Technical Notes for yesterday

Soybeans ETN $SOYB moved above $27.66 resuming an intermediate uptrend.

Globex Uranium ETF $URA moved above $22.12 extending an intermediate uptrend. Japan announced plans to return to use of nuclear power. Mainly reflected strength in Cameco.

Coffee ETN $JJOFF moved above $20.70 resuming an intermediate uptrend.

AT&T moved below $17.99 extending an intermediate downtrend

Enbridge $ENB.TO, a TSX 60 stock moved above $Cdn$57.18 resuming an intermediate uptrend.

Cenovus Energy $CVE.TO a TSX 60 stock moved above Cdn$25.20 resuming an intermediate uptrend.

Trader’s Corner

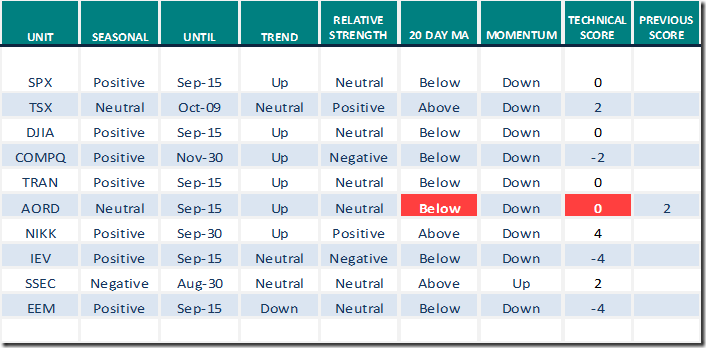

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for August 24th 2022

Green: Increase from previous day

Red: Decrease from previous day

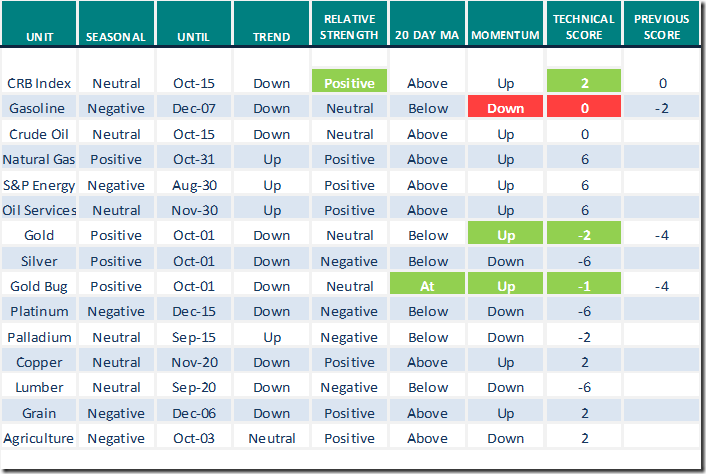

Commodities

Daily Seasonal/Technical Commodities Trends for August 24th 2022

Green: Increase from previous day

Red: Decrease from previous day

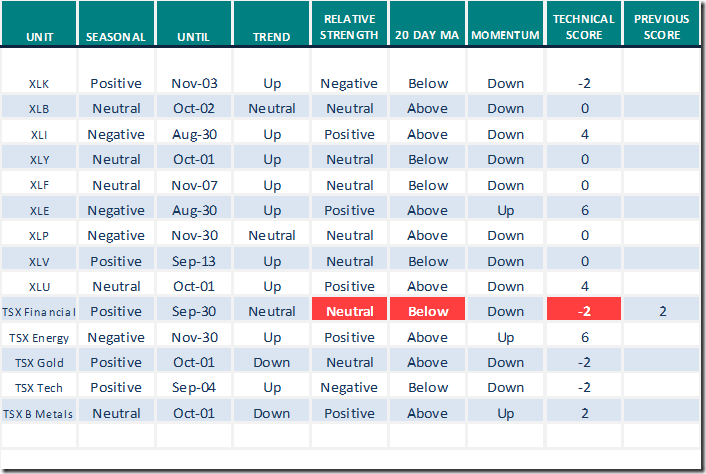

Sectors

Daily Seasonal/Technical Sector Trends for August 24th 2021

Green: Increase from previous day

Red: Decrease from previous day

CATA Meeting

Next meeting of the Canadian Association for Technical Analysis is held tonight at 8:00 PM EDT. Speaker is Jake Bernstein. Not a member? Click on www.canadianata.ca for information.

Links offered by valued providers

Mark Bunting and www.uncommonsenseinvestor.com offers the following links:

The Ugliest Chart of Them All – Uncommon Sense Investor

Strategist: Time to Raise Cash for Another Correction – Uncommon Sense Investor

The Fed May Stop Hiking By End of Year: RBC Capital Markets’ Tom Porcelli

https://www.youtube.com/watch?v=eFIuShNkDgA

Greg Schnell asks “Is this growing”? A focus on the Agriculture sector

https://www.youtube.com/watch?v=QjuH8Q09a8E

John Kosar discusses “The key to market direction into yearend “. Includes a comment on seasonal weakness through early October followed by strong gains thereafter.

https://www.youtube.com/watch?v=ZvbLP4FgTvo

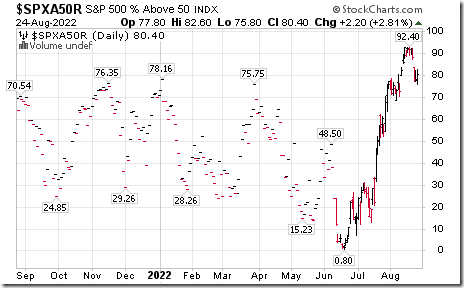

S&P 500 Momentum Barometers

The intermediate term Barometer added 2.20 to 80.40 yesterday. It remains Overbought.

The long term Barometer added 1.40 to 38.60 yesterday. It remains Oversold.

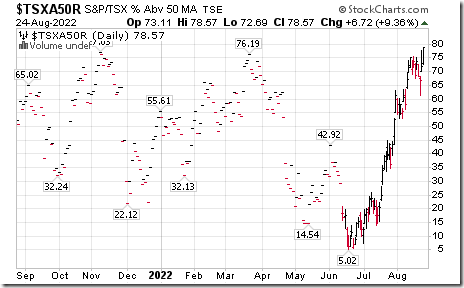

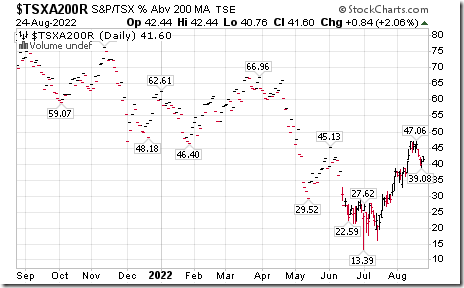

TSX Momentum Barometers

The intermediate term Barometer added 6.72 to a new recent high at 78.57 yesterday. It remains Overbought. Trend remains up.

The long term Barometer added 0.84 to 41.60 yesterday. It remains Neutral.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed