Wolf on Bay Street

Don Vialoux is a guest on this week’s radio show. Tune in to Corus 640 at 7:00 PM EDT on Saturday.

Technical Notes for yesterday

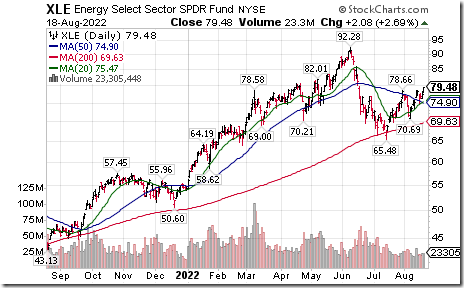

Energy SPDRs $XLE moved above $78.66 resuming an intermediate uptrend.

U.S. Insurance iShares $IAK moved above $88.90 extending an intermediate uptrend.

MetLife $MET an S&P 100 stock moved above $67.99 extending an intermediate uptrend.

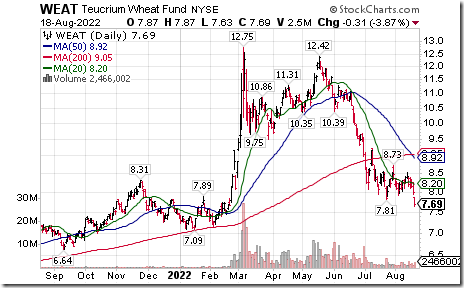

Wheat ETN $WEAT moved below $7.81 extending an intermediate downtrend.

Baidu $BIDU a NASDAQ 100 stock moved below 128.50 setting an intermediate downtrend.

Pembina Pipeline $PPL.TO a TSX 60 stock moved above $49.06 extending an intermediate uptrend.

Trader’s Corner

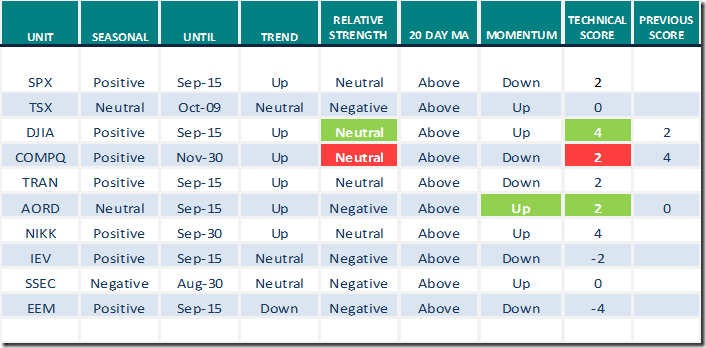

Equity Indices and Related ETFs

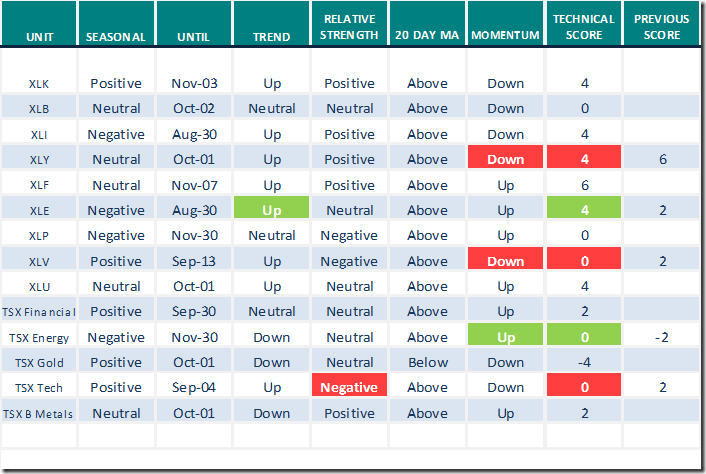

Daily Seasonal/Technical Equity Trends for August 18th 2022

Green: Increase from previous day

Red: Decrease from previous day

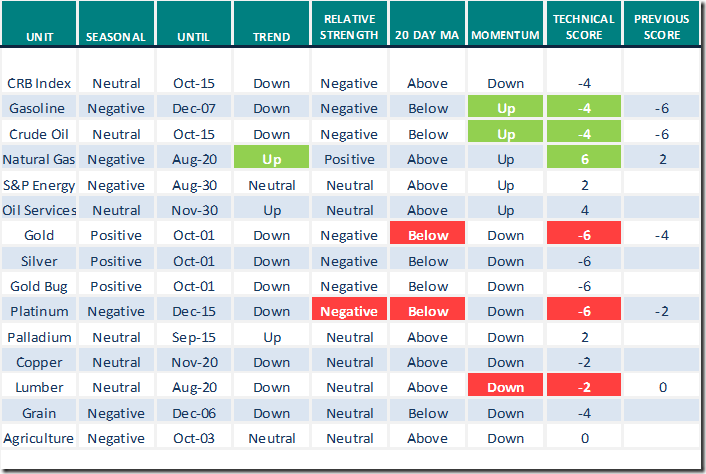

Commodities

Daily Seasonal/Technical Commodities Trends for August 18th 2022

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for August 18th 2021

Green: Increase from previous day

Red: Decrease from previous day

Links offered by valued providers

Lawrence McMillan opinion: “Now that the S&P 500 is looking overbought, watch what happens to this downtrend line that defines the bear market”.

Mark Hulbert opinion: “Proceed with caution if you trade stocks based on this popular market signal”.

David Hunter talks about “S&P 500 Upside Target 6000”

https://www.youtube.com/watch?v=r4y-LEX-gus

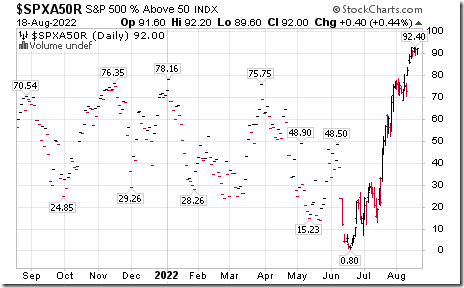

S&P 500 Momentum Barometers

The intermediate term Barometer added 0.40 to 92.00 yesterday. It remains Overbought.

The long term Barometer added 1.40 to 49.80 yesterday. It remains Neutral. Trend remains up.

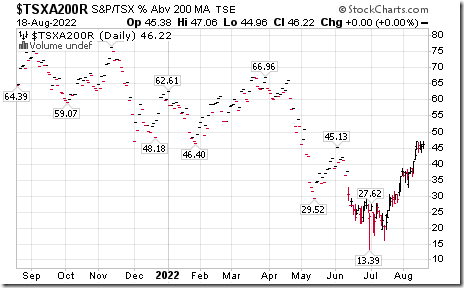

TSX Momentum Barometers

The intermediate term Barometer added 5.04 to 73.53 yesterday. It remains Overbought. Trend remains up.

The long term Barometer was unchanged at 46.22 yesterday. It remains Neutral.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed