance and inflation around the world.

The geography of global manufacturing has been shifting for seventy years. In the 1950s, the United States made about 40% of the world’s steel, and 60% of its cars. Today, those fractions are 4% and 12%, respectively. The migration has been especially rapid since 2001, when China was granted entry to the World Trade Organization.

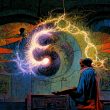

Initially, the movement of manufacturing was prompted by labor cost differentials and energy efficiency. Western plants were older, union wages were elevated and successive shocks in the price of oil raised the costs of operations and transportation. In the 1980s, Japan rose to prominence as a dominant global producer; twenty years later, China took the leadership mantle and has held onto it ever since. China has maintained its position despite a gradual erosion in its labor cost advantage.

As a result, the United States now has a trade deficit in goods that amounts to more than 7% of annual gross domestic product. Heavy industries in the West have cried foul throughout the offshoring era. Foreign providers are not held to the same environmental and labor laws, and leading firms in Japan and China operate with the sponsorship (or ownership) of the state. Accusations of economic espionage and unfair trade practices have been leveled frequently.

But Western consumers and shareholders generally benefitted from the shift to overseas providers. Low-cost foreign competition provided better pricing and motivated domestic firms to become more efficient. The owners of companies enjoyed better profit margins and higher stock prices. For workers and communities that were displaced by globalization, programs were chartered to help them make a successful transition.

Over time, global value chains were honed to a fine edge. Just-in-time production techniques and sophisticated logistics combined to produce components and finished products at very low costs. Deliveries were carefully choreographed to maximize efficiency. Concentrations developed, but threats to the fluidity of global commerce seemed minor.

Concern over global sourcing was building prior to the pandemic, and has intensified since.

But ever since the financial crisis of 2008, trade frictions have been on the rise. Struggling to recover from that episode, nations began to take a less favorable view of trade and its impact on domestic workers and firms. Questions about the evenness of playing fields led to a substantial increase in tariffs, quotas and trade disputes. Even prior to COVID-19, sourcing from overseas had become more problematic, and expensive.

The pandemic added momentum to the anti-globalization movement. Supply chains have been in terrible disarray since 2020, and the downsides of concentration of global production in just a handful of providers have become more apparent. Shipments have been less consistent, impairing production. Scarcity of certain items, and long lead times for receiving them, are still common.

Long supply lines are not only vulnerable, but they are not carbon friendly. As firms work to manage their environmental footprints, moving material over extended distances is intrinsically costly. (And, in areas where carbon pricing is taking root, explicitly costly.)

The war in Ukraine has sent chills across the world, on both humanitarian and economic grounds. Extensive sanctions were implemented against Russia in the wake of their invasion, essentially closing the country to sourcing. While Russia is not a major cog in the machinery of global trade, the use of economic and financial sanctions could extend to other nations one day. The term “friend-shoring” has entered the lexicon, to describe the desire of companies to limit exposure to those kinds of events.

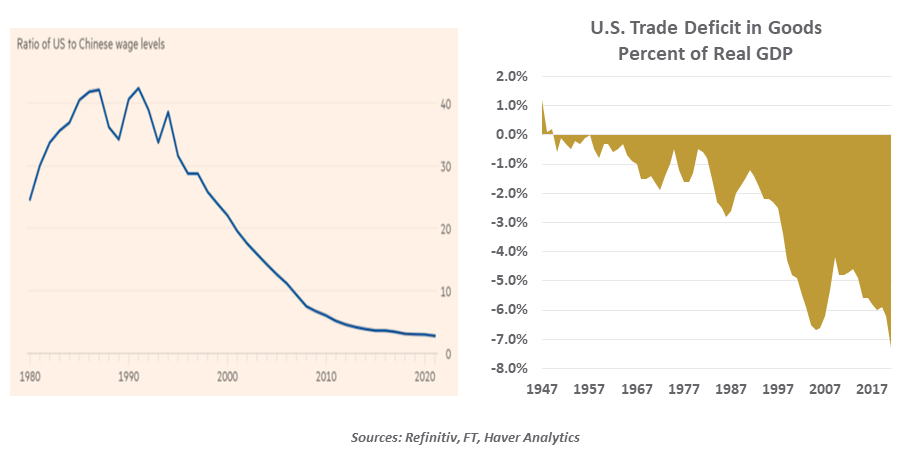

In sum, resilience has become more important as companies consider where to place operations. Multinational companies are mentioning reshoring and near-shoring in their public statements, and the Reshoring Initiative estimates that 350,000 jobs will return to the U.S. from overseas this year.

On the other side of the evidentiary ledger is the trend in manufactured goods sourced from low-cost Asian countries. As shown in the right-hand chart above, the ratio of imported manufactured goods to domestic output has increased significantly over the past two years, producing a negative reshoring indicator.

Restructuring supply chains is not at all easy. Firms hoping to bring production home have to secure sufficient labor, construct new facilities and acquire new equipment. New locations may be farther from sources of parts or raw material, creating new supply chain extensions and costs. Logistics have to be re-oriented, which requires access to transit hubs (like ports) with spare capacity. If the reshoring movement gathers steam, new capacity may need to be established; this will be an expensive proposition.

Globalization held back inflation; a reversal of this trend may be underway.

Governments in a number of countries are trying to make the homecoming easier, offering to defray costs for companies who are contemplating it. But the full costs of reshoring will be borne by consumers. Globalization has suppressed inflation over the past generation; it is logical to assume that de-globalization will have the opposite effect.

Countries that are on the losing end of reshoring will find themselves in the same position that Western countries were forty years ago. Expect big producers like China to compete hard to keep business, and to make it hard for those who depart to continue doing business. The tide may be turning for global value chains; but for now, it’s a trickle and not a flood.

Information is not intended to be and should not be construed as an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Under no circumstances should you rely upon this information as a substitute for obtaining specific legal or tax advice from your own professional legal or tax advisors. Information is subject to change based on market or other conditions and is not intended to influence your investment decisions.

© 2022 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A. Incorporated with limited liability in the U.S. Products and services provided by subsidiaries of Northern Trust Corporation may vary in different markets and are offered in accordance with local regulation. For legal and regulatory information about individual market offices, visit northerntrust.com/terms-and-conditions.