by Edward Bryan, CFA | Portfolio Manager—Sustainable Global Small Cap Portfolio; Senior Research Analyst—Sustainable Thematic Equities

Daniel C. Roarty, CFA| Chief Investment Officer—Sustainable Thematic Equities, AllianceBernstein

In small-cap markets, fundamental research is in short supply—and good environmental, social and governance (ESG) research is even scarcer. But diligent investors can still find ways to access robust ESG data and create active global small-cap portfolios of companies that are making meaningful contributions to address sustainability issues.

ESG ratings are lacking for small-cap stocks globally. This prevents asset managers who rely exclusively on third-party ratings from building small-cap funds. Since smaller companies often struggle to complete all the disclosures necessary to earn a rating, many remain unrated by leading ratings providers (MSCI and Sustainalytics) even if they disclose a range of valuable ESG information (Display).

Complying with relevant ESG regulation—in particular, the European Union’s (EU’s) Sustainable Finance Disclosure Regulation (SFDR)—is nearly impossible for small-cap managers to do using third-party ESG ratings alone. From January 2023, SFDR will require investment managers who have classified their funds as article eight or nine to provide a wide range of environmental, social and governance data.

Data consistency is another challenge. The shortage of data and wide variations in methodology between the leading ESG ratings providers lead to low correlations between their ratings, making it hard for fund managers to adopt a consistent approach. That applies particularly in small-cap stocks, where the rating correlations are less than half those in large-cap markets.

