ditor’s Note

Despite a Civic Holiday on Monday, Tech Talk will appear as usual.

Technical Notes for yesterday

Solar ETF $TAN moved above $80.52 resuming an intermediate uptrend. Responded to improving chance for passage of a Congressional bill supporting greater solar energy construction and development.

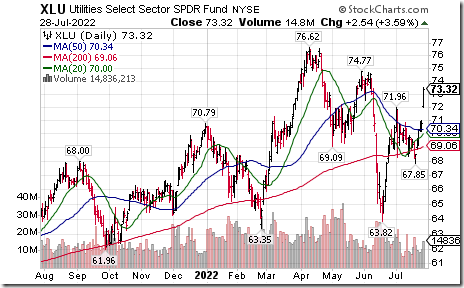

Utilities SPDRs $XLU moved above $71.96 resuming an intermediate uptrend.

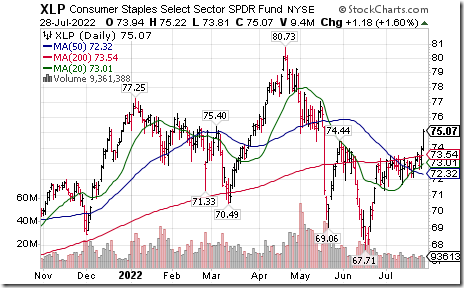

Consumer Staples SPDRs $XLP moved above $74.44 completing an intermediate base building pattern.

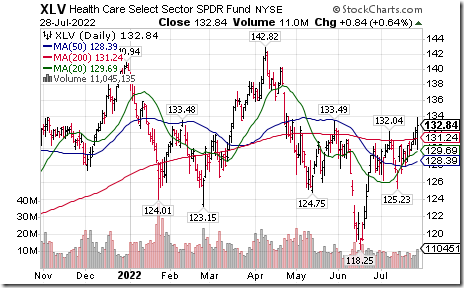

Healthcare SPDRs $XLV moved above $133.49 completing a reverse Head & Shoulders pattern.

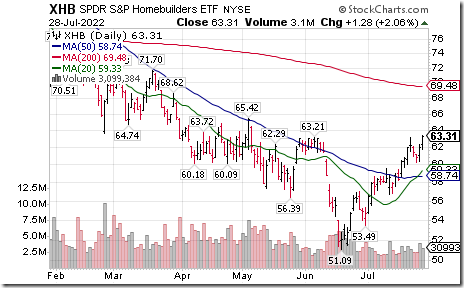

Home Builders SPDRs $XHB moved above $63.21 extending an intermediate uptrend.

Water Resources ETF $PHO moved above $50.48 extending an intermediate uptrend.

More Dow Jones Industrial Average stocks breaking intermediate resistance!

Microsoft $MSFT moved above $269.05 completing a double bottom pattern. Procter & Gamble $PG) moved above $146.54 completing a reverse Head & Shoulders pattern. Goldman Sachs $GS moved above $329.72 extending an intermediate uptrend.

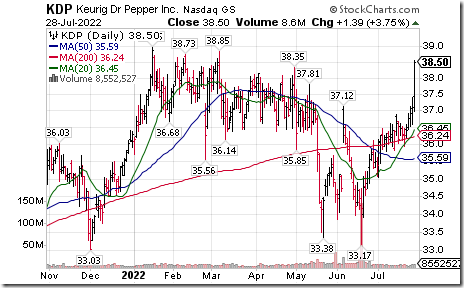

More S&P 100 stocks breaking intermediate resistance! Keurig Dr. Pepper $KDP moved above $37.12 extending an intermediate uptrend. Blackrock $BLK moved above $652.75 completing a double bottom pattern. Ford $F moved above $13.97 extending an intermediate uptrend. Exelon $EXC moved above $64.62 resuming an intermediate uptrend.

More NASDAQ 100 stocks breaking intermediate resistance! Intuitive Surgical $ISRG moved above intermediate resistance at $230.00. Fiserv $FiSV moved above $110.99 extending an intermediate uptrend. Paychex $PAYX moved above 127.45 extending an intermediate uptrend. Paccar moved above $89.88 extending an intermediate uptrend.

TSX 60 stocks caught the “breakout wave” from U.S. equity markets.

Dollarama $DOL.TO moved above $78.41 to an all-time high extending an intermediate uptrend. Commerce Bank $CM.TO moved above intermediate resistance at $63.93. BCE $BCE moved above $64.62 setting an intermediate uptrend. Waste Connection $WCN.TO a TSX 60 stock moved above $11.90 extending an intermediate uptrend.

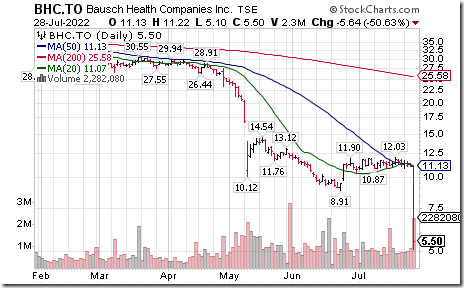

Bausch Health $BHC.TO moved below $8.41 extending an intermediate downtrend.

