by Stephen Vanelli, CFA, Knowledge Leaders Capital

After the June 17, 2022 low, stocks have jumped higher, taking out the 50-day moving average yesterday in the S&P 500. Many are debating whether this is a bear market rally or the reversal of the bruising 6-month decline. For the time being, we think stocks have further to run based on a couple indicators. We try to shy away from predictions and rely more on our skills of adaptation. As such, when the backdrop changes, we try to sense and adapt to the change.

First, since the June 17 low, we have seen a sizeable drop in the 30-day realized volatility of the S&P 500. Falling by close to 14 points since mid-May, this is the biggest drop in realized volatility experienced all year. Note the S&P 500 is using the inverted axis on the left, so as realized volatility drops, it is consistent with rising stocks. We think there is more room for stocks to catch up to the drop in realized volatility.

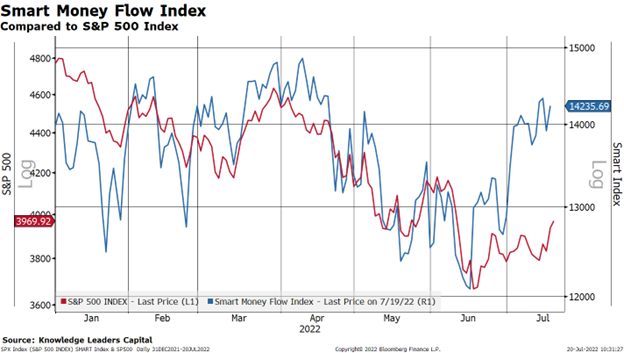

Our second indicator signaling to us there is more room to run on the upside for the S&P 500 is the Smart Money Flow index, which measures trading in the first and last hour of the day. When rising it is generally consistent with a rising market, as it suggests institutional investors are buying into the market. Off the June 17 low, the Smart Money Index has surged and telegraphs a S&P 500 north of 4,300.

On June 17, just 2% of the S&P 500 stocks traded above their 50-day moving average. Readings this low are consistent with great buy spots historically (2003, 2008, 2011, 2018, 2020 & 2022). Historically after the percent of stocks above the 50-day moving average has dropped this low, it has cycled up to 80% in the months to come.

All in all, we see more room for stocks to run and the “bear market” rally narrative beginning to fade.

Copyright © Knowledge Leaders Capital