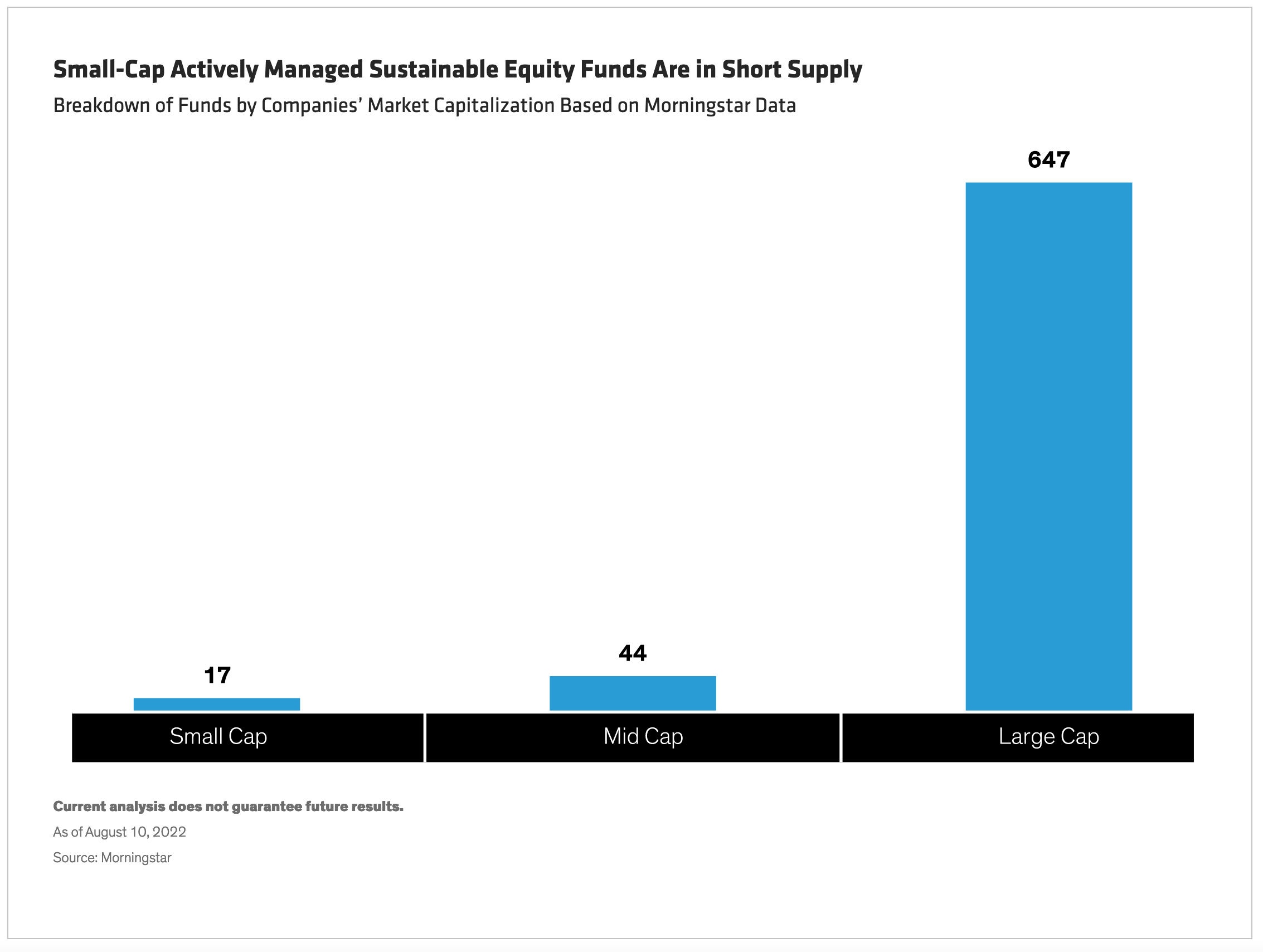

As a result, sustainable global small-cap strategies are very rare, in sharp contrast to the popularity of sustainable funds in larger-cap markets (Display, below).

Proprietary Research Unlocks Sustainable Small-Cap Opportunities

These challenges shouldn’t deter investors with a sustainable agenda from smaller stocks, in our view. Many of the most innovative providers of goods and services that address sustainability issues such as climate change and health are smaller companies. And small-cap stocks often offer attractive return potential, in part because the lack of analyst coverage can create opportunities to capitalize on mispricing.

So how can investors overcome the ESG data challenges of smaller companies? We believe that asset managers should develop independent assessments to determine a company’s sustainability credentials and earnings potential. This requires a clear process that we think should include the following components: a mapping approach geared to clearly defined sustainability objectives; proprietary ESG scoring of material issues based on in-house forward-looking fundamental research; and engagement with management teams to better understand companies’ ESG risk–mitigation strategies.

Defining Objectives with the UN SDGs

In our view, the most widely recognized and comprehensive set of sustainable objectives globally is the UN Sustainable Development Goals (SDGs). By mapping to the SDGs a manager can unearth companies that are providing solutions to the world’s biggest sustainability challenges.

The SDGs provide a robust framework to identify companies whose products and services are contributing to sustainable development. We’ve created a list of products and services that we believe are relevant for achieving the SDGs. Using data analysis techniques, that list is then used to identify companies whose products and services contribute to the achievement of the SDGs, which forms an investment universe. For instance, our mapping process has identified waste-management equipment and services as a product contributing to the achievement of SDG 12. Our research identified Li-Cycle as aligned to this product as a leader in recycling lithium-ion batteries, which is crucial for a successful transition to electric vehicles. Our robust mapping process enabled us to include the company in our investable universe despite its lack of an MSCI rating.

From Independent Research to Active Engagement

After creating a defined investment universe, independent fundamental research can be used to build a comprehensive picture of a company’s ESG profile, including material risks and company actions to mitigate those risks. This approach is particularly valuable for smaller companies, as ratings agencies use fewer indicators and collect less data for small cap companies than for their large-cap counterparts. Fundamental research conducted by sector analysts can help uncover important information that may otherwise be missed if depending on third-party ESG ratings.

Such research could include, for example, leveraging data and analytics derived from Glassdoor job reviews or from occupational safety and health administration violations. Monitoring data trends can help identify changes in a company’s culture—a key social pillar. An improving trend can provide comfort where no third-party rating exists—and deterioration can be a red flag that an existing rating may no longer be deserved.

Selecting an attractive portfolio candidate based on alignment to the SDGs and careful consideration of ESG risks is only the start of an effective sustainable investing strategy. By engaging with company management, portfolio teams can gain insight into companies’ future strategies, which can inform better research decisions. Engagement efforts can also be used to help companies address key risks and to improve their ESG transparency over time.

For instance, LegalZoom, an online platform for legal and compliance solutions, currently lacks an MSCI rating. However, our fundamental research has resulted in a positive view of the company’s governance practices. Although LegalZoom only went public in June 2021, it is managed by an experienced founder. Top industry professionals joined the management team pre-IPO and bring a history of best-in-class governance practices with them.

By asking the right questions, portfolio managers and analysts can overcome the problems of scarce ESG data in small-cap markets. But in practice, simply adopting a formula won’t deliver the required results. It takes a strong commitment to identifying SDG linkages, integrating ESG factors into the research process and active engagement to gain an ESG edge and uncover smaller sustainable companies with bigger long-term return potential.

The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

Copyright © AllianceBernstein