Pre-opening Comments for Wednesday July 27th

U.S. equity index futures were higher this morning. S&P 500 futures were up 32 points in pre-opening trade. Investors are waiting for an update on monetary policy by the Federal Reserve to be released at 2:00 PM EDT.

Index futures were virtually unchanged following release of the June Durable Goods Orders report at 8:30 AM EDT. Consensus was a slip of 0.4% versus a gain of 0.8% in May. Actual was a gain of 1.9%. Excluding transportation orders, consensus was an increase of 0.3% versus a gain of 0.7% in May. Actual was an increase of 0.3%.

Chipotle gained $108.57 to $1,425.00 after reporting higher than consensus second quarter results.

Amazon gained $1.20 to $115.60 after reporting higher than consensus second quarter revenues.

Alphabet (GOOG) advanced $2.73 to $107.41 despite reporting less than consensus quarterly results.

Microsoft advanced $10.00 to $261.90 despite reporting less than consensus second quarter results. The company also offered positive guidance.

EquityClock’s Daily Comment

Headline reads “In our work, we look for dislocations compared to seasonal norms and the abnormal decline in new home sales through the first half of the year certainly stands out. Prior to the pandemic, sales of new homes have never fallen through the spring, even during past recessions”. Following is a link:

http://www.equityclock.com/2022/07/26/stock-market-outlook-for-july-27-2022/

Technical Notes for yesterday

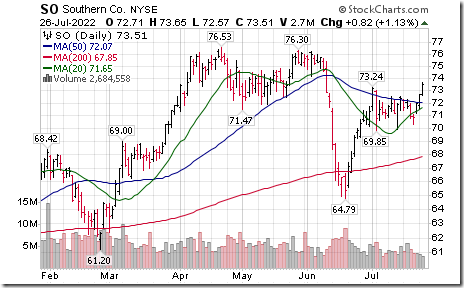

Southern Companies $SO an S&P 100 stock moved above intermediate resistance at $73.24 resuming an intermediate uptrend.

Trader’s Corner

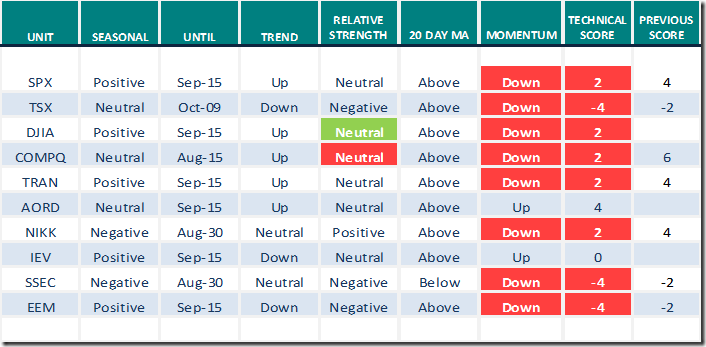

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for July 26th 2022

Green: Increase from previous day

Red: Decrease from previous day

Commodities

Daily Seasonal/Technical Commodities Trends for July 26th 2022

Green: Increase from previous day

Red: Decrease from previous day

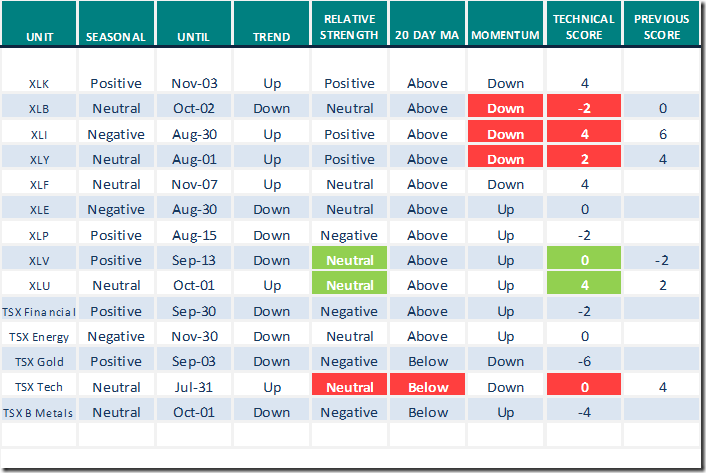

Sectors

Daily Seasonal/Technical Sector Trends for July 26th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

Links offered by valued providers

Tom Bowley asks “Should we wait for gaps to fill”?

Should We Wait For Gaps To Fill? | Tom Bowley | Trading Places (07.26.22) – YouTube

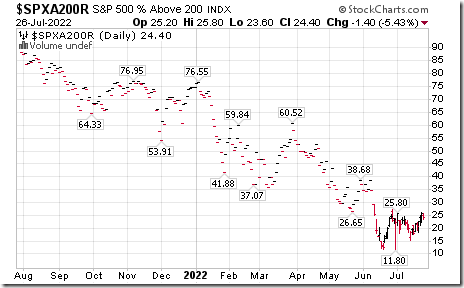

S&P 500 Momentum Barometers

The intermediate term Barometer dropped 6.00 to 54.40 yesterday. It returned to Neutral from Overbought on a move below 60.00.

The long term Barometer dropped 1.40 to 24.40 yesterday. It remains Oversold.

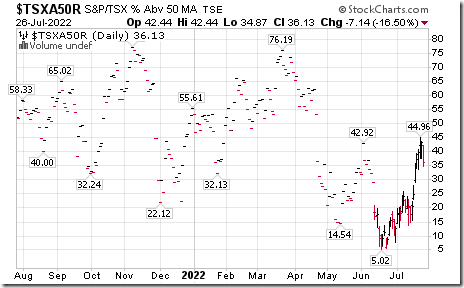

TSX Momentum Barometers

The intermediate term Barometer dropped 7.14 to 36.13 yesterday. It returned to Oversold from Neutral on a drop below 40.00.

The long term Barometer dropped 1.68 to 28.99 yesterday. It remains Oversold.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed