Responses to the FOMC meeting released yesterday

Key markets responded as follows after the release at 2:00 PM EDT

S&P 500 Index rose sharply.

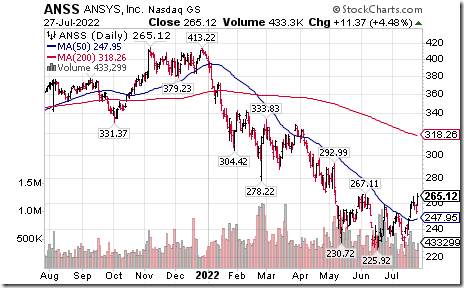

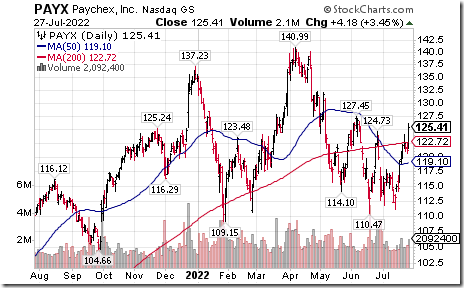

The technology sensitive NASDAQ Composite Index and related ETFs led the advance.

The U.S. Dollar Index and related ETF $UUP moved sharply lower.

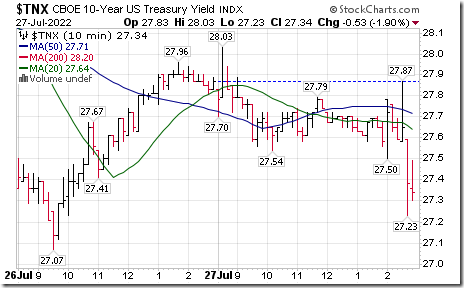

Yield on 10 year Treasuries moved lower

Gold and precious metal prices moved higher

Ditto for precious metal equities and related ETFs

Technical Notes for yesterday

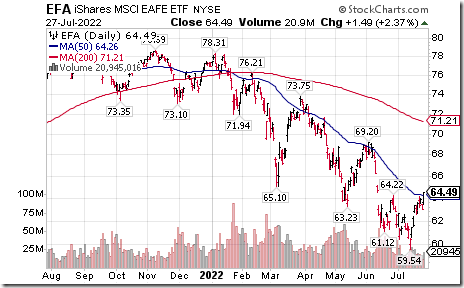

EAFA iShares $EFA moved above intermediate resistance at $64.22.

Technology stocks and related ETFs led the advance yesterday. Notable breakout by NASDAQ 100 stocks included Synopsys $SNPS on a move above $342.59, ANSYSS $ANSS on a move above $267.11 and Paychex $PAYX on a move above $124.73 and T Mobile on a move above $138.99

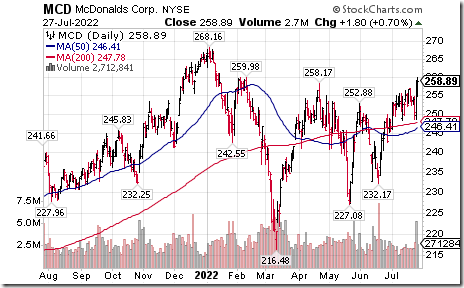

Breakouts by S&P 100 stocks that extended intermediate uptrends included McDonalds $MCD, Mondelez $MDLZ and Union Pacific $UNP

Bank of Montreal $BMO.TO a TSX 60 stock moved above intermediate resistance at $126.95.