Trader’s Corner

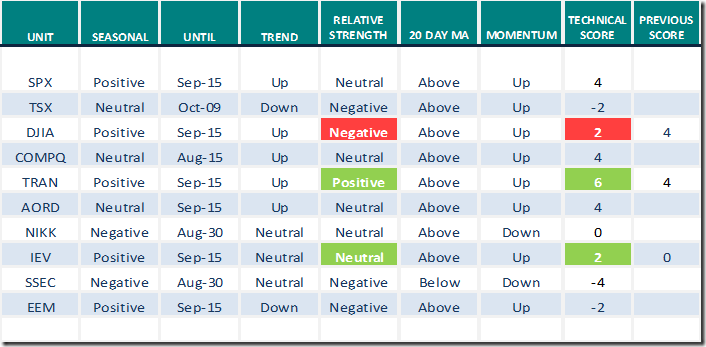

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for July 28th 2022

Green: Increase from previous day

Red: Decrease from previous day

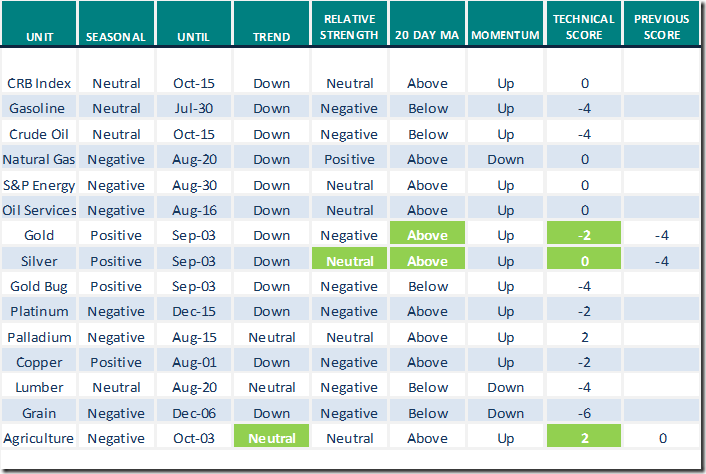

Commodities

Daily Seasonal/Technical Commodities Trends for July 28th 2022

Green: Increase from previous day

Red: Decrease from previous day

Sectors

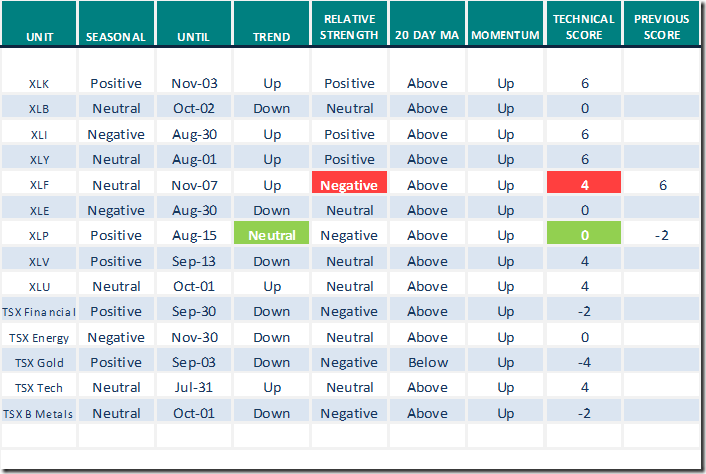

Daily Seasonal/Technical Sector Trends for July 28th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

Links from valued providers

Greg Schnell discusses “Scanning stocks for strength”

Scanning Stocks For Strength | Greg Schnell, CMT | Market Buzz (07.27.22) – YouTube

Tom Bowley says “Secular bull market underway again”

https://www.youtube.com/watch?v=zzEbbEHLfJ4

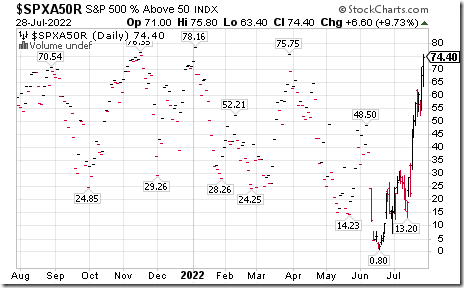

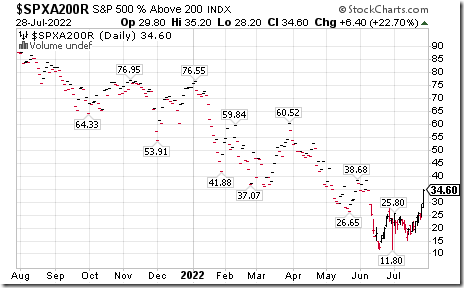

S&P 500 Momentum Barometers

The intermediate term Barometer added another 6.60 to 74.40 yesterday. It remains Overbought. Trend remains up.

The long term Barometer added 6.40 to 34.60 yesterday. It remains Oversold. Trend remains up.

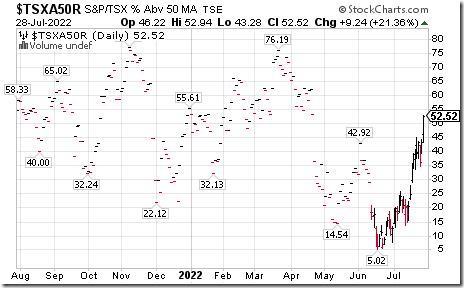

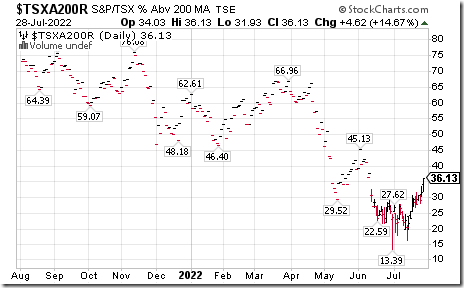

TSX Momentum Barometers

The intermediate term Barometer jumped 9.24 to 52.52 yesterday. It remains Neutral. Trend remains up.

The long term Barometer added 4.62 to 36.13 yesterday. It remains Oversold. Trend remains up.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed