by Brad Jung, Russell Investments

We believe advisors are never more valuable than in times of significant change. And 2021 was a year in which a lot changed.

There was the Great Resignation—in which many people left their jobs or moved on to other pursuits. There was the Great Migration out of cities and into smaller towns or rural areas. There was the rise of the hybrid office. Inflation, which had been relatively tame for years, soared. Tom Brady changed teams (but still won the Super Bowl).

And as the pandemic waned, people began thinking about what was next for them and their families. For many, the future may not be the same as they had envisioned before the COVID-19 outbreak. And that means their investment portfolio may need to adapt to the new outlook they have. We believe advisors provided substantial value in 2021 helping investors prepare for their post-pandemic lives.

Every year since 2014 we have created an annual report that holistically analyzes the real value advisors deliver through the vital services they provide their clients. This year we also considered the value inherent in helping guide their clients through the upheaval the pandemic wrought on markets, lifestyles and future plans.

That’s why we updated the formula we use to articulate the value of an advisor’s services. We want to recognize that many investors may have new priorities and an evolving outlook, that younger generations are entering the market and that both spouses and often the children as well are involved in determining financial goals.

Our equation remains simple and easy to follow.

Value of an Advisor = A+B+C+T

Active rebalancing of investment portfolios

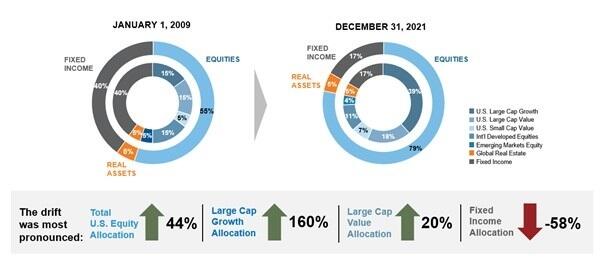

Portfolio rebalancing may go on the back burner when financial markets are rising calmly as they did for most of 2021. But that could be a mistake. Rebalancing works to keep the mix of assets in a portfolio in line with the investor’s risk-and-return profile no matter what happens in the markets.

Markets don’t rise evenly. Some sectors can go up while others go down, some stocks can go up much faster than others (think Amazon and other tech giants during the pandemic), and so on. Generally, when equity markets rise, fixed income markets fall. All of that movement can affect a portfolio’s asset allocation. And that in turn can affect future returns and risks.

Historically, rebalancing to fixed weights causes one to sell equities and buy bonds. For this reason, a portfolio that has not been rebalanced since 2009 would look very different today than it did back then. For example, a hypothetical balanced portfolio of 60% equities and 40% fixed income purchased in January 2009 would now have a significant overweight in equities at 84% and an underweight in fixed income at 17% (percentages have been rounded up). Being so top-heavy in large-cap growth equities can be risky if the markets were to suddenly plunge. Having to explain to a client why they now have a more aggressive allocation, instead of the balanced one they thought they had, is not a conversation most advisors would relish having.

Click image to enlarge

Source: Hypothetical analysis provided in the chart & table above for illustrative purposes only. Source for both chart & table: U.S. Large Cap Growth: Russell 1000 Growth, U.S. Large Cap Value: Russell 1000 Value, U.S. Small Cap: Russell 2000, International Developed Equities: MSCI World ex USA, Emerging Markets Equity: MSCI EM, Global Real Estate: FTSE EPRA NAREIT Developed, and Fixed Income: Bloomberg U.S. Aggregate Bond.

B is for Behavioral coaching

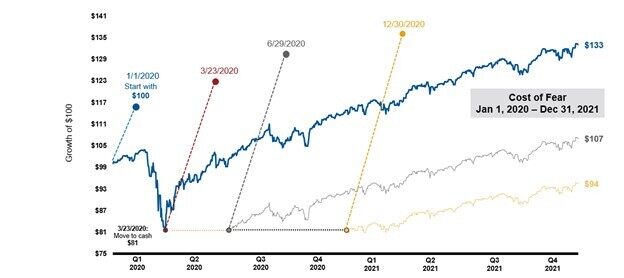

Behavioral mistakes cost real money. When it comes to delivering value, avoiding behavioral mistakes may be the most significant contributor to total value.Left to their own devices, many investors buy high and sell low. Helping your clients avoid pulling out of markets at the wrong time and sticking to their long-term plan is one way advisors provide substantial value.

The last few years are a perfect example. An investor who fled for the exits in mid-March 2020 when the pandemic emerged (as many did), could have missed out on some significant gains, depending on whether and when they re-invested in the market.

The chart below shows the difficulty of finding a new point of entry once an investor pulls out of the markets. Remaining invested for the entire two years of the pandemic would have seen a $100 investment on Jan. 1, 2020, rise to $133 by the end of 2021. But an investor who moved to cash in March 2020 and then returned to the market a few months later at the end of the second quarter, would only have $107 by the end of 2021. Meanwhile, an investor who moved to cash in March 2020 and stayed in cash until January 2021, would have only $94 at the end of 2021.

This is where we believe an advisor can be a valuable guide. Keeping their clients focused on the long-term rather than falling prey to emotions when markets get volatile can potentially bring better returns.

Click image to enlarge

Fear impacts opportunity

Source: Morningstar Direct. Balanced Portfolio: 60% S&P 500 Index & 40% Bloomberg Aggregate Bond Index. As of December 31, 2021. The S&P 500® Index, or the Standard & Poor's 500, is a stock market index based on the market capitalizations of 500 large companies having common stock listed on the NYSE or NASDAQ. The Bloomberg U.S. Aggregate Bond Index is an index, with income reinvested, generally representative of intermediate-term government bonds, investment grade corporate debt securities, and mortgage-backed securities.

Pulling out of the market when it is falling can lock in losses and could lead to missing out on any subsequent rally. Without a crystal ball, it’s hard to time the perfect point to get back into the market.

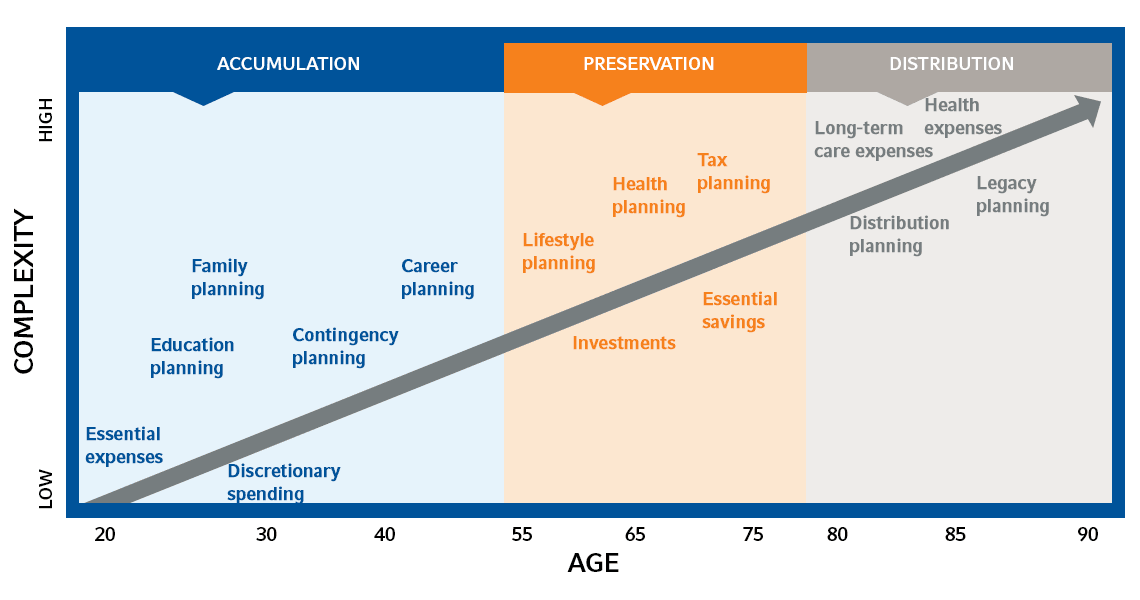

C is for Customized experience and family wealth planning

Let’s face it, people’s lives are becoming more and more complicated, and each person has their own set of personal goals, circumstances and preferences. An advisor who has a deep understanding of an investor’s individual situation can provide significant value. The customized client experience and comprehensive wealth planning that advisors can provide may be vital to guiding entire families through their major life events and decisions.

For illustrative purposes only.

We also recognize the role of the advisor is quickly evolving and is expected to help ensure that any wealth transition is properly managed. Research suggests that 70% of investible assets will be in the hands of the next generation in over the next two decades.1 A trusted advisor can ensure that everyone in the family is involved in the process and their wishes met. We believe there is value in the role an advisor plays to build financial stability for entire families.

T is for tax-smart planning and investing

Nobody wants to pay more taxes than they have to. And 2021 was the kind of year that shows how important it is to manage the taxes on your investments.Not only did equity markets rise, but most U.S. equity funds paid capital gains distributions at the end of the year, and those distributions were the highest in 20 years.

Why is managing taxes under these circumstances important? Without proper tax management, your clients could have received a substantial tax bill this month. Advisors who focus on tax-smart investing can distinguish themselves and demonstrate differentiating value. Because it’s not what you earn. It’s what you get to keep.

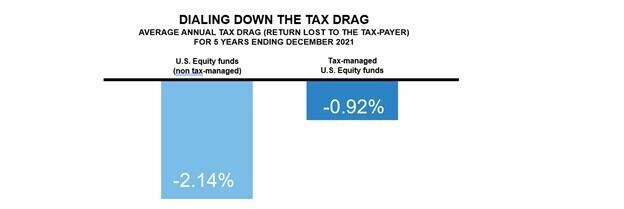

The average annual tax drag for the five years ending Dec. 31, 2021, was significant. Investors in non-tax-managed U.S. equity products (active, passive and ETFs) lost, on average, 2.14% of their return to taxes. Those in tax-managed U.S. equity funds forfeited only 0.92%. With taxable investors holding $11.2 trillion of the $23.9 trillion invested in open-end mutual funds2, this is a massive concern—and a massive opportunity for added value.

Tax-managed: funds identified by Morningstar to be tax-managed. Universe averages*: Created table of all U.S. equity mutual funds and ETFs as reported by Morningstar. Calculated arithmetic average for pre-tax, post-tax return for all shares classes as listed by Morningstar. Morningstar Categories included: U.S. ETF Large Blend, U.S. ETF Large Growth, U.S. ETF Large Value, U.S. ETF Mid-Cap Blend, U.S. ETF MidCap Growth, U.S. ETF Mid-Cap Value, U.S. ETF Small Blend, U.S. ETF Small Growth, U.S. ETF Small Value, U.S. OE Large Blend, U.S. OE Large Growth, U.S. OE Large Value, U.S. OE Mid-Cap Blend, U.S. OE Mid-Cap Growth, U.S. OE Mid-Cap Value, U.S. OE Small Blend, U.S. OE Small Growth, U.S. OE Small Value. *Methodology for Universe Construction on Tax Drag chart: From Morningstar, extract U.S. equity and fixed income mutual fund and ETFs for reported period. Averages calculated on a given category. For example, average after-tax return for the large cap category reflects a simple arithmetic average of the returns for all funds that were assigned to the large cap category as of the end date run. For funds with multiple share classes, each share class is counted as a separate “fund” for the purpose of creating category averages. Morningstar category averages include every type of share class available in Morningstar’s database. Large Cap/Small Cap/Municipal Bond determines based upon Morningstar Category. If fund is indicated by Morningstar as passive or an ETF, the fund is considered to be passively managed. Otherwise, the fund is considered to be actively managed. Tax Drag: Pre-tax return less after-tax return (pre-liquidation).

Tax-smart advisors can help add this value by helping build and implement a personalized, comprehensive and tax-sensitive portfolio.

The bottom line

The waning of the pandemic and the new geopolitical environment could be the perfect time for advisors and their clients to work more closely. As noted earlier, our post-pandemic lifestyles, dreams, goals and finances may be vastly different from what they were before COVID-19 emerged. But one thing likely hasn’t changed: the universal desire for financial security. And that’s where a trusted advisor can truly provide value.

Advisors, we believe in your value. We see the advantages you create for your clients. We know the commitment you bring to your relationships. So as we emerge into a post-pandemic world full of unknowns, take pride. You’ve helped your clients navigate a tumultuous period and your value is clear.

To learn more about the 2022 Value of an Advisor Study, click here.

1 Source: https://info.cerulli.com/HNW-Transfer-of-Wealth-Cerulli.html

2 Source: 2021 ICI Factbook