Trader’s Corner

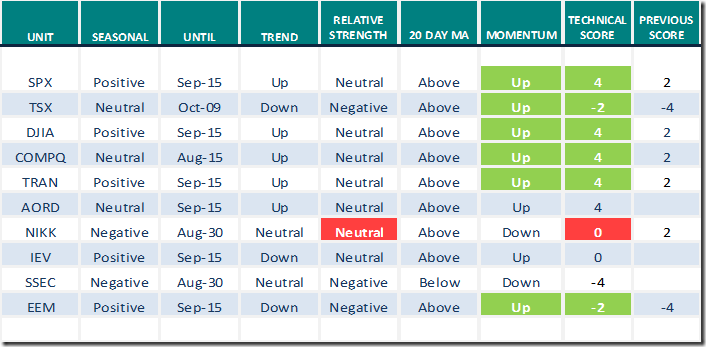

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for July 27th 2022

Green: Increase from previous day

Red: Decrease from previous day

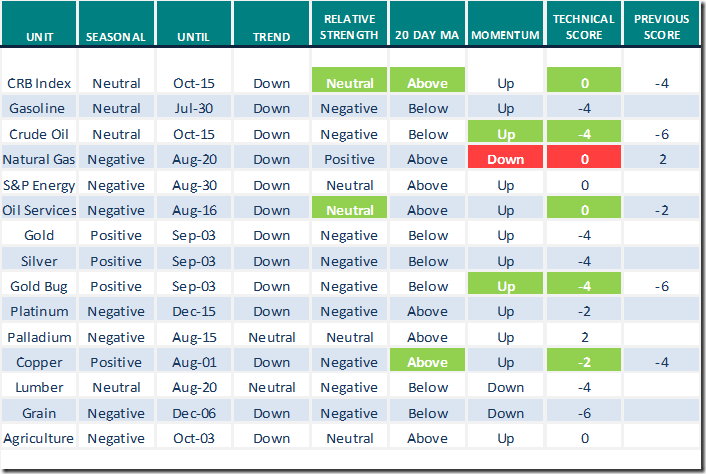

Commodities

Daily Seasonal/Technical Commodities Trends for July 27th 2022

Green: Increase from previous day

Red: Decrease from previous day

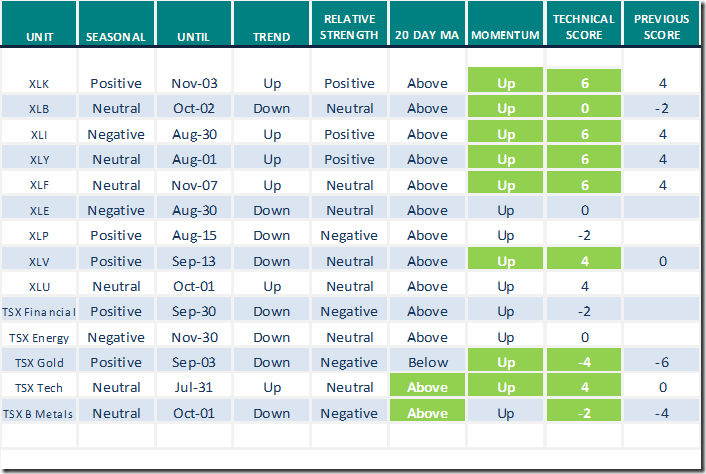

Sectors

Daily Seasonal/Technical Sector Trends for July 27th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

Link offered by a valued provider

Link offered by Mark Bunting and www.uncommonsenseinvestor.com

Three Mighty Mid-Cap Stocks – Uncommon Sense Investor

Next Meeting:

Canadian Association for Technical Analysis

Next meeting is tonight. Following are details:

Topic: CATA Meeting July 28 with Jermaine McGruder

Time: Jul 28, 2022 08:00 PM Eastern Time (US and Canada)

More information on CATA and its services is available (including a list of upcoming events) at www.canadianata.ca

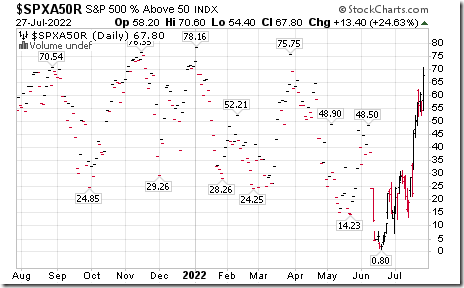

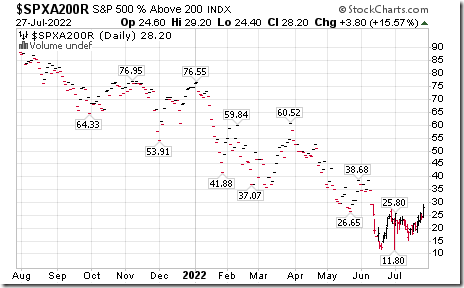

S&P 500 Momentum Barometers

The intermediate term Barometer added 13.40 to 67.80 yesterday. It changed from Neutral to Overbought on a move above 60.00. Trend remains up.

The long term Barometer added 3.80 to 28.20 yesterday. It remains Oversold. Trend remains up.

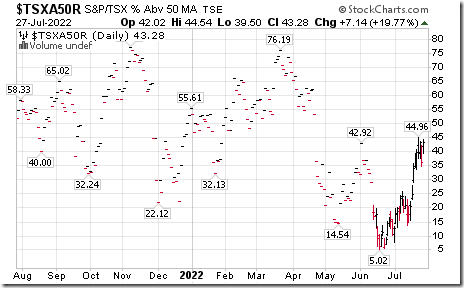

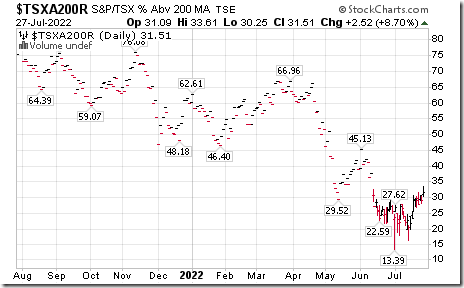

TSX Momentum Barometers

The intermediate term Barometer added 7.14 to 43.28 yesterday. It changed from Oversold to Neutral on a move above 40.00. Trend remains up.

The long term Barometer added 2.52 to 31.51 yesterday. It remains Oversold. Trend remains up.